As the festive seasons draw nearer, people across the world make it a priority to give their family and loved ones the best experience at all costs. In Nigeria, people mark this period as “Detty December,” a term used to refer to lavish celebrations. However, here at Inclusion Times, we believe you and your loved ones deserve the best holidays and a financially free life, so we offer you a list of budgeting and savings apps that can help you achieve that.

Budget spending apps go a long way in assisting with money management. They help improve your spending habits by providing personalised spending goals and insights. Here are some of these apps:

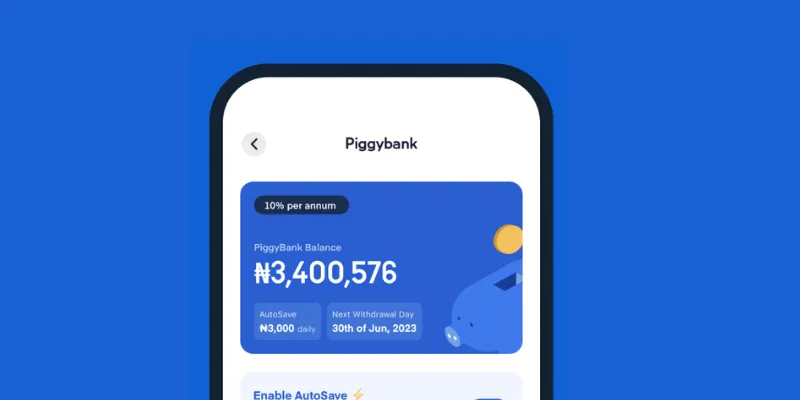

PiggyVest:

PiggyVest is one of Nigeria’s most popular online places to save and invest money. The platform makes it easy for over two million users to save money and invest, which helps them meet their financial goals.

Piggyvest allows you to use the “piggybank” feature to save money more quickly and meet your savings goals, irrespective of how much you earn or what you are saving for. You may want to join the ongoing Christmas saving challenge and earn interest on your savings.

PiggyVest is available for Apple and Android phone users.

