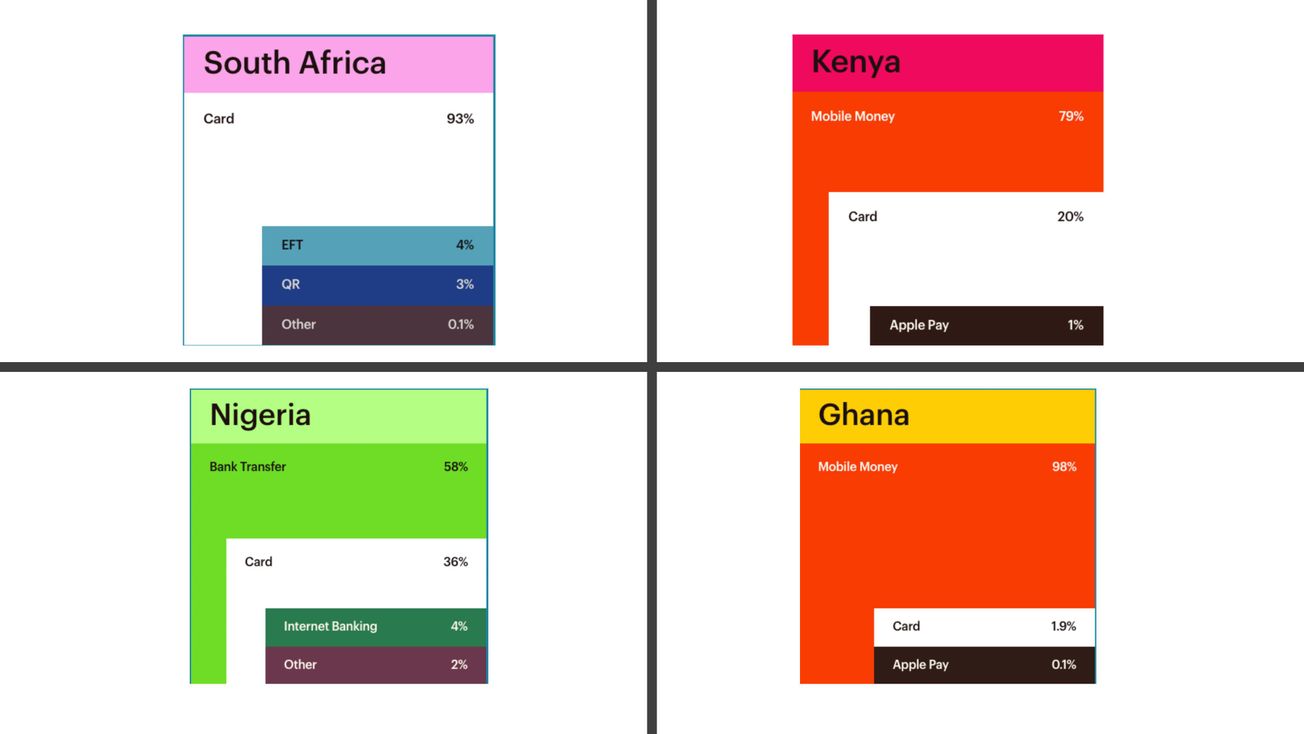

As digital payments continue to transform the financial landscape across Africa, the data from Paystack’s 2023 review offers valuable insights into the payment preferences in Nigeria, Ghana, South Africa, and Kenya. By examining these trends, businesses, policymakers, and stakeholders can better understand the evolving payment ecosystem and tailor their strategies to meet the needs of these dynamic markets.

