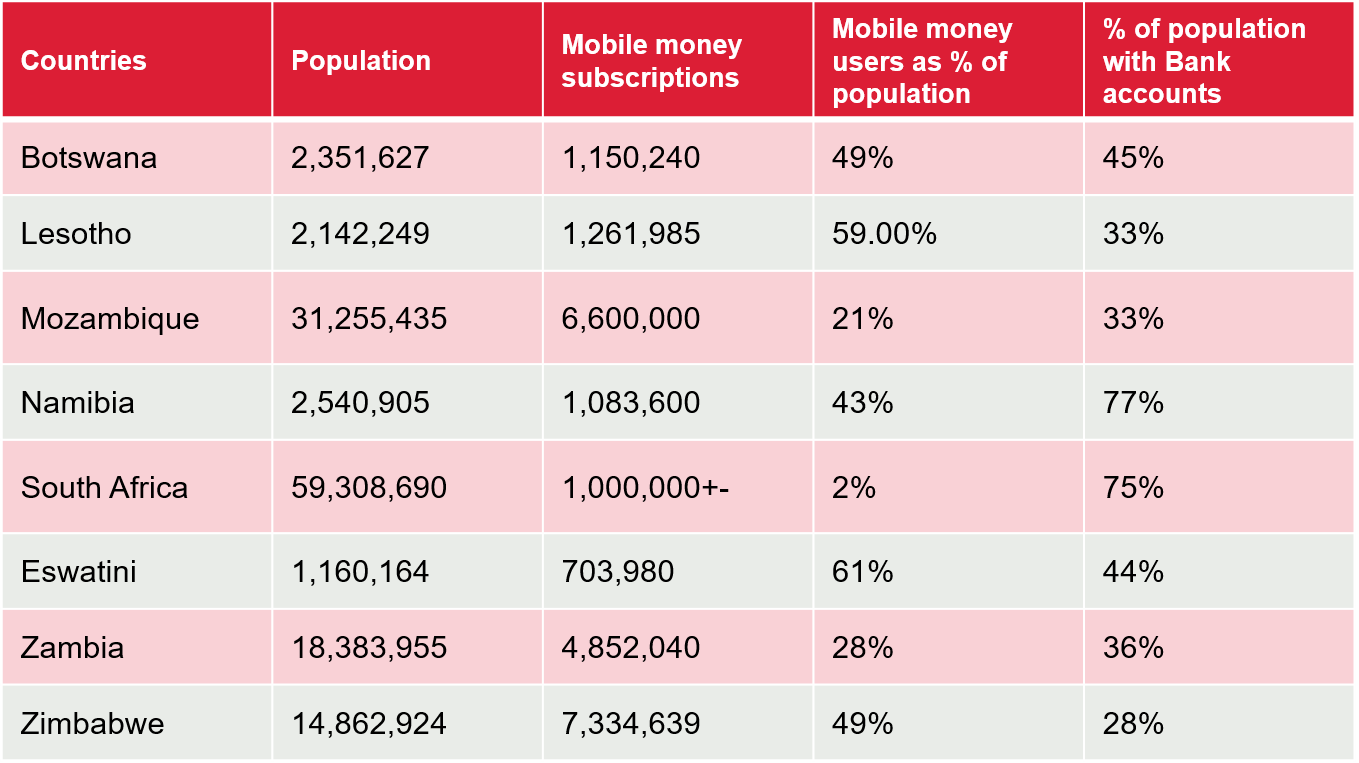

The uptake of mobile money and bank accounts in some of the 8 countries have not been equally distributed, half have a larger mobile money user base compared to those with bank accounts.

South Africa has only 2% of its population using mobile money whereas Zimbabwe has the largest disparity (21% more mobile money users than there are banked people). Zimbabwe relies on mobile money and other digital financial services in lieu of actual cash because of the cash shortage crisis in the economy. Ecocash remains the market leader in this market with over 90% market share.

In South Africa, mobile money has failed to take off between 2012 and 2016. MTN relaunched their mobile money service this year and a lot is yet to be seen on the readiness of the market to adopt the service. The failure of mobile money in South Africa's can be attributed to the sophistication and competitiveness of the payments and banking system, making mobile money redundant. Also, the governments social grants program called SASSA is linked to the traditional banking system with a compulsory Mastercard debit card, targeted at the poor who are mostly the unbanked or underserved, hence, leaving no room for mobile money.

Mozambique, a country facing a tremendous scale of insurgency that has put a USD 20 billion investment by Total Plc at risk, has a near-balanced usage of mobile money and bank accounts with 1 in every 5 people having a mobile money account and 1 in 3 having a bank account. However, a large portion of the Mozambican population remains underserved by both banks and mobile money.

In a country like Namibia where 77% of the population is banked, it’s difficult to see where or how mobile money becomes a necessity. They already have a sophisticated and competitive banking system similar to that of Nigeria and South Africa.

Eswatini with a small population of 1.1 m has quite a high adoption of mobile money at 61% driven by MTN Momo.

Part 2 would be focused on mobile money agents.