Zambia, Africa’s second-biggest copper producer, has a population estimated at 17.9 million and rapidly growing at 2.8% per year. Zambia is experiencing a demographic shift and is one of the world’s youngest countries by median age.

Zambia enjoyed free global media coverage in November 2020, for defaulting on its foreign debt, totalling $12 Billion (51% of its 2019 GDP). President Edgar Lungu, credited the COVID-19 pandemic for missing a $42.5m interest payment in the middle of extensive negotiations on restructuring its debt.

Zambia's indebtedness cannot be more apparent with the signpost of the Bank of China (one of Zambia's key lenders) at the entrance of its International Airport in Lusaka, Zambia.

The COVID-19 (coronavirus) pandemic has worsened the country's macroeconomic weaknesses. The Zambian Kwacha(currency) has depreciated by 30% since the beginning of the year.

Amidst the health and economic crisis facing Zambia, its digital financial services industry has blossomed in the last year. Thanks to sustained government regulation, consumer digitization and supply-side innovation.

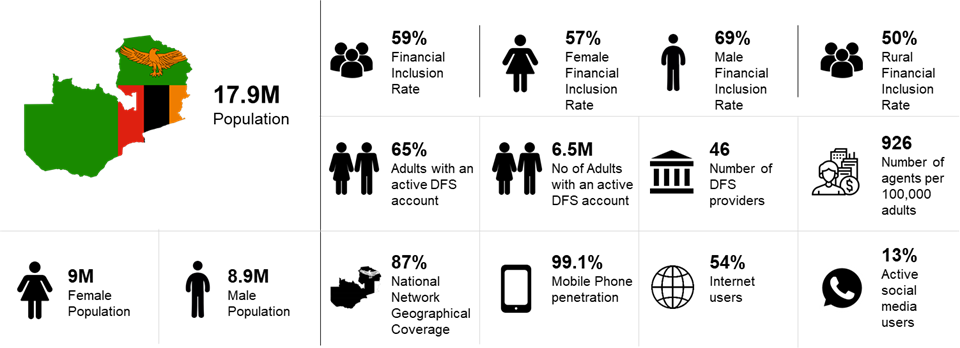

Snapshot of Digital and Financial in Zambia

Government Regulation

To mitigate the negative impact of COVID-19 on the stability of the financial sector and reduce reliance on cash, the Bank of Zambia took the following regulatory measures:

- Lowered the policy rate by 225 basis points to 9.25%.

- Waived charges for person to person (P2P) electronic money transfers of up to K150. These transactions are now free of charge

- Revised upwards transactions and balance limits for individuals, small scale farmer and enterprises. To decongest bank halls, the limits by agents have been revised upwards to give agents more float to deal with transactions.

- Removed the transaction and balance limits on agents and corporate wallets;

- Reduced the processing fees for the Real-Time Gross Settlement System.

Supply Side

There are 17 banks and 25 fintechs in Zambia and over 90,000 active agents points, a 92% increase from 46,781 in 2018. Additionally, as of September 2020, there are 22,763 POS terminals, a 28% increase from 17,851 in January 2020.

A UNCDF survey on DFS in Zambia in April 2020, reported that 84% of DFS providers were confident that their businesses would remain commercially viable, which is an improvement from 2018 when 61% of providers said their business could generate enough revenue to cover operation costs.

In less than ten months ending October 2020, the number of MTN Mobile Money users in Zambia increased from 3 million to 4.5 million, Bart Hofker-MTN Zambia CEO.

Zambia remains attractive to foreign banks and fintechs. Access Bank Nigeria acquired 100 per cent of Cavmont Bank Limited, a Zambia-based financial institution. Joining UBA, Standard bank, Ecobank in the market. Also, Nigeria's Flutterwave, now allows merchants to accept payments from customers in Zambia using their mobile money wallets.

Demand Side

There are over 6,500,000 DFS accounts active on a 90-day basis, a 49.6% increase from 4,345,858 in December 2018. Consumers in Zambia have responded positively to the government regulations instituted by the government of Zambia in response to the COVID-19 crisis.