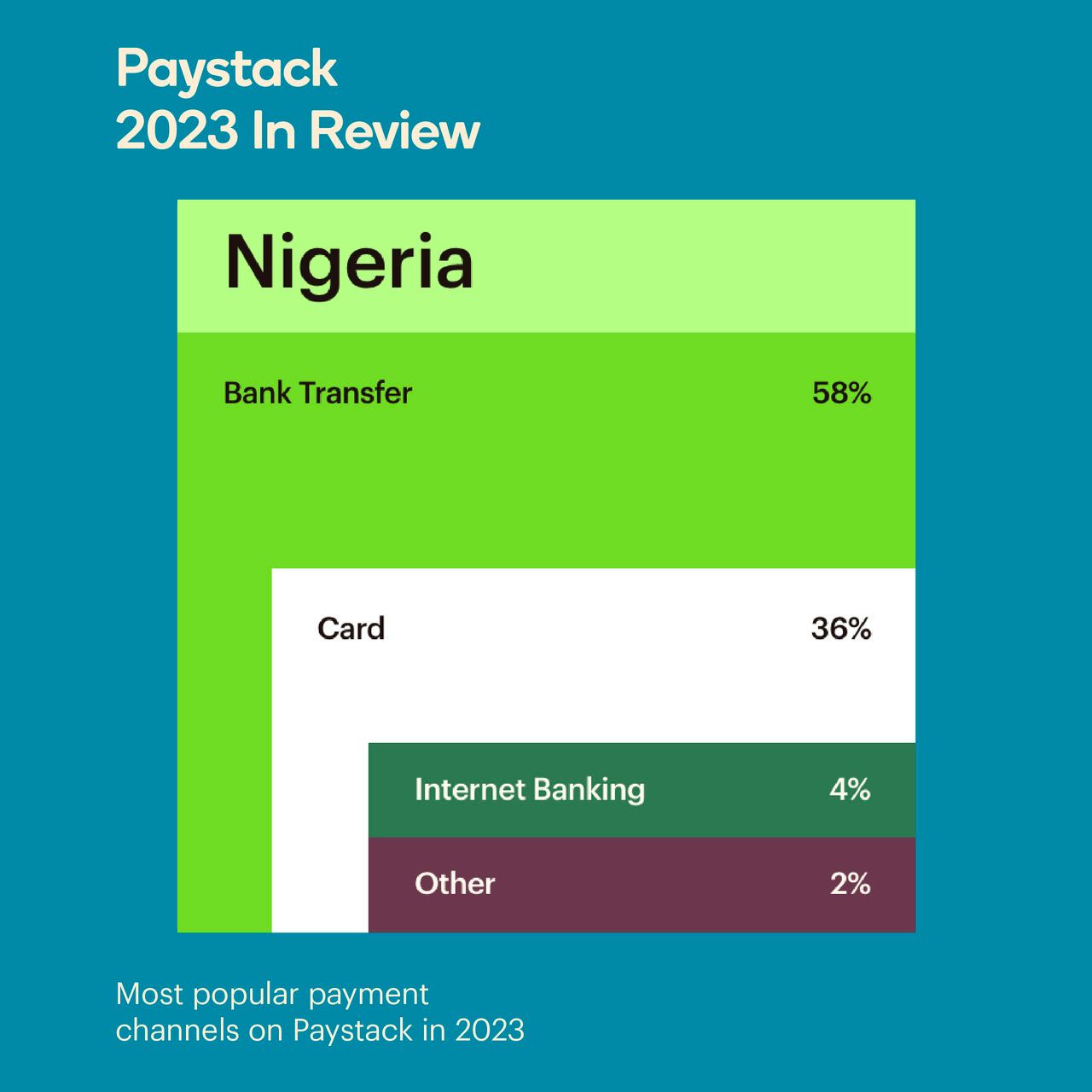

Nigeria: A Shift Towards Bank Transfers

In Nigeria, the data reveals a significant preference for bank transfers, which account for 58% of payment transactions. This indicates a growing trust and reliance on direct bank transfers for payments, possibly driven by the open banking technology (PaybyBank), increasing penetration of banking services and the convenience offered by neo banks like Opay, MonniePoint and PalmPay. Cards, while still popular, come in second at 36%, showing that traditional card payments remain a significant channel but are being outpaced by bank transfers. Internet banking and other methods make up a smaller fraction, at 4% and 2% respectively.

