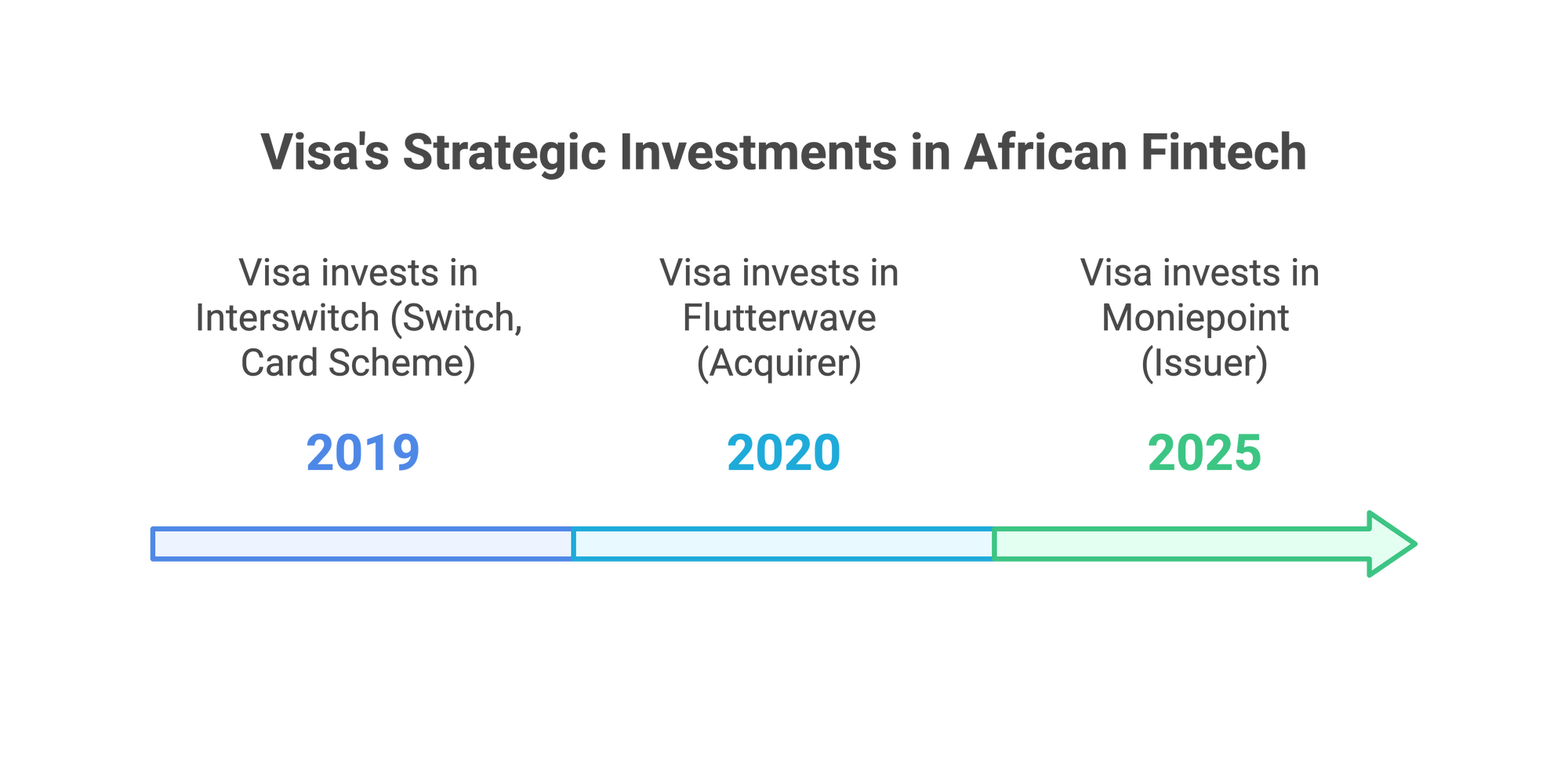

On January 23, 2025, it was announced that Visa made a strategic investment in the Nigerian unicorn Moniepoint. This investment is part of a broader strategy that began in 2019, with Visa acquiring a significant minority equity stake in Interswitch. This was followed by a strategic investment in Flutterwave in 2020 and now, in 2025, in Moniepoint. There is a larger strategy at play here. I will let you in on this strategy.