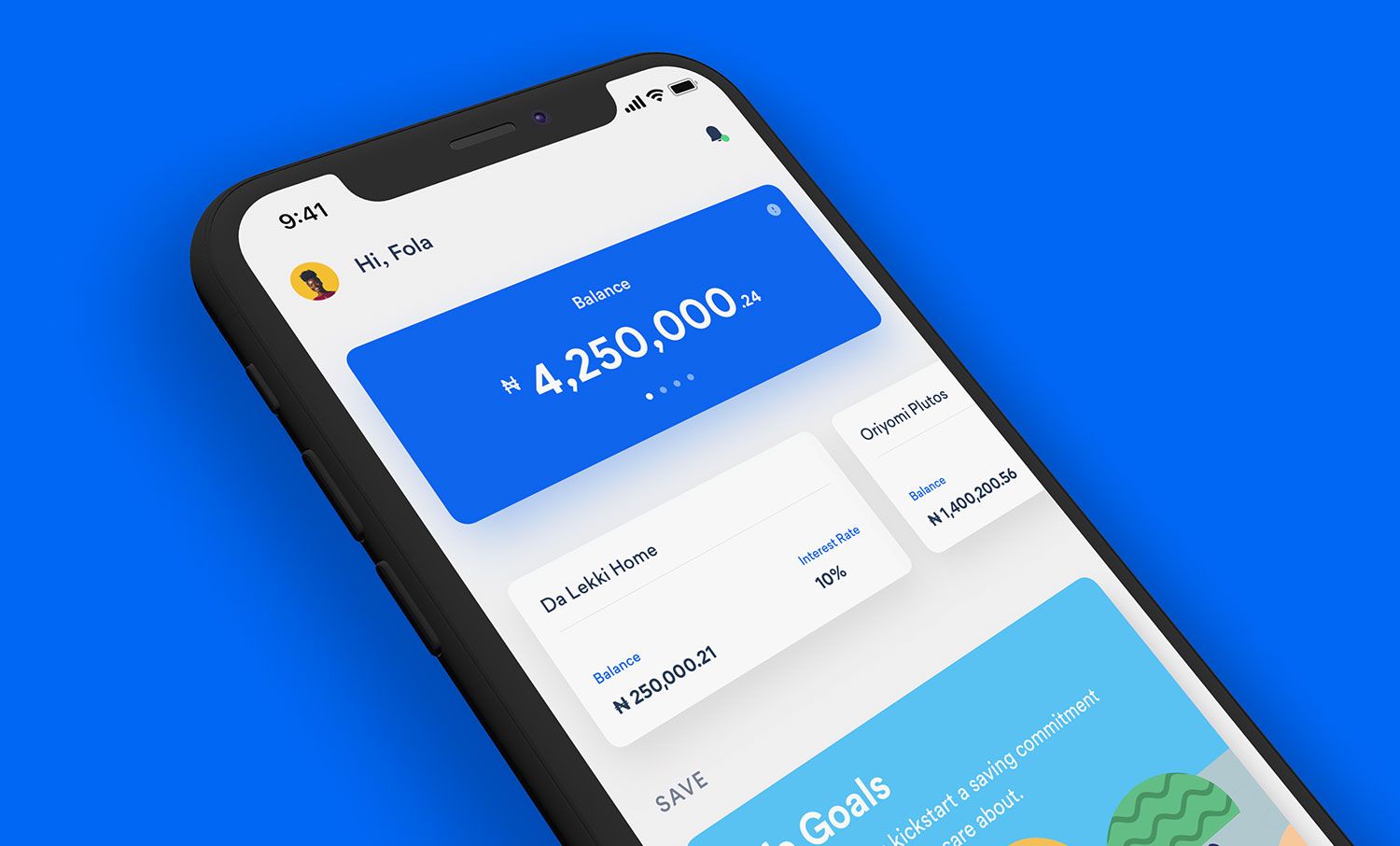

Cowrywise:

Like other great savings apps, Cowrywise offers a range of savings options to suit individual needs. While on holiday and looking to plan for the new year or save some extra cash, you can look at the platform for exciting saving plans or join the circles, a feature that encourages you to save per every goal your favourite team scores.

Cowrywise is available for Apple and Android phone users.

Sparkle:

Sparkle is a digital bank that assists Nigerians with their finances, lifestyles, and businesses. This digital bank has exciting features that allow you to save and spend smartly.

With over 150,000 users across Nigeria, Sparkle offers a personalised means of saving money through its feature, Sparkle Stash. You could set a January goal or for the entire new year and save towards it.

Sparkle is available for Apple and Android phone users.

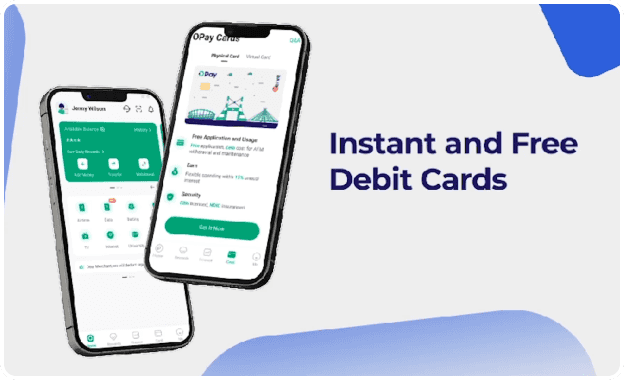

Opay:

Launched in 2018, Opera’s Africa fintech startup OPay has taken the Nigerian fintech ecosystem by storm, and its mobile money service is one you can trust for saving and smoother transactions, overcoming the network issues popular amongst traditional banks.

Opay is available for Apple and Android phone users.