Key Takeaways:

- Bank Transfer Dominance: The high usage of bank transfers suggests that Nigerians are increasingly favoring this method for its perceived speed of service (particularly Opay, MonniePoint and PalmPay), security and ease of use.

- Card Usage: The substantial 36% indicates that card payments are still widely used, especially for online transactions and retail purchases.

- Opportunities for Growth: There is potential for growth in internet banking and other innovative payment solutions as more Nigerians come online and become familiar with digital financial services.

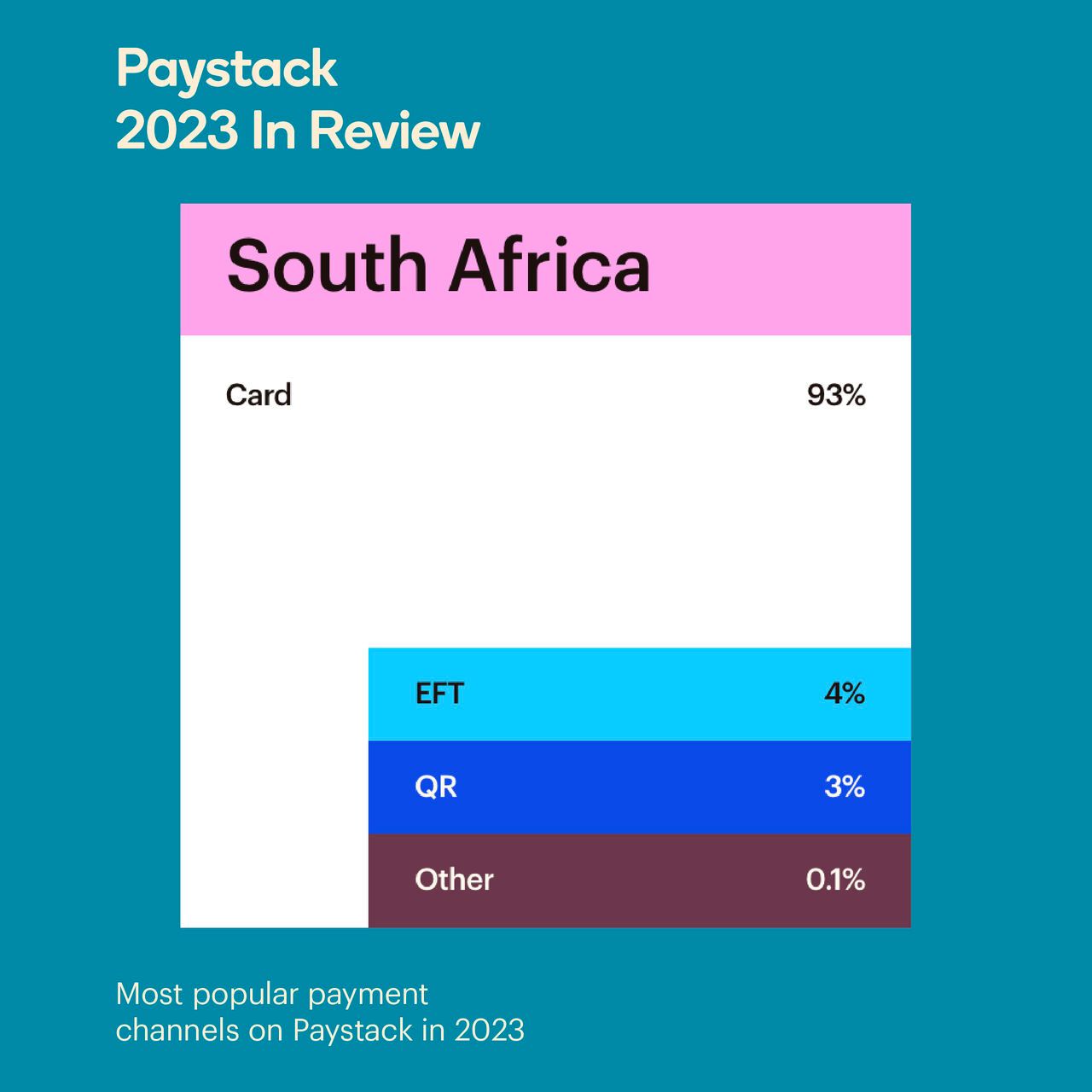

South Africa: Card Payments Reign Supreme

South Africa presents a stark contrast, with an overwhelming 93% of transactions conducted via card payments. This dominance highlights the established infrastructure and consumer comfort with card transactions. EFT (Electronic Funds Transfer) and QR code payments are also present but with much lower adoption rates of 4% and 3% respectively, and other methods barely making a mark at 0.1%.

Key Takeaways:

- Card Payment Preference: The preference for card payments is indicative of a mature payment ecosystem where consumers are accustomed to and trust card transactions.

- Emerging Channels: While EFT and QR payments are still in the minority, they represent emerging channels that could see increased adoption as more banks and mobile money entities roll out PayShap for individuals and businesses. EFT will also see more growth as open banking led by Stitch and Ozow matures in the market.

- Infrastructure and Trust: The high card usage underscores the importance of robust payment infrastructure and consumer trust in digital payment methods.

