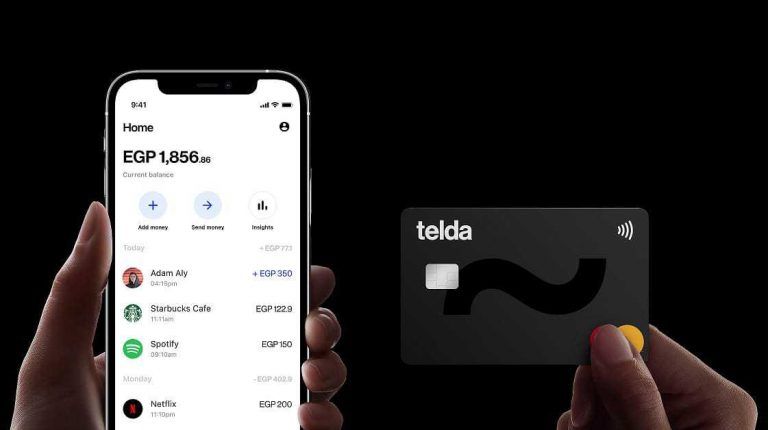

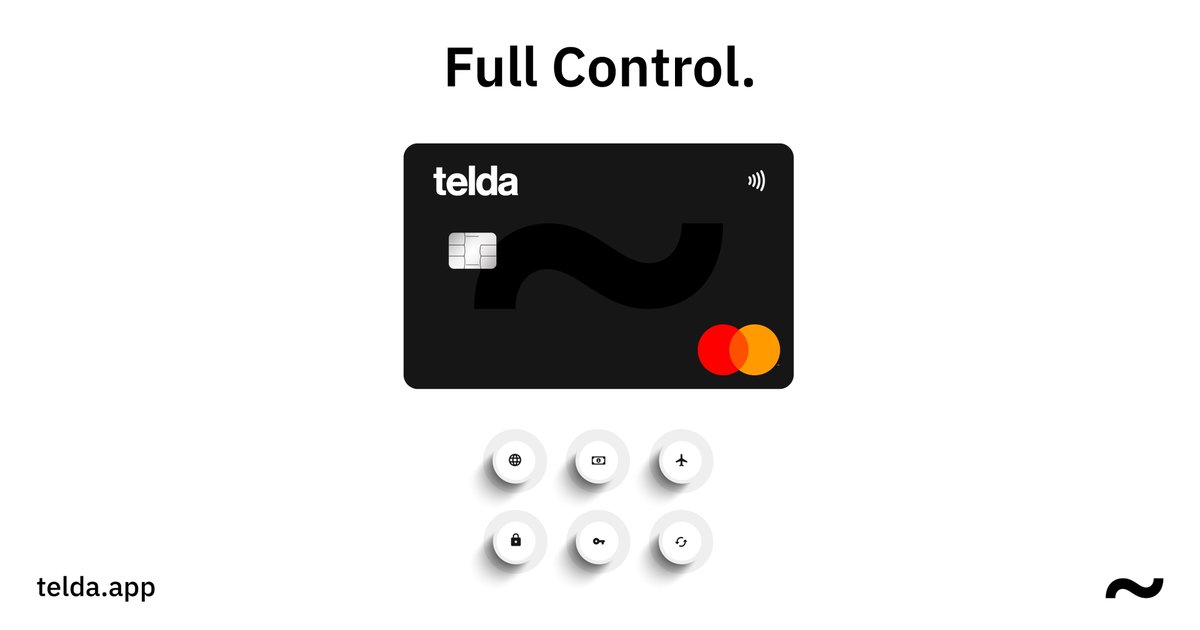

Telda has launched its card and application operations after acquiring regulatory approval from the Central bank of Egypt. April 2021 marked the beginning of an innovative project that would seek to revolutionise the payment experience of many Egyptians as Telda began its operations by teaming up with Banque du Caire (a local Egyptian bank) as it was yet to be licensed as an independent