The digital payment market is booming, with a projected total transaction value of US$11.53 trillion in 2024 and an expected growth rate of 9.52% annually, reaching a projected total of US$16.59 trillion by 2028. According to the World Bank, most adults worldwide are already involved in digital payments, with developing economies experiencing significant growth from 35% in 2014 to 57% in 2021.

Smartphone penetration and access to the internet are the major drivers of this growth. Fifty-four per cent of the global population, approximately 4.3 billion people, now owns a smartphone, according to GSMA's annual State of Mobile Internet Connectivity Report 2023 (SOMIC). The report further shows that approximately 4 billion people out of the 4.6 billion people using mobile internet do so through a smartphone.

When the subject matter is digital payments, smartphone penetration and increased access to network connectivity don't tell the complete story. In addition to these two factors, innovation in the payment space plays a crucial role. Continuous innovation in payments has led to the rise in several payment methods across different countries, and the popularity and preferences of payment methods are unique to different countries. For example, "Argentina's most popular online payment methods generate a voucher that can be paid offline in cash, while shoppers in the Netherlands commonly use direct online transfers from their bank accounts," as highlighted by Wonderproxy.

...the popularity and preferences of a payment method are unique to different countries.

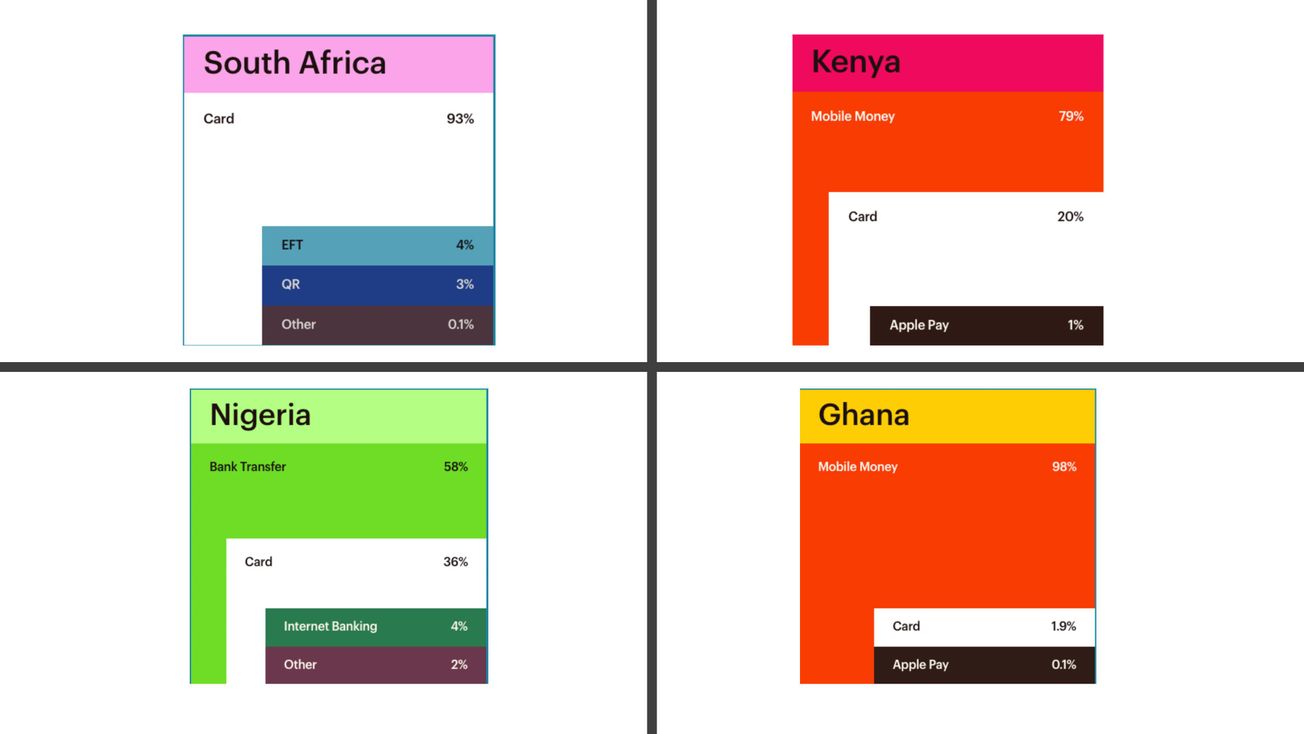

Across Africa, the digital payment landscape is diverse, as Tochukwu Egesi's article confirms. Mobile money is the dominant method in countries like Ghana and Kenya, representing 98 and 79 per cent of digital payments, respectively. However, the story is different in countries like Nigeria and South Africa. In South Africa, card payments are the norm, while in Nigeria, bank transfers are the preferred mode. This diversity underscores the need for a nuanced understanding of digital payment trends in different African countries.