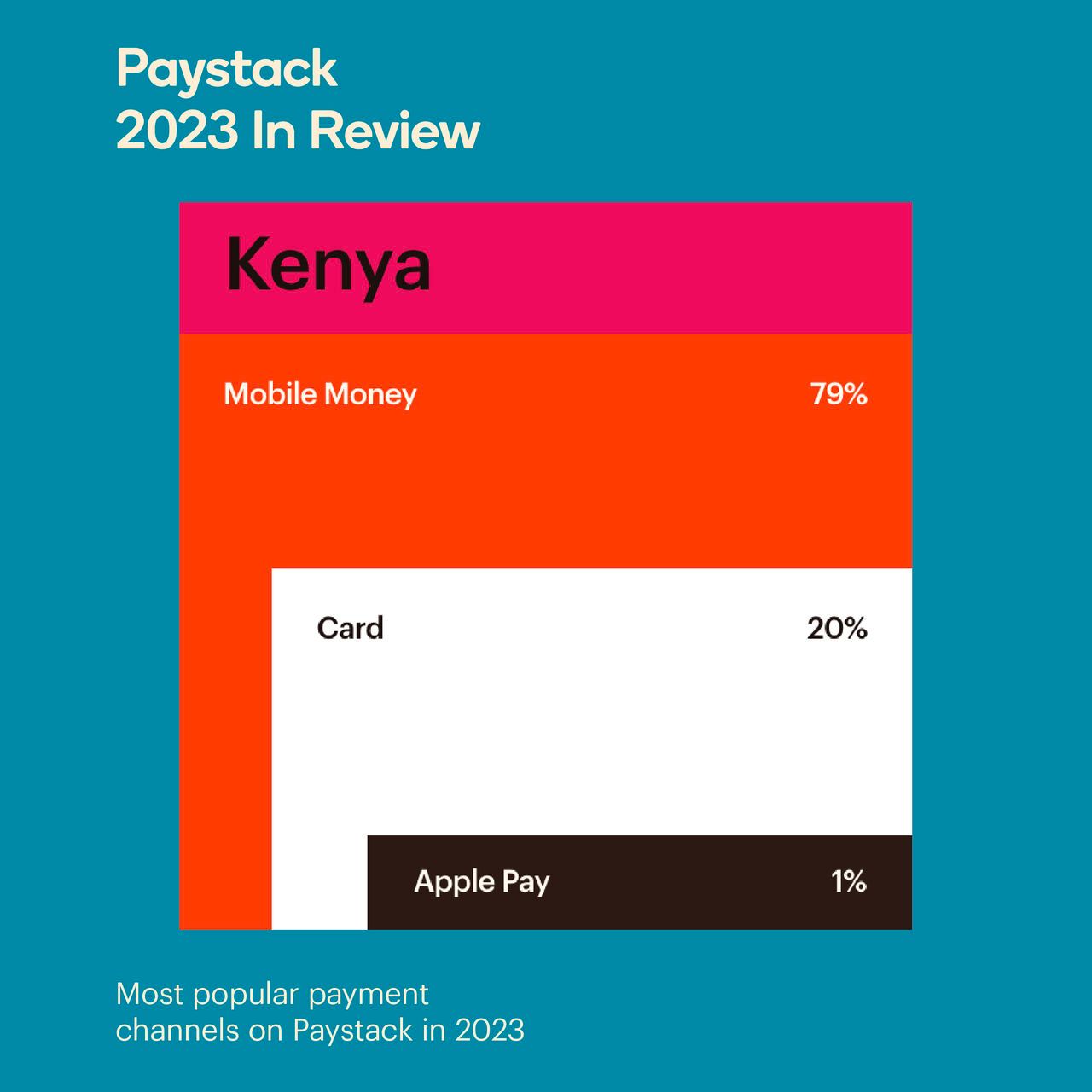

Kenya: The Mobile Money Hub

Kenya’s payment landscape is dominated by mobile money, accounting for 79% of transactions. This reflects the success of mobile money platforms like M-Pesa, which have revolutionized financial inclusion in the country. Card payments follow at 20%, and Apple Pay, a relatively new entrant, makes up just 1%.

Key Takeaways:

- Mobile Money Leadership: Kenya’s strong mobile money ecosystem demonstrates how mobile technology can drive financial inclusion and provide convenient payment solutions.

- Card Payments: The 20% card payment share shows that while mobile money is dominant, there is still a significant market for card transactions. The use of cards was almost negligible in Kenya a few years ago, which makes it surprising that they are now becoming more prevalent. As the consumer profile matures and the trend of business globalization continues, cards have proven to be best suited for cross-border transactions.

- Innovation Potential: The presence of Apple Pay, albeit small, indicates a market open to new payment technologies and innovations.