Africa's payment landscape is undergoing a transformation, focused on the domestication of payment infrastructure. This includes the development of local payment systems and domestic card networks. Similarly, Asian countries have integrated domestic switch networks with their own card schemes. For instance, China's Union Pay and India's Rupay Card by the National Payments Corporation of India (NPCI). These local systems and their card networks have been extremely successful in their local markets and beyond their market. This trend challenges global card networks like Visa and Mastercard.

The transformation in Africa's payment landscape presents further challenges, particularly with the shift in payment modalities. Kenya and Francophone Africa are predominantly mobile money markets, whereas Nigeria primarily relies on bank transfers and electronic funds transfers (EFT). These payment methods circumvent traditional card networks such as Visa and Mastercard. Indeed, global card networks have found it difficult to secure a significant share of the domestic transaction market in Kenya due to the dominance of mobile money.

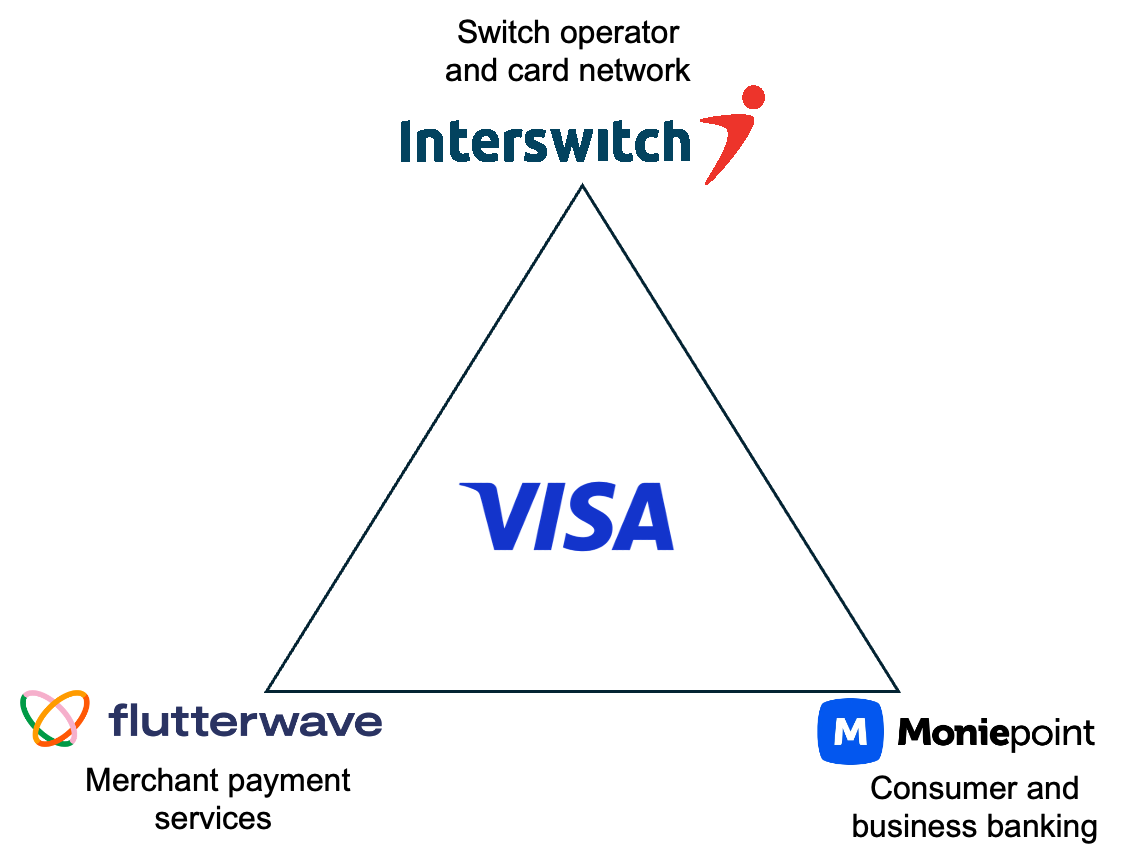

In response to this shift in Africa's payment landscape, Visa has made strategic investments in three key companies: Flutterwave, Moniepoint, and Interswitch over the last few years. I refer to this strategic alignment as the "Visa Triangle." These three companies create a vertically integrated powerhouse that covers the entire payment value chain—issuing, acquiring, and processing. As a payments expert, I view this not merely as a series of investments but as a masterful strategy to dominate Africa's digital economy. Here’s why.