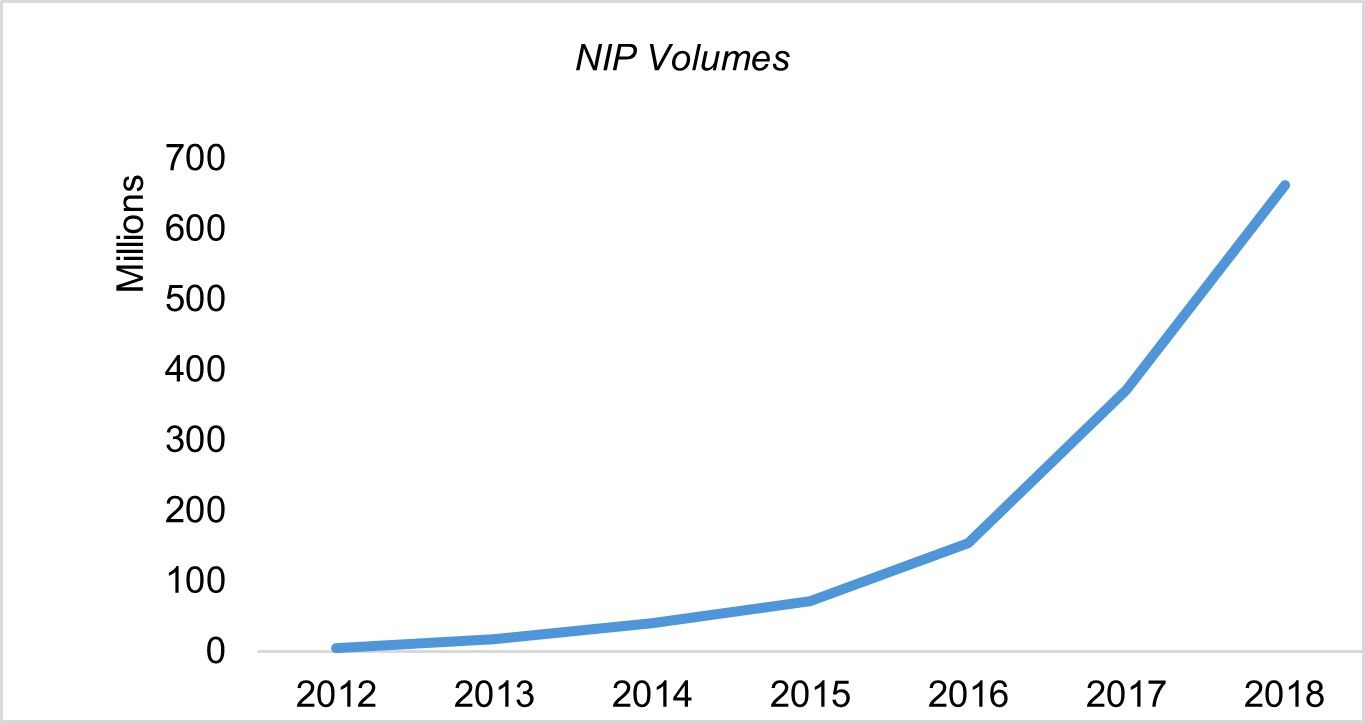

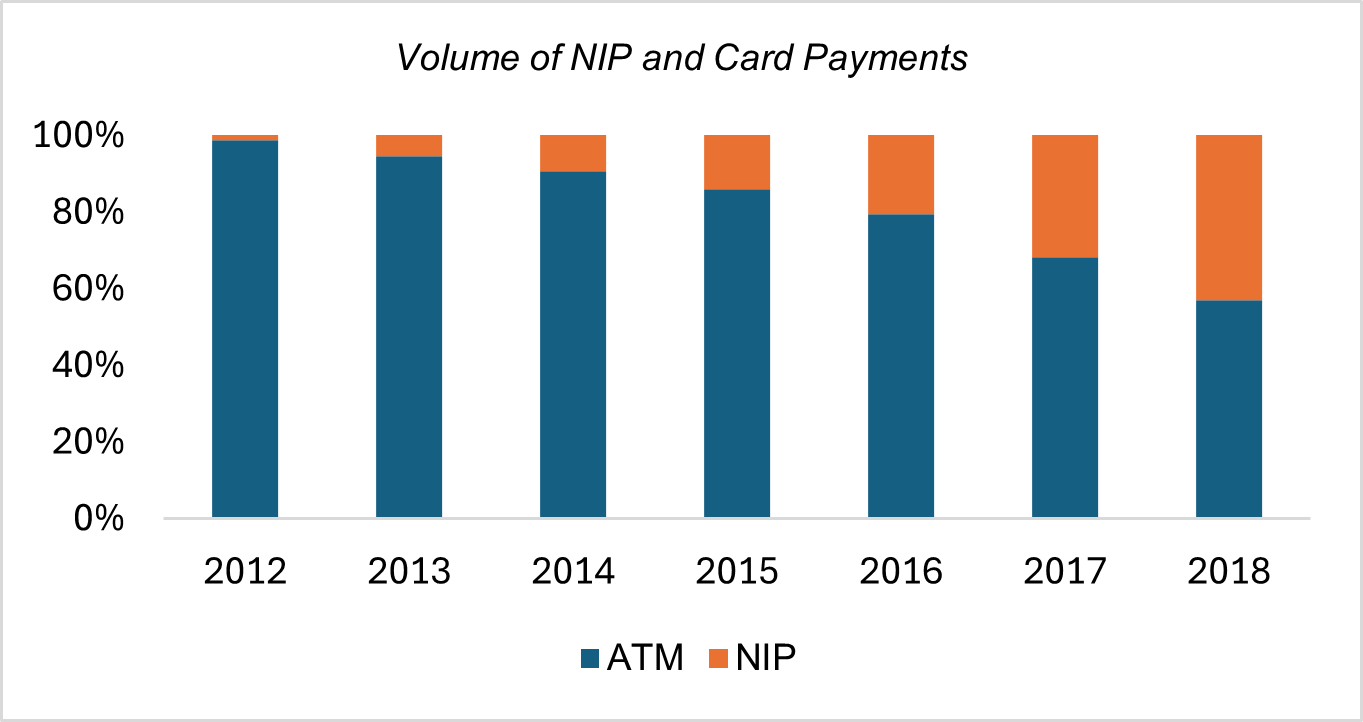

While Toch's analysis is limited to Paystack's data, it gives a picture of the general trend in each country. CBN's data on e-payments provide more insight into this trend in Nigeria. From 2012 to 2018, although card payments (using ATM volume as a proxy) initially surpassed transfers (NIP as a proxy), the latter was steadily gaining ground, starting at less than 10 per cent and climbing to over 40 per cent by 2018 when we combined both transaction volumes.

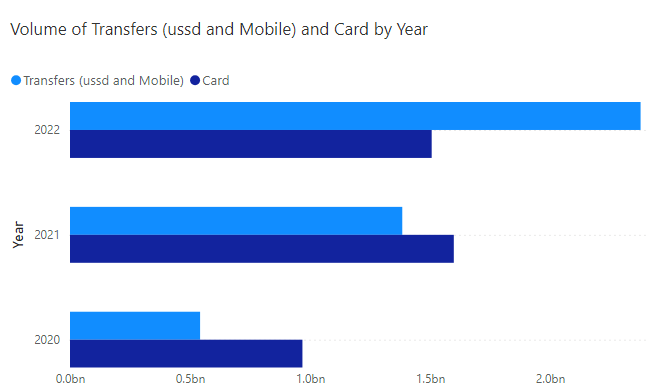

The momentum of transfer payments continued to surge, surpassing card payments in 2022. The volume of transfer payments reached a staggering 2.3 billion, outpacing the 1.5 billion for cards. This rapid growth is a testament to the increasing popularity and adoption of transfer payments in Nigeria. These trends paint a clear picture of the future of payments in Nigeria.

Fintechs are driving the adoption

The data strongly suggests that mobile transfers are not just a trend, but a future reality, poised to become the country's dominant payment method. Mobile payments company Boku reported that mobile wallet penetration in Nigeria reached 9.2% in 2020 and it is expected to hit a new milestone of 18.9% in 2025. Factors like smartphone penetration and access to Internet are the major drivers of the rapid adoption of digital payments in Nigeria. According to Statista, Nigeria's smartphone user base is estimated to reach a peak of 184.79 million by 2029.

