Consumer lending platform Carbon, which rebranded last year to Carbon from Paylater won my heart by unmasking its financial statements and operations.

Carbon a privately held Fintech had no legal compulsion to make its audited report public, but they have voluntarily chosen to do so.

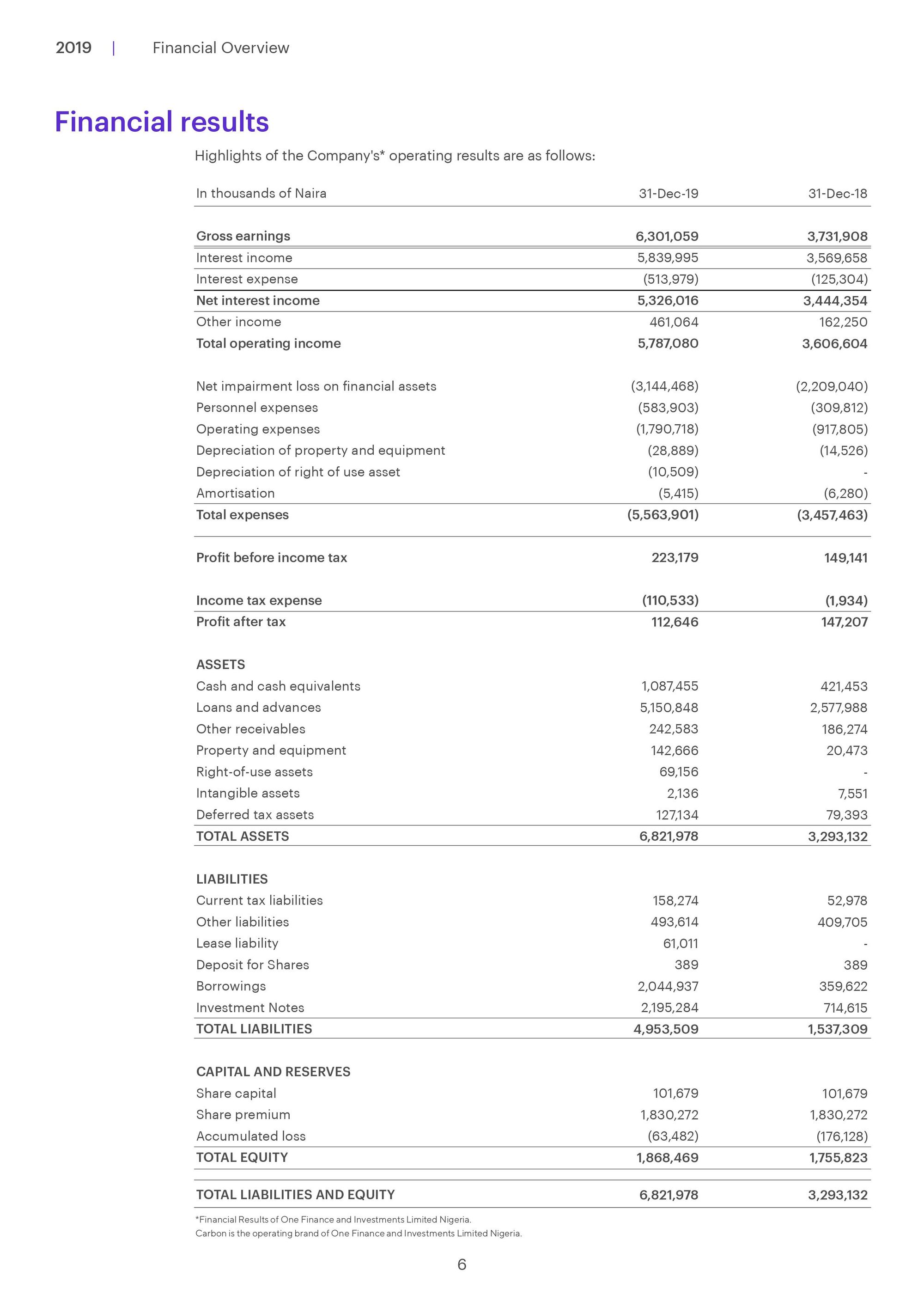

In its audited report published this week, Carbon, the Nigerian fintech company, declared that it made the naira equivalent of $312,905 in profit after tax in 2019.

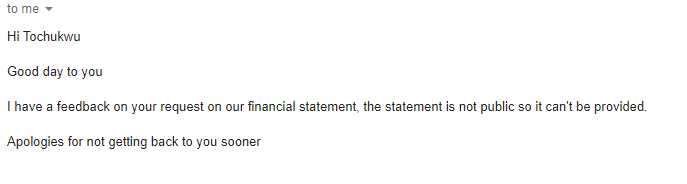

At the time that I wanted to start using one of the savings startups, I called the customer support team and asked for their annual report. They got back to me a few days later to let me know that their report is not available to customers, potential customers or the public.

I ended up banking with another fintech who also do not make their annual report public but has a longer history of existence. No doubt, I am moving my business to Carbon.

Carbon's transparency action comes at a time that German fintech company, Wirecard, is embroiled in a scandal that has caused it to file for insolvency.

There is need for fintechs to voluntarily publish their annual report to attract the audience they are targeting which is the educated working professional saving for life goals.

There is also a need for regulators in Africa to institute transparency focused policies on fintechs in Africa as they become the choice savings partners for the next generations of savers.

Carbon's transparency made me re-download the Carbon app and will commence saving with them as soon as I can.