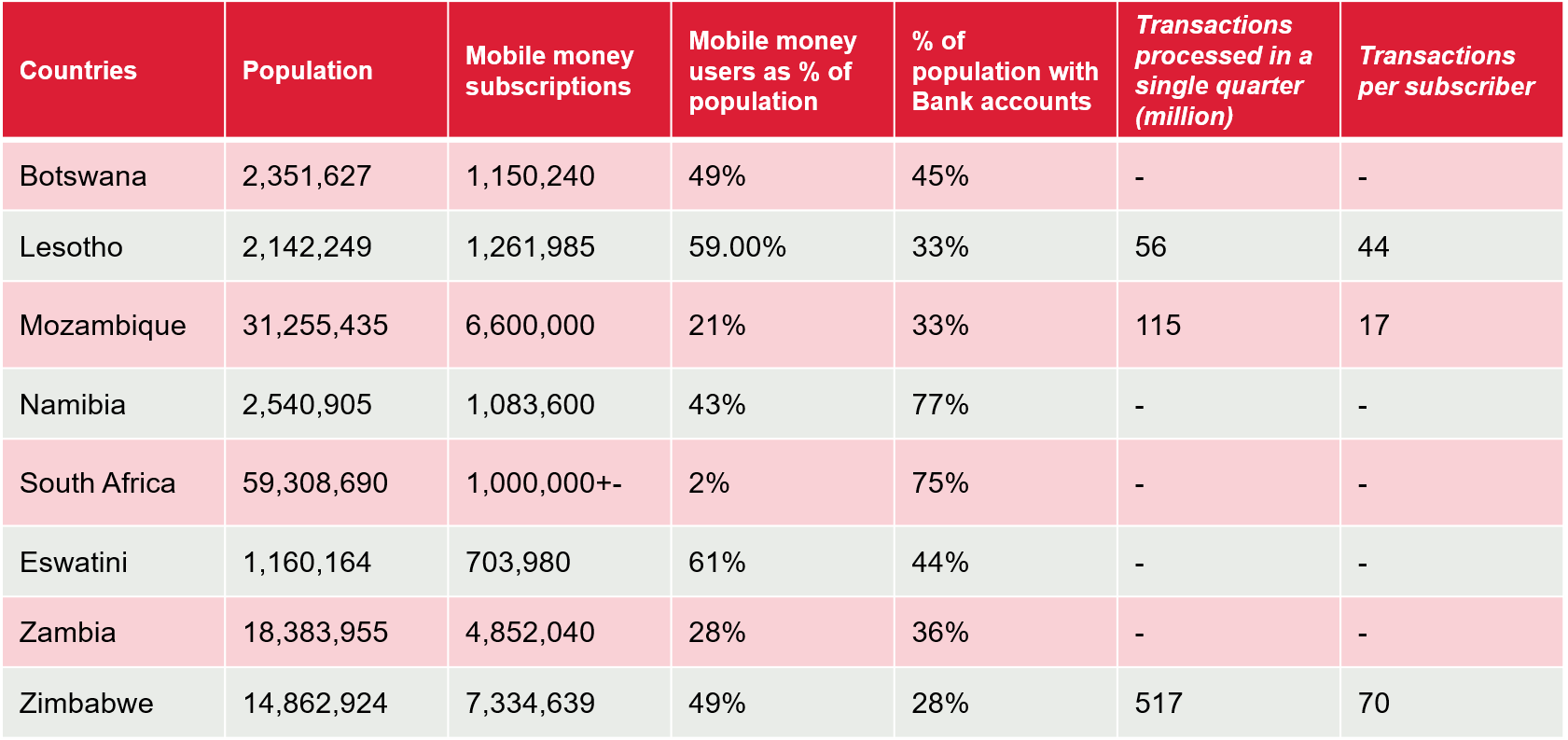

This review attempted to showcase the transaction volume of mobile money across the 8 countries in review in part 1 and part 2. However, 5 out of the 8 countries above do no report mobile money transaction volume and/or value.

From the data above, users in Zimbabwe transact 4.1 times more than Mozambicans on mobile money. What you may have missed is that both countries have almost the same number of active mobile money users although Mozambique is twice the size of Zimbabwe.

This clearly shows the reliance of Zimbabwe on mobile money. The reason why 49% of Zimbabwe's total population are active mobile money users versus only 21% of Mozambique is not far-fetched.

There is a cash crisis in Zimbabwe. Due to cash shortage, there is always a log queue at the ATMs and bank branches. In addition, there are weekly limits on withdrawals via ATM. Thus, consumers are forced to transact electronically. Mobile money alone make up 86% of the total transaction volume in Zimbabwe.

The transition to mobile money in Zimbabwe and by extension to digital payments is a clear indication that a cashless society can be achieved faster if the consumers do not have a choice.

A case study would be India's 2016 demonetization policy to stop the use of its 500 and 1000 rupees notes. India's unprecedented move forced merchants to adopt digital payment tools to ease their business process. Not even the banks were notified in advance of President Modi's plan. Prior to the 2016 demonetization policy, cash accounted for upwards of 95% of all transactions, 90% of vendors didn’t have card readers or the means of accepting electronic payments, 85% of workers were paid in cash, and almost half of the population didn’t even have bank accounts. By 2018, almost 80% of adult Indians have bank accounts according to the Global Findex Database published in April 2018.

The difference between Zimbabwe and Mozambique with respect to mobile money usage further showcases the difference between financial inclusion and financial deepening. Whereas Mozambicans use mobile money to mostly to send and receive money, Zimbabweans use it for domestic remittances and for transacting in their daily activities.