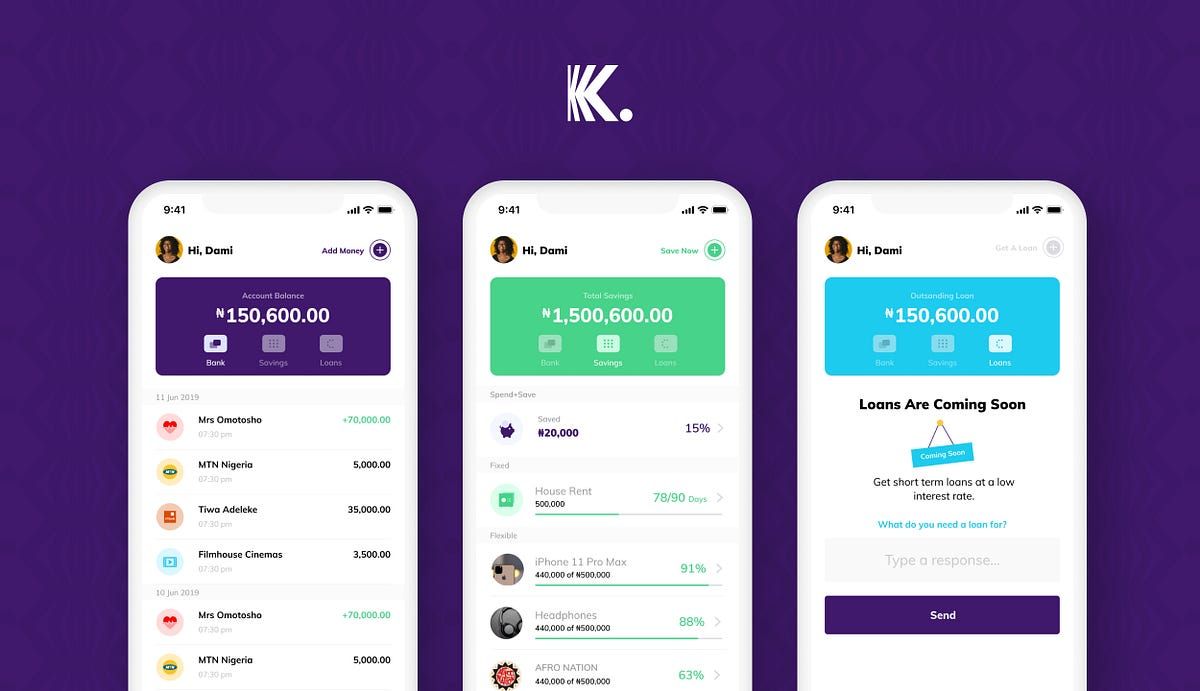

Kuda Bank:

Kuda is a Nigerian digital bank offering customers various savings options via its mobile app. The bank has a fixed savings plan that allows users to save a lump sum and earn annual interest. However, withdrawal before maturity means users will lose accrued interest.

The Spend and Save plan is an exclusive feature that automatically saves (a pre-specified amount of) money every time users spend from their Kuda account. Kuda’s Flexible savings plans let users save money at will daily, weekly or monthly.

The Kuda Bank app is available for Apple and Android phone users.

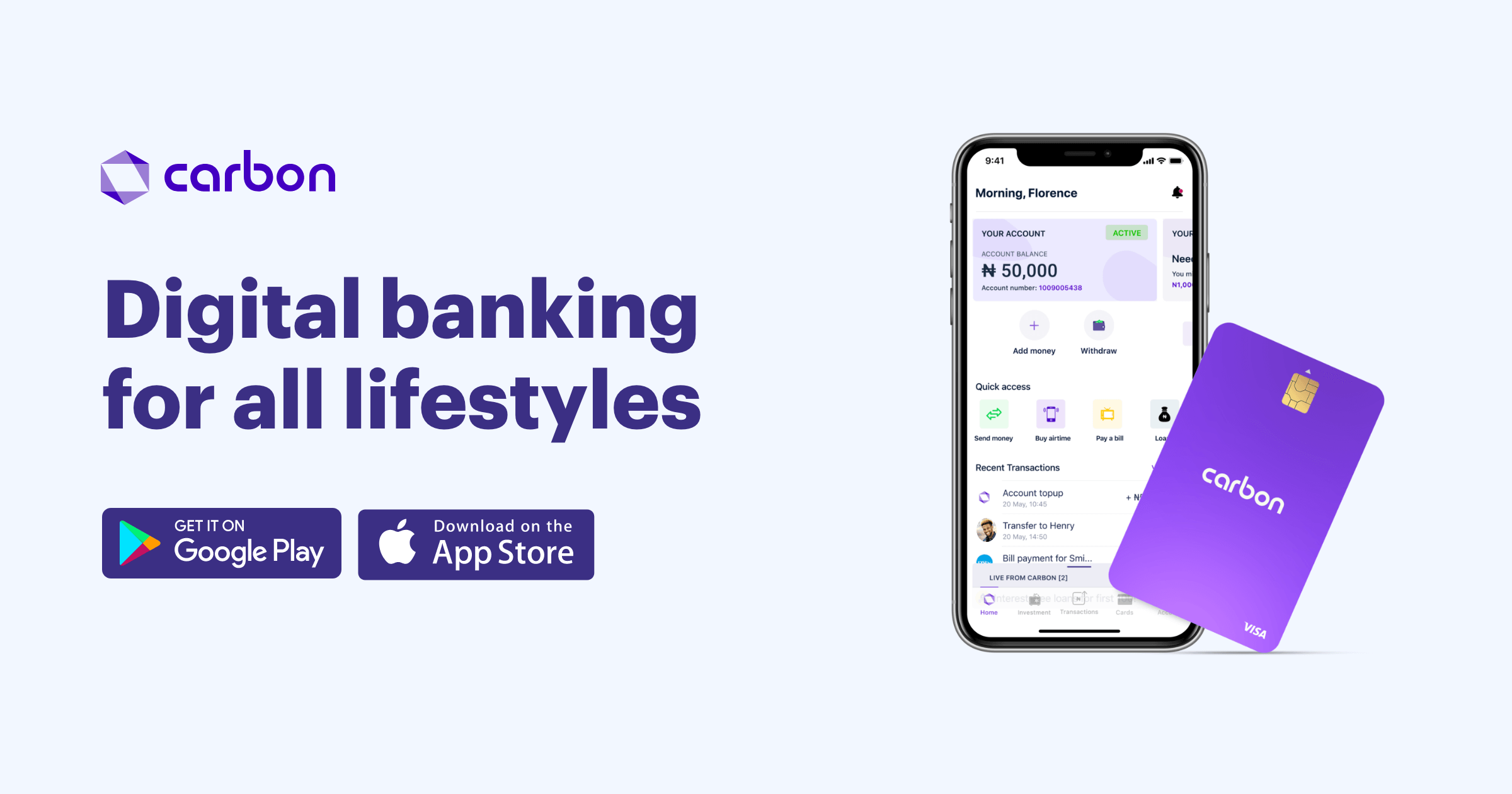

Carbon:

