Thousands of British consumers have been unable to access their cash as some financial technology apps relying on scandal-hit payments processor Wirecard were forced to freeze their accounts.

On Friday, the Financial Conduct Authority (FCA) ordered the German firm’s U.K unit, Wirecard Card Solutions, to stop carrying out regulated activities. It comes after Wirecard filed for insolvency following the revelation that 1.9 billion euros ($2.1 billion) of cash had gone missing from its accounts.

The insolvency of Wirecard has affected customers of Curve, Anna, Pockit, and U Account, as they relied on Wirecard’s systems to process payments.

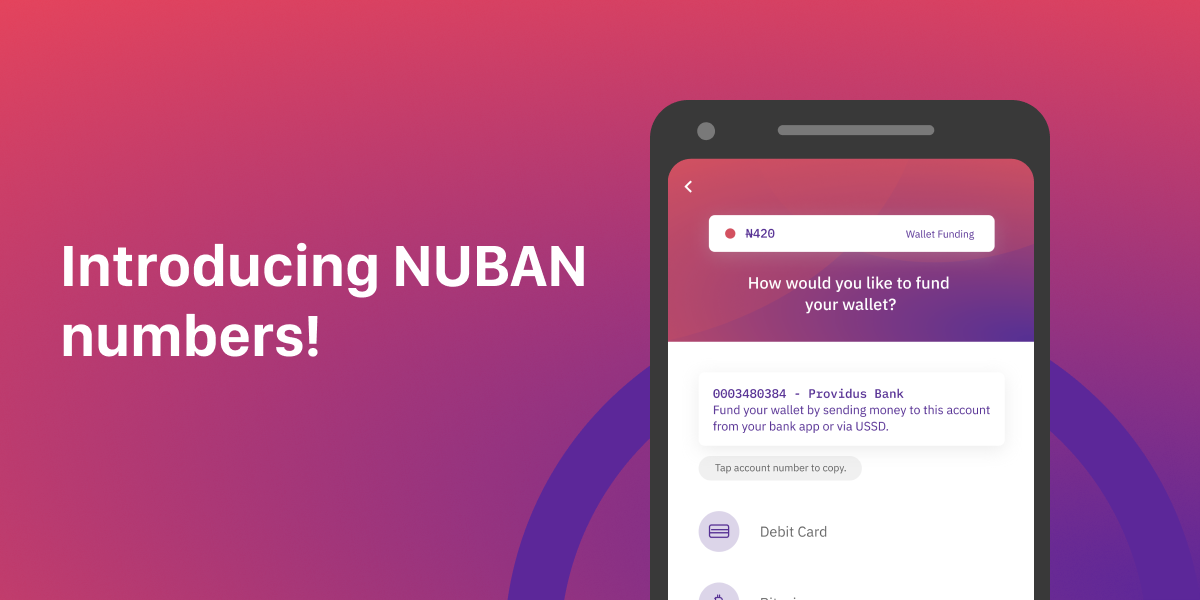

In Nigeria, a new wave of Fintechs rely on a bank for its account number. While this practice appears to be a creative way to navigate the regulatory maze; this could as well be a huge risk to account owners. If the bank(s) should become insolvent, the customers of these fintechs would also be affected as in the case of Wirecard.

On a much broader scale, most fintech companies in Nigeria rely on Flutterwave or paystack to process payments, it is, therefore, important to note that these startups now share the risk of the account number provider (bank) and the payment processor.

Across Africa, this practice has become the order of the day as MFS Africa spreads its tentacles to include more mobile money solutions into its hub. MFS who has just acquired a Ugandan Fintech startup, Beyonic; boasts of Paga, MTN Mobile Money, Safaricom, Ecobank, and several other operators in its portfolio of Payment as-a-Service (PaaS) clients.

Wirecard's scandal which EY, a global audit firm has been roped into as the startup's auditor has beamed the torchlight on the risks associated with Banking as-a- Service (BaaS) and Payment as-a- Service (PaaS) that fintech and neo-banks are embracing today.