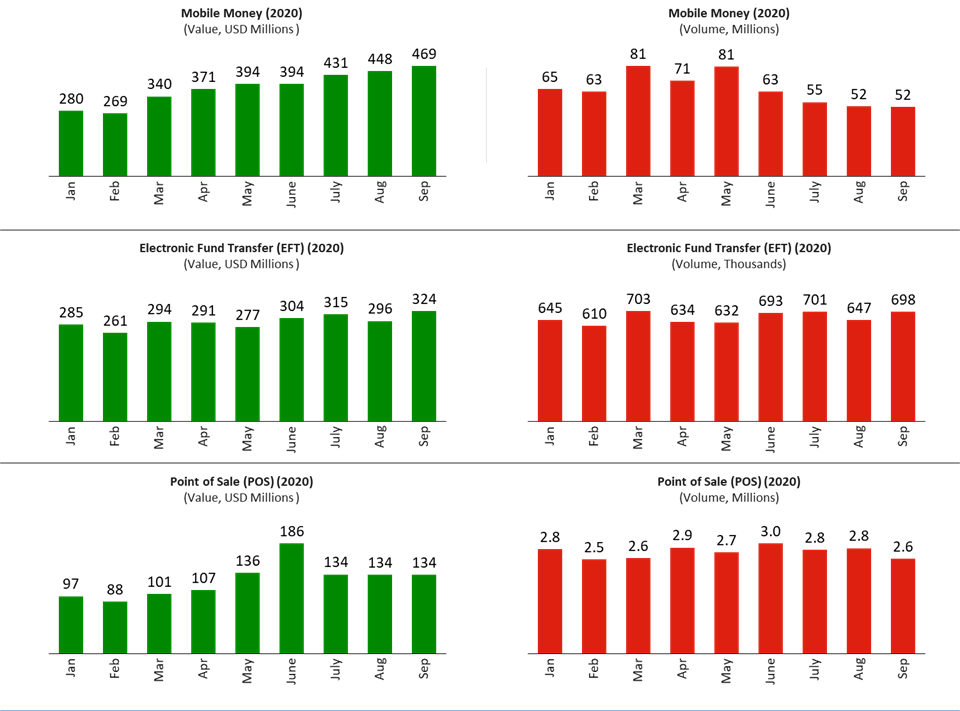

As in the graph below, Mobile money transactions have reduced starting in May 2020 but remained stable over the last three months ending September 2020. However, mobile money transaction values have hit an all-time high of 469 million USD as a result of inflation due to the economic tides the country is facing.

Despite, the lockdown and reduced business activities' transaction volumes and values across all rails have remained relatively stable in 2020.

Snapshot of Digital Financial Services usage in Zambia, 2020

Additionally, a survey by UNCDF on digital financial services in Zambia reported that increased appetite for digital financial services is also as a result of the following efforts by digital financial service providers:

- Offering products and services tailored to address the needs of specific customer segments;

- Reactivating inactive customers by increasing customer education efforts, and re-introducing product offerings;

- Using data analytics to understand customer behaviours or usage trends.

Conclusion & Recommendations

The World Bank has projected that the Zambian economy will contract by about 4.5% in 2020. Lower copper export earnings and capital inflows will put pressure on reserves and the Zambian Kwacha (currency).

The following recommendations are critical to deepening the usage of financial services in Zambia despite the health and economic crisis:

- Utilize data analytics to identify and test additional use cases for digital financial services such as cashless transport systems as in Rwanda.

- Merchant payments: DFS providers should develop context-specific and affordable payment channels. An example would be a bill pay number accessed using Unstructured Supplementary Service Data (USSD) as with Kenya's Mpesa. Bill pay number and USSD will suit locations without adequate internet infrastructure or a situation where the consumer has no smartphone.

- Build an ecosystem that attracts customers for the informal economy could be a solution. Kenya's Boda Boda and Nigeria's Flutterwave store are good examples.

I created a podcast with colleagues, experts and operators based in Zambia and South Africa aimed at getting additional perspectives to the economics of Zambia as well as its Digital Financial Services landscape. Listen here