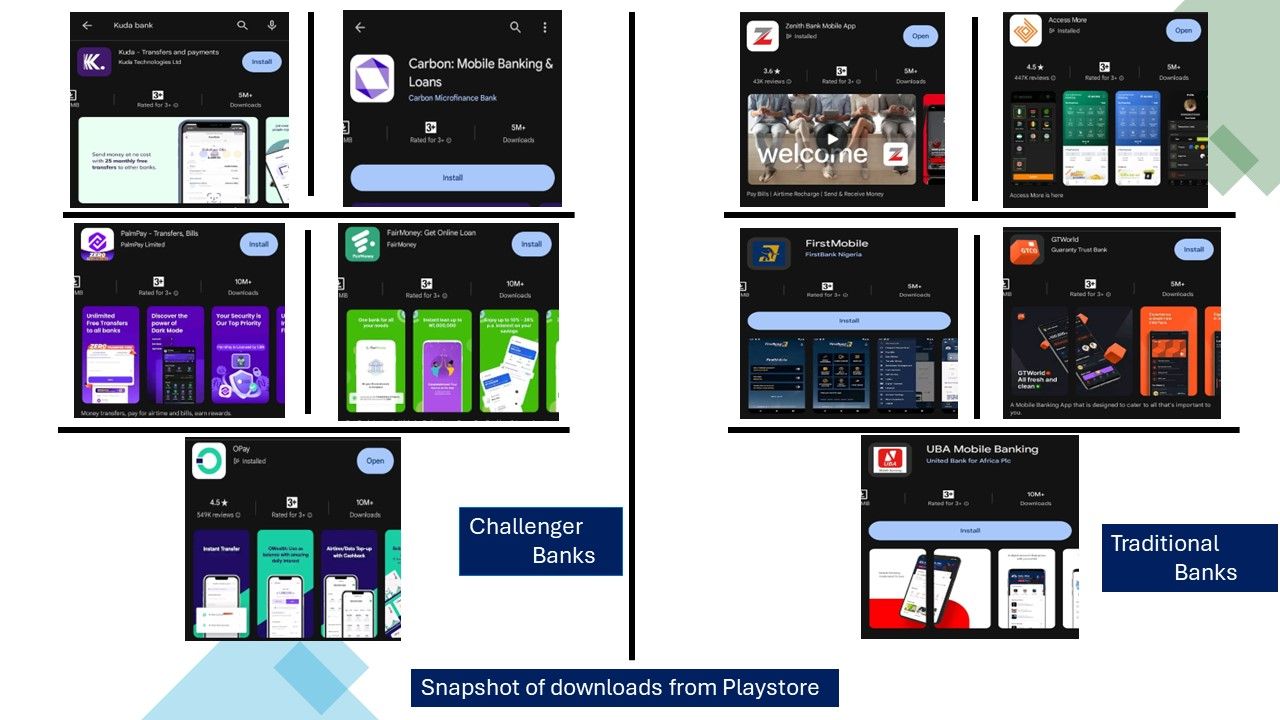

The country's new found love for transfer payments is far from complete without fintechs. To quote Tochukwu again, Nigerians increasingly favor this method because of its perceived speed of service, security, and ease of use. Players like Opay, Kuda Bank, and PalmPay are at the wheel of this trend, as data from the Play Store suggests that some of these apps have an average of 10 million downloads, thus highlighting their popularity. When compared to traditional banks, say, for instance, the top five banks in Nigeria, only UBA boasts a figure that matches that of Opay, PalmPay, and Fair Money.

With the above data from Playstore, it is clear that fintechs are at the core of this new trend. But how are they doing it? I highlight a few points below.

1. Onboarding process: The onboarding process for most fintech is quite simple. The KYC process for most fintechs is done on the app, and once completed, the customer starts transacting on the app in no time. In contrast to most traditional banks, the KYC process is not done on their mobile banking app, and there is every possibility that a customer must go to a bank branch to complete the KYC process. Only then will the customer get the license to register on the bank app, which must be done using a card.

2. Speed and reliability: In the early stages of players like Opay, most Nigerians were skeptical about transacting on their app owing to lack of visibility. Compared to traditional banks with several locations nationwide, most challenger banks have limited branches. However, these sentiments have changed over time. Fintechs have gained Nigerians' trust via the speed at which transactions are settled following a transfer from a payer account and the low failure rate.

3. Transaction Fees: Low transaction fees are another reason people are adopting fintechs. For example, Opay makes your first three transactions to other banks free, with a charge of 10 Naira after exceeding that threshold, while transactions between Opay accounts are free. Kuda Bank ensures that the first 20 transactions done in a month are free with a charge of 10 Naira (this might change based on the value of the transaction) after exceeding the threshold of 20 transactions.

What next?

Fintechs are currently in the lead in the retail banking sector, and it's crucial for banks to respond. Some banks are making moves in the fintech arena by establishing their own fintech companies, such as Squad(owned by GTCO), HydrogenPay (owned by Access Holdco), and Zest(owned by Stanbic). While these companies primarily focus on payments, it's high time for banks to reassess their retail banking strategies to avoid potential risks.

We've seen a similar strategy in the Nigerian financial services sector, with Access Holdco venturing into the payment and lending sectors through two distinct fintech companies (Hydrogen and Oxygen). It's not far-fetched to imagine another bank approaching the retail banking sector in a unique way, possibly through a Banking as a Service model, similar to the successful partnership between Chime and Bancorp Bank. This strategic shift could potentially open up new avenues for traditional banks, enabling them to thrive in the evolving financial landscape.