In the last decade, technology companies have made strategic moves that left industry outsiders ask questions such as "To What End?" or "What is the relationship between company A and company B". A good example is Apple's acquisition of Beats Music & Beats Electronics in 2014. Industry outsiders and some Apple shareholders questioned this playbook; however, Apple was trying to embed music streaming and great sound into its core offering. The acquisition of Beats, of the least, disintermediated a significant competitor, HP, who was using Beats speaker technology in its products, including the HP laptop. Most importantly, the acquisition allowed Apple to relaunch Beats music streaming service as Apple Music in 2015 and exclusively integrate the beats sound technology into its devices- giving Apple a substantial edge over other players.

In the last decade, Financial service providers have focused on building standalone solutions within themselves instead of integrating their services in the daily touchpoints of consumers. This standalone approach has exposed players to a threat not captured by the legendary Porter's five forces model. I would describe this as competition from non-industry players.

Competition is coming from unexpected places when Walmart, a number 1 Fortune 500 retail giant, poaches Goldman Sachs consumer banking chief Omer Ismail to lead its new fintech venture established in January 2021. I will unpack the potential of Walmart's new fintech as a major financial services player in another publication.

Embedded financial service is the fusion of a financial service such as payment processing, lending, or insurance with a non-financial service provider, such as Shoprite/Spar (retailer) in Nigeria or platforms such as SafeBoda in Uganda or Bolt in Nigeria or even SweepSouth in South Africa.

Globally, embedded financial services could be the future of the financial services industry. This phenomenon is in its growth stage in developed economies but led by non-financial services providers. Good examples would be Ant Financial, WeChat Pay, WhatsApp Pay, Grab Pay etc. Similarly, fintechs are providing new services in partnership with non-financial services.

GSMA, in its State of Industry Report on Mobile Money, 2021, stated that Sub-Saharan Africa (SSA) boasts of 550 million mobile money accounts and 220 million active mobile money accounts. Specifically, Kenya's innovation poster face, Safaricom, in its latest annual report released in May 2021, reported that one-month active Mpesa (mobile money) stood at 27 million, more than half of Kenya's entire population. There is a clear opportunity to deepen the engagement of the 220 million active mobile accounts in SSA.

Case studies that showcase strategic partnership that feature embedded financial services are as follows:

Wise and Western Union (Global)

- Partner: Google

- Proposition: Google Pay users in the United States will transfer money to app customers in India and Singapore. Google plans to extend this service to 280 countries by the end of the year. Eighty countries via Wise and 200 via Western Union.

- Why is it Strategic: Google's Android commands 72% of the mobile operating system market share worldwide as of April 2021, with 1.6 billion users globally.

- Google's benefit: 0.5% to 1% commission on every remittance transaction through its platform.

- Wise and Western Union's benefit: Unprecedented access to 1.6 billion users globally with zero acquisition cost excluding commission.

M-pesa (Kenya)

- Partner: Amazon E-commerce

- Proposition: The use of mobile-money service M-Pesa on the e-commerce giant's platform as a payment option. This direct integration will allow Kenyans to pay on Amazon from their Mpesa wallet instead of a bank debit card.

- Why is it Strategic: Amazon is a major platform for cross border trade between Kenya and the rest of the world. This relationship forms part of Mpesa efforts to expand its global reach and bounce back from a first profit decline in a decade.

- Amazon's benefit: Access to Mpesa's 27 million active customers

- Mpesa's benefit: Revenue from transactions processed using Mpesa.

Grab (Asia)

- Partner: Several financial services partners (Mastercard, Stripe, Citi, Maybank, Credit Saison, OVO etc.)

- Proposition: Integration of several services to provide payment, insurance, loans, rewards, and investment products to Grab users through the Grab Pay platform.

- Why is it Strategic: As of June 2020, Grab's ride-hailing service had 184 million users and 3 million drivers. Grab Pay expands Grab into newer segments to increase engagement, addressable market, drive monetization, and profitability.

- Grab's benefit: Increased revenue from commissions.

- Partners' benefit: Access to Grab's 184 million users and 3 million drivers

Similar case studies abound, and they include:

- Access bank's In Vitro Fertilisation (IVF) treatments insurance: Access bank partnered with Hygeia Health Maintenance Organisation (HMO) to amplify access to In Vitro Fertilisation (IVF) treatments with 30 per cent cash-back on unsuccessful procedures.

- WhatsApp Pay: Person to person (P2P) payments within WhatsApp

- PayPal: PayPal acquired Happy Returns - a startup that aims to make returning e-commerce goods easier for both shoppers and sellers.

- Ant Financial: Person to person (P2P), Person to Business (P2B) and merchant loan within the Alibaba Ecosystem

- DubaiCars: Buy Now, Pay Later -BNPL option for car purchasers in the DubaiCars platform

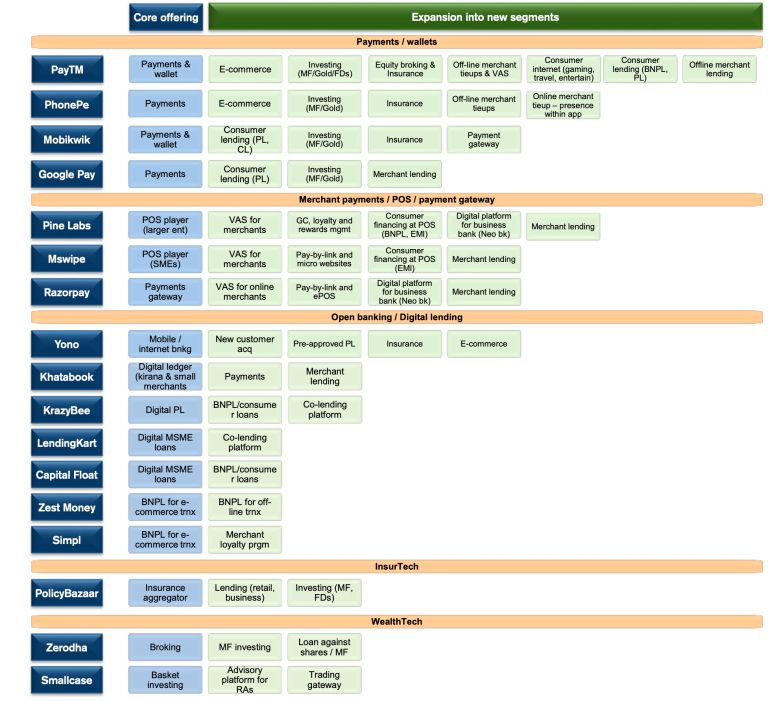

It is imperative for banks, mobile money operators, and fintechs to expand into newer segments to increase engagement, addressable market, drive monetization, and profitability. To achieve this, financial service providers should forge strategic partnerships that embed essential financial services with non-financial service providers and financial service players that are not direct competitors.