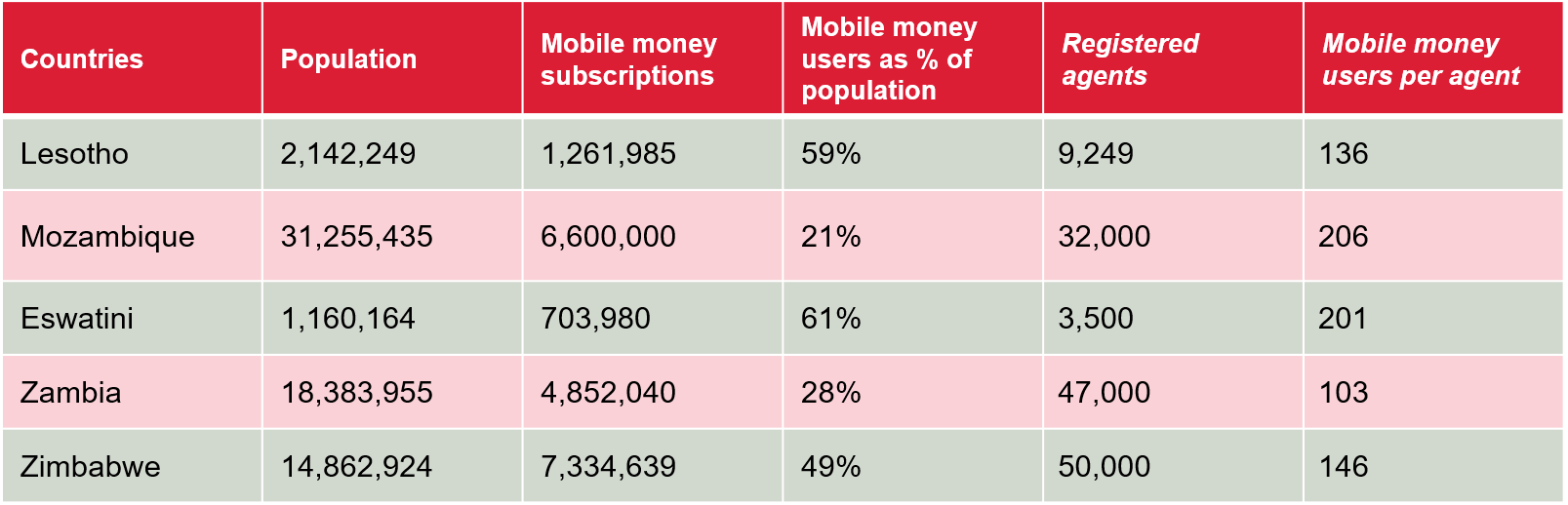

This is the second part of a 3 part series on mobile money in Southern Africa. The first part initially x-rayed the mobile money uptake in the region. 3 of the 8 countries in view do not report agent numbers and thus the table above is aimed at showcasing the agent network in 5 out of 8 countries of interest

The role of mobile money agents have evolved over time. Initially agents were focused on facilitating Cash-in/Cash-out transactions. Now Agents are able to onboard new subscribers and provide other supporting service such as Insurance.

It is interesting to note that Manko, a subsidiary of Société Générale has successfully piloted and scaled a new model of mobile money agent services which I call Mobile Money-Agent-s-a-Service.

This company was initially setup to serve Yup, Société Générale's mobile money brand in French-speaking West Africa. Now these agents support banks and even other mobile money companies, providing many other services including insurance. The Manko agents essentially move about local communities on motorcycles, providing mobile money services to interested consumers.

The presence of Ecocash in Zimbabwe and Lesotho, may account for the reason why both countries have a similar number of agents. As they could be adopting the same model for growth and expansion.

Agents in countries such as Zambia make most of their money from opening new accounts as mobile money penetration remains low. This reliance on account opening could prove to be a risk as account opening requests will diminish when the market matures and interoperability permeates the Southern African region.

In Zimbabwe, the recent announcement of Zimswitch as the national payment switch has made interoperability possible in Zimbabwe, causing Ecocash to lose its competitive edge in a market where it had over 10 m registered accounts (not active accounts) out of a 14 m population, that previously could not transfer money to users on the other two mobile money services (Telecash and Money).

Part 3 would be focused on transaction volumes and values.