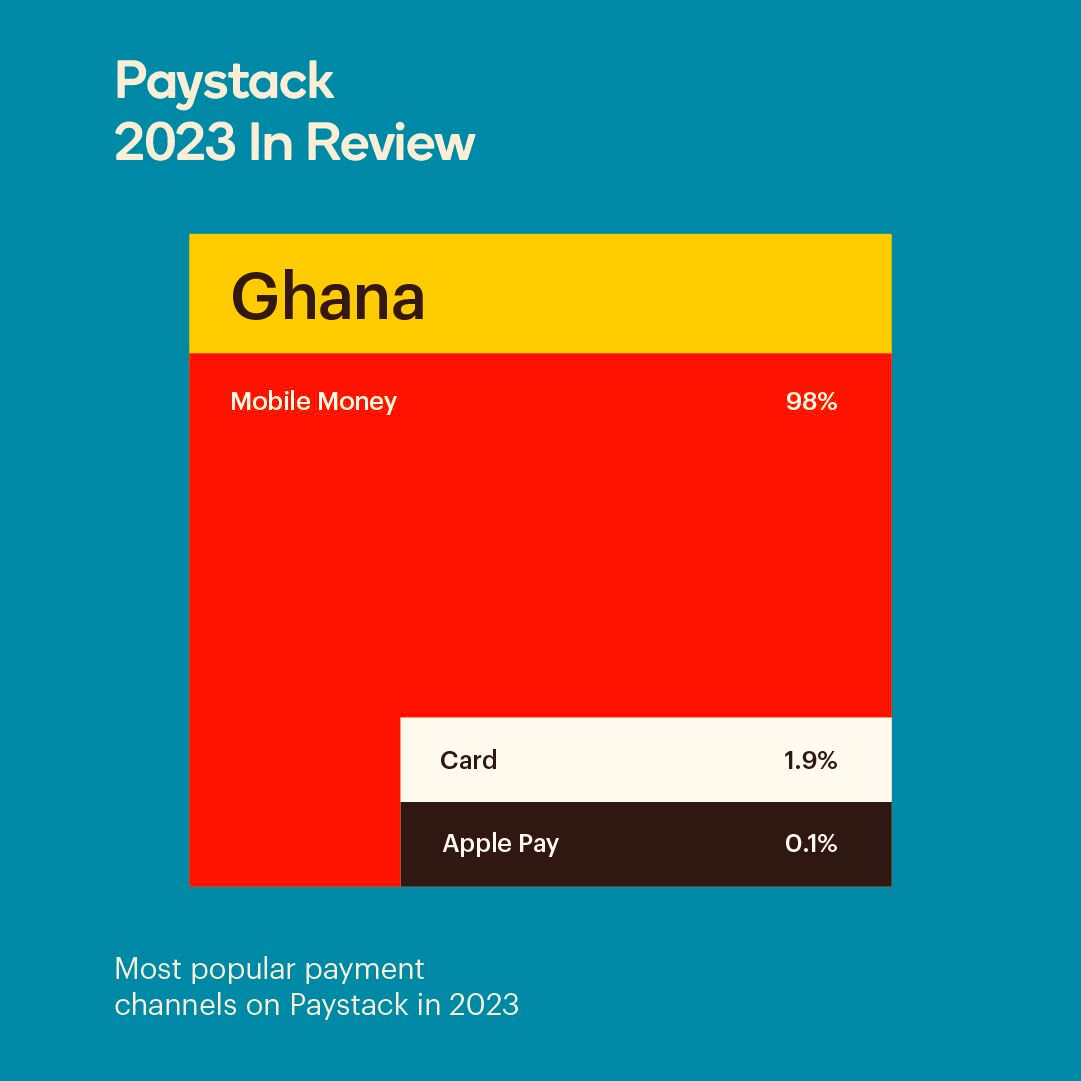

Ghana: A Near-Monopoly of Mobile Money

In Ghana, mobile money holds an overwhelming 98% of the payment transaction market, showcasing its near-monopolistic position. Card payments are minimal at 1.9%, and Apple Pay is almost negligible at 0.1%.

Key Takeaways:

- Mobile Money Dominance: The near-complete dominance of mobile money in Ghana emphasizes its role in everyday transactions and financial inclusion.

- Limited Card Usage: The minimal use of cards suggests a need for efforts to diversify payment options and reduce reliance on a single payment method.

- Potential for Digital Payment Expansion: The low figures for card payments and other methods highlight opportunities for expanding digital payment solutions and educating consumers about their benefits.

Conclusion

The data from Paystack’s 2023 review provides a snapshot of the diverse payment landscapes across Nigeria, South Africa, Kenya, and Ghana. Each country shows unique preferences shaped by their local contexts, infrastructures, and consumer behaviors.

- Nigeria shows a strong shift towards bank transfers, suggesting a need for continued enhancement of banking services and mobile banking solutions.

- South Africa’s preference for card payments points to a mature market with potential for growth in EFT and QR payments as instant transfer emerges.

- Kenya’s mobile money dominance highlights the success of mobile financial services in driving inclusion - with cards as an emerging payment tool necessitated by cross-border transactions.

- Ghana’s overwhelming reliance on mobile money indicates both its strength and the opportunity for diversification in payment methods.

Understanding these trends can help businesses and policymakers craft strategies that enhance financial inclusion, improve payment convenience, and foster trust in digital financial systems.