Providus Bank Plc was granted a commercial banking license with regional authorization by the Central Bank of Nigeria (CBN) in 2016.

Following the launch of the bank, it has positioned itself as a premium bank with its ultra-modern head office branch in Victoria Island, Lagos and launched the world elite MasterCard service for its customers. To date, Providus bank has opened five branches including one in Akure, Ondo State, a city six hours away from Lagos by road.

We strive to provide cutting -edge technology that delivers best-in-class customers satisfaction,and our customer demand access to the most innovative solutions". The world elite mastercard platform provides access to an exclusive global network of benefits that satisfies every lifestyle and travel need".MD/CEO Providus Bank, Walter Akpani

In 2019, Providus changed course with a strategy that would constitute a turning point in its brief existence.

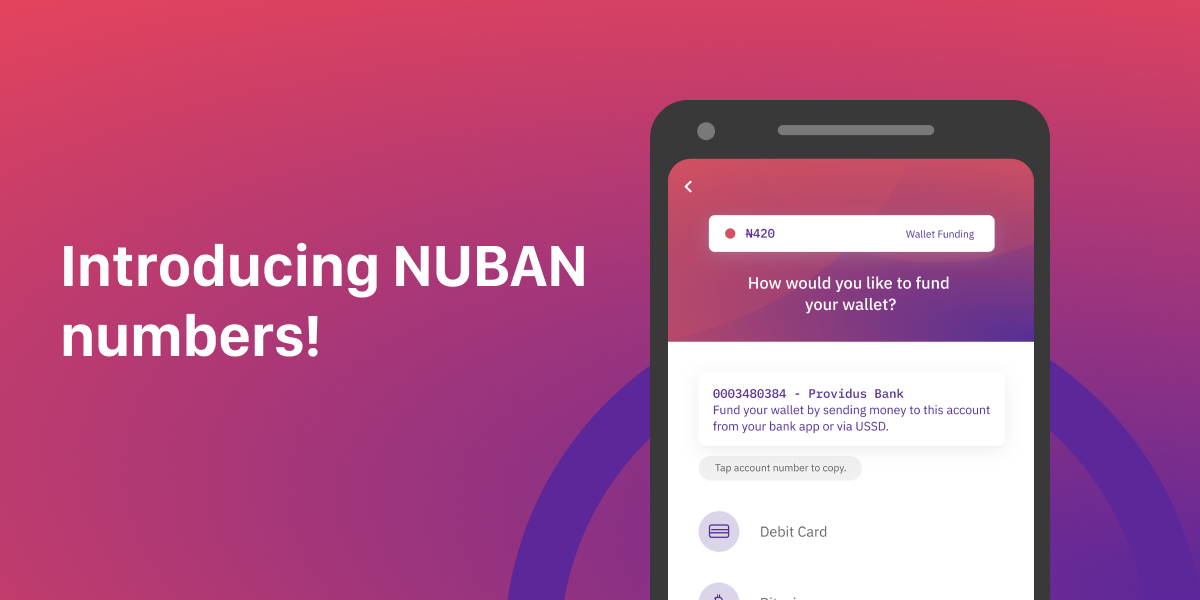

Here is how Providus Bank entered into a strategic partnership with Piggyvest (formerly Piggybank) to issue and maintain a bank account also know as NUBAN to all Piggyvest customers through a product called Flex account. I have a Flex account and I will talk about this account in another post.

In no less than a week, Providus announced the same strategic relationship with Cowrywise, another Nigerian Fintech darling. Both fintechs are winning over a new generation of bank customers, "the millennials" as a result of their competitive savings interest rate starting from 8% per annum.

Providus has since then managed to establish the same relationship with a growing list of fintechs. If anyone is winning the digital banking war in Nigeria it is Providus Bank who with a regional license is mopping up customers across the country through the fintechs without a single national advert/campaign.

Providus' unprecedented friendliness to Nigerian fintechs can be described as innovative and they are pushing the limits of that relationship as much as the Central Bank of Nigeria permits.

On the demand side, Nigerian consumers have an increased acceptability of these fintechs because of their relationship with Providus Bank as it is a legally licensed Nigerian commercial bank. Therefore it is a win-win scenario for the fintechs and Providus Bank.

The growing list of Fintechs that have partnered with Providus for bank accounts numbers and Naira debit cards are as follows:

Piggyvest (Flex- Bank account only)

Cowrywise (Stash- Bank account only)

Wallets Africa (Bank account and Naira debit card)

From a financial inclusion perspective, this strategy will enable all fintechs in any part of Nigeria including the ones based in underserved communities to achieve scale from their location by going into a strategic partnership with Providus Bank or any other Nigerian bank thereby cutting off the red tape that is required to get a bank license.

If local fintech companies combine their market knowledge and understanding with a trust-worthy bank brand, they will be able to reach the unbanked in their local communities and reduce the unbanked population (60 million adults) according to EFiNA.