In what looks like a shutdown of the financial system, Zimbabwe has shut down mobile money and the national stock exchange, even though 77% of its population rely on mobile money services for survival.

In fact, Zimbabwe's Reserve Bank reports that, due to lack of cash in the Zimbabwean economy, mobile money and card payment options make up over 90% of all transactions.

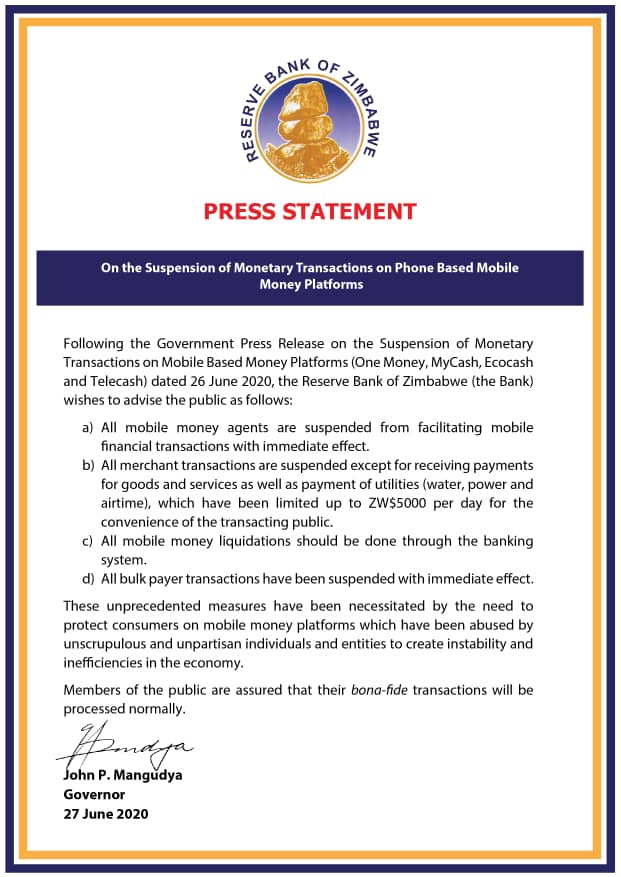

Explaining the government's decision via a press statement, on Friday, Reserve Bank of Zimbabwe said, "These unprecedented measures have been necessitated by the need to protect consumers on mobile money platforms which have been abused by unscrupulous and unpartisan individuals and entities to create instabilities in the economy."

It is however worthy of note that millions of Zimbabweans rely on these now-suspended digital payment operators, as obtaining physical cash has become extremely difficult since the country's government attempted to engineer a return to the local Zimbabwean Dollar from a host of foreign currencies, including The Japanese Yen, the US Dollar, and pound sterling.

This informed the government's decision to ban the domestic use of foreign currencies. The resulting cash crisis then made mobile money king in Zimbabwe, and placed it as one of the African countries with the highest level of financial inclusion. This move, however threatens that standing.

Macroeconomic View of Zimbabwe

Zimbabwe is a landlocked country in southern Africa with a population of 14.4 million and a GDP per capita of $ 1,368.0, which is ranked 166th in the world. Zimbabwe is one of the world's 25 poorest economies, with 61.0% of its population living below the poverty line, and a 319.0% hyperinflation (largely due to the current cash crisis in the country). Its Life expectancy currently stands 61.36 years, amidst the country's worst economic crisis in over a decade which sees some 7.7 million people (half of the country's population) needing food assistance, according to the UN). In fact, the country is currently heading back to the use of the US Dollar for transactions, as the Zimbabwean Dollar continues to tumble.