Carbon is a CBN-licensed digital bank that provides loan facilities, investment opportunities, and usual digital banking features such as debit cards. Accounts are enabled for P2P payments, as well as bill payments and mobile recharges. The fintech company currently has over two million customers and is a trusted platform for your financial transactions this holiday.

Carbon is available for Apple and Android phone users.

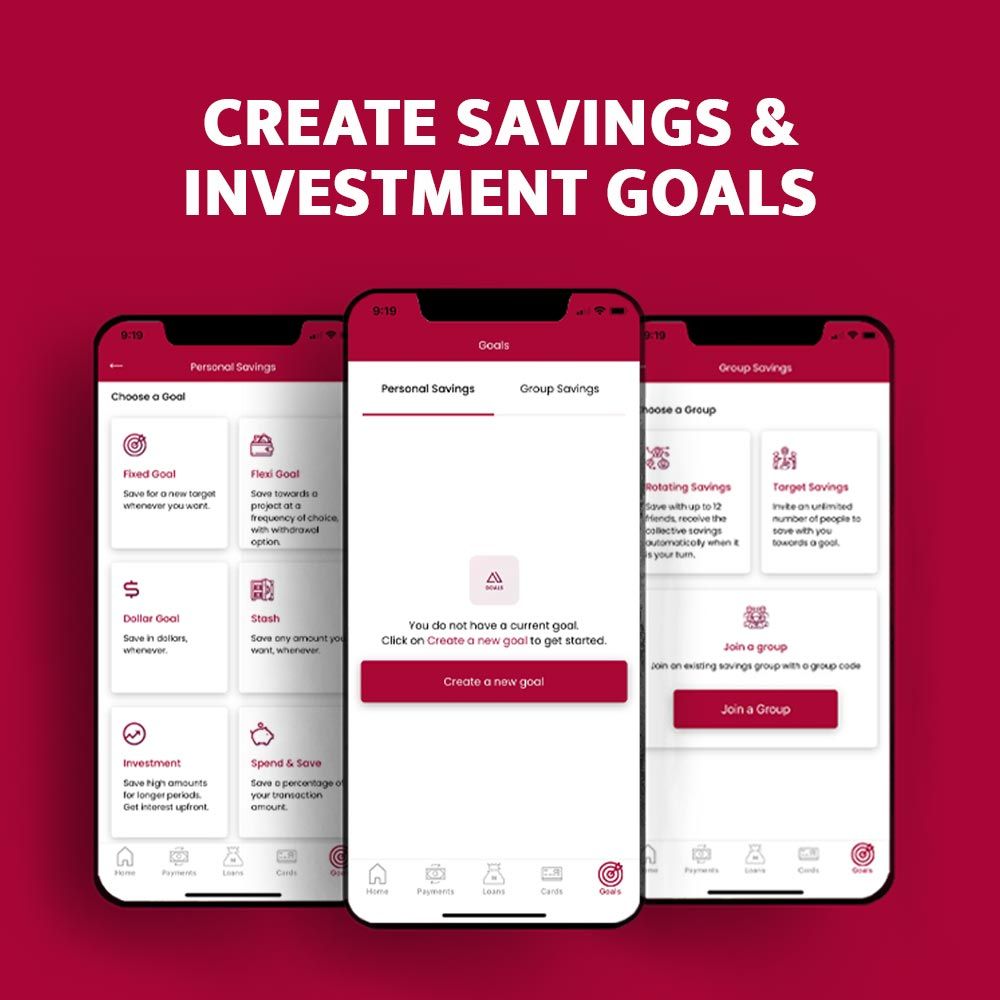

ALAT by Wema:

ALAT is the digital branch of WEMA Bank Nigeria and is fully digital. This means you can perform all your transactions on your electronic devices and from the comfort of your home – you do not have to go to a physical branch.

ALAT allows you to set your savings goal and determine how much you want to save and for how long. You can automate your savings or choose to save at your own pace. You can also save alone or with friends via the Group Savings option.

ALAT by Wema is available for Apple and Android phone users.

Disclaimer: This is not a sponsored post. Thus, readers are encouraged to research before using any of these platforms.