The Acquirer: Flutterwave's Hyper Localization

Flutterwave, Africa's leading merchant payment solution provider, sits at the base of the Triangle. Flutterwave enables businesses to accept payments from anywhere in the world, processing transactions in over 150 currencies. Flutterwave's real value lies in its hyper-localization. Integrating with domestic payment methods like Kenya's M-Pesa and Nigeria's bank transfers bridges the gap between global card networks and Africa's unique payment markets.

The Issuer: Moniepoint's Grassroots Reach

As a consumer and business bank, Moniepoint distributes cards, POS terminals, and digital wallets to millions of SMEs and individuals. With over 10 million users and a USD 22 billion monthly payment volume, Moniepoint could drive Visa's cards into the hands of Nigeria's unbanked.

The Switch: Interswitch's Infrastructure Backbone

Linking these two pillars is Interswitch, Africa's largest payment infrastructure provider. Interswitch operates the pipes that move money—domestic switches, card schemes (like Verve), and aggregators that connect banks, fintechs, and telcos. By investing in Interswitch, Visa isn't just tolerating local rails—it's co-opting them. This neutralizes rivals like Mastercard, which struggles to penetrate markets where Verve dominates, and ensures Visa remains relevant even in markets that are leading the domestication agenda.

Potential Complexities

Interswitch's Verve cards compete with Visa domestically, creating a delicate dance between collaboration and cannibalization. For example, Moniepoint currently issues Verve cards by Interswitch, raising the question of whether Moniepoint might switch to Visa due to Visa's strategic investments. International network fees and Merchant Discount Rates (MDRs) are typically higher than domestic networks. A switch to Visa could significantly alter Moniepoint's market positioning and financial health.

Furthermore, Visa is keen on partnering with fintechs that have a Pan-African presence, such as Flutterwave and Interswitch, which operate across multiple African countries. Despite their size, the success of these fintech giants depends on their ability to navigate markets where even basic infrastructure like internet access is inconsistent. Visa's strategy will need to carefully balance the push for standardization with the necessity for localization, such as adapting to the mobile money dominance in Francophone Africa while capitalizing on the growing adoption of Electronic Funds Transfers (EFT) in Nigeria.

The Bigger Picture: Visa as Africa's Financial Operating System

Visa now has a substantial opportunity to acquire increased equity stakes in these companies, potentially achieving significant ownership or even complete acquisition. Card networks typically do not outright purchase companies. Instead, they make small investments or enter into strategic partnerships to gauge potential opportunities. If their assessment proves correct, they may consider a complete acquisition.

Visa is positioning itself as the invisible hand shaping Africa's financial future. By controlling issuance, acquiring, and switching, it could evolve into a platform offering everything from SME loans to insurance—all fueled by transaction data. This mirrors Alipay's evolution in China but with a focus on formalizing Africa's informal sector, which contributes 38% of GDP. For context, imagine a Lagos street vendor using a Flutterwave POS to accept payments, securing a microloan via Moniepoint, and insuring her inventory through a Moniepoint-partnered underwriter. This isn't fantasy—it's the logical endpoint of the Triangle's data-driven ecosystem.

The Visa Triangle is more than a portfolio—it's a blueprint for how global fintechs can win in emerging markets. For Africa, the implications are profound: millions of SMEs gaining access to global markets, consumers escaping cash's risks, and economies leapfrogging into the digital age. Yet, the human element remains critical. Will a smallholder farmer trust a digital payment over cash? Can Moniepoint's algorithms fairly score a trader with no formal credit history? The answers will determine whether the Triangle becomes a catalyst for inclusion or a tool for extraction. One thing is sure: Visa is building a formidable moat in the race to digitize Africa. And for now, its rivals are playing catch-up.