OPay, the Nigerian fintech startup founded by Opera, plans to expand its payments service operations to North Africa early next year. This comes on the heels of Amazon unveiling its digital financial service in the Middle East and North Africa.

OPay has come a long way in Nigeria, its debut country in Africa where it almost successfully deployed a super app by giving Africa's largest population(Nigeria) a less than $1 motorcycle-based ride-hailing service amongst several other services such as OCar, OKash, OSave, betting, OList, OLoan, and a lot of Os.

The dream to be a super app in Nigeria, was cut short when the Lagos state government took away its motorcycle-based ride-hailing licence leading to the eventual shutdown of OPays services across Nigeria except for its payment services. Well at this point, OPay had amassed millions of customers already, setting the stage for its fintech-only strategy to thrive.

In an interview with Bloomberg, OPay's MD, Iniabasi Akpan confirmed that the volume of monthly settlements on the OPay platform grew almost by 400% to $1.4 billion in November 2020 from $363 million in January 2020.

“With a network of 300,000 offline agents, we plan to reach transactions value of about $2 billion by the end of this year,” Akpan

OPay's Current Product Strategy

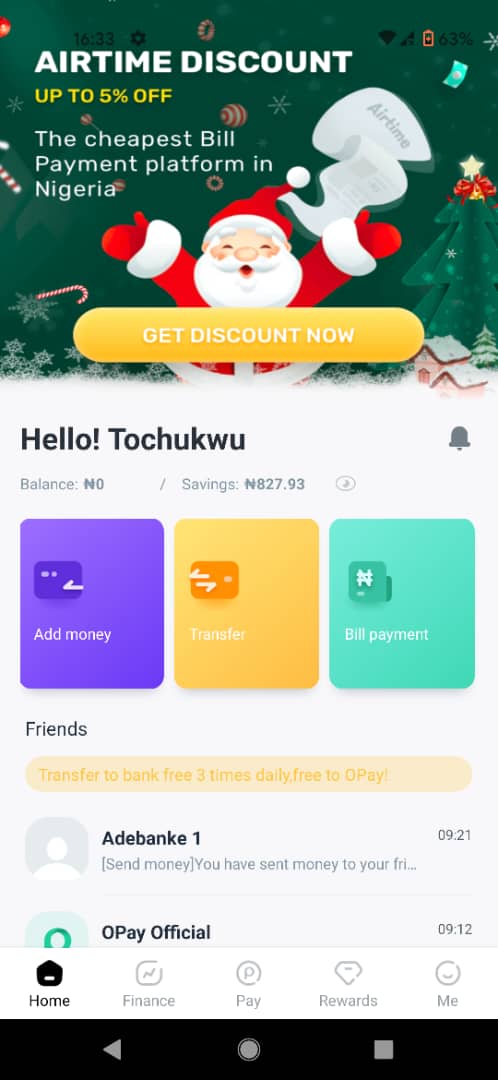

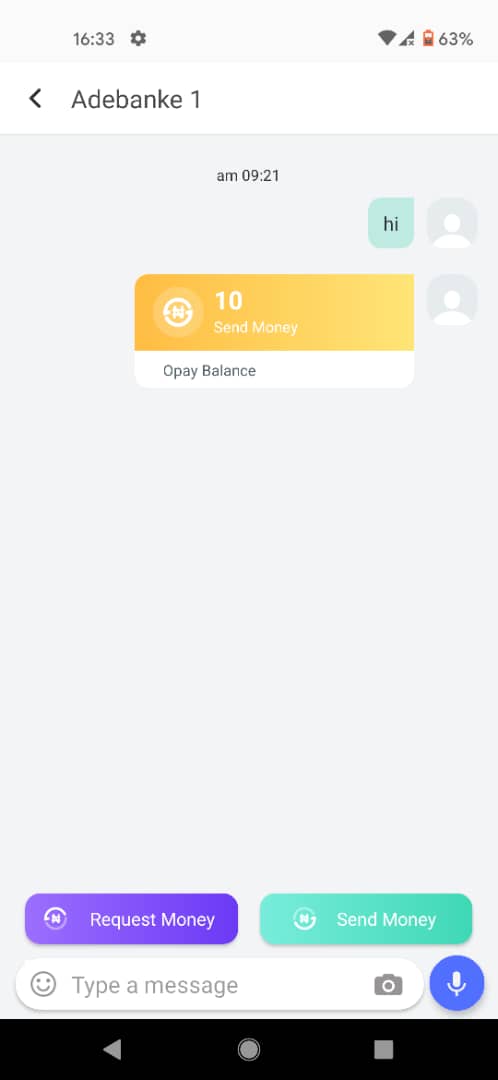

I stopped using the OPay app after the government's regulatory action. A review of OPay in the last 24 hours revealed a fleet of new services including FlexiMini, FlexiBang, CreditMe, Payday load and most notably, WhatsApp like Chat. One could call it OChat. This chat feature allows users to chat with OPay users on your contact list, just as in WhatsApp; but in this case, you can send another user money or request for money right from the chat section of the app.

Whilst WhatsApp expands the reach of its payment service, WhatsApp Pay, which has gone live in Brazil and India, it is interesting to see that African fintechs are already building walls of defence around its users.

OPay also acquired an international money transfer licence last year and has announced a partnership with WorldRemit to process remittances into Nigeria. Again, this plan was halted as a result of new remittance regulations in Nigeria.

North Africa

There are six countries in the North African region – Algeria, Egypt, Libya, Mauritania, Morocco and Tunisia with a total population of 248 million as at December 2020.

Backed by Japan's Softbank Group, OPay is now planning an entry into the North African market after its success in Africa’s most populous country, Nigeria and attaining financial self-sufficiency in June 2020 with a customer base of over 7 million.

OPays's previous plans to expand to South Africa and Kenya, after raising $190 million in funding last year, have been put on hold due to the disruption caused by the coronavirus pandemic.

Why North Africa?

There are several hypotheses behind OPay and Amazon launching in North Africa. Two of which include:

- The battle for the rest of Africa (South, East and West Africa) has been largely won by large, growing and innovative financial and technology institutions. OPay's honey (motorcycle ride-hailing) is well established in East Africa. Uganda's Safeboda has exited Kenya because of strong competition. On the financial services end, Safaricom's Mpesa is holding down the forte in East Africa's most important market, Kenya.

- North Africa's financial services regulatory landscape is not as sophisticated as in the rest of Africa. The case of Safaricom in Kenya and slightly EcoCash in Zimbabwe has shown us that the best time to launch in a market is when there is little to no regulation. Of course, this comes with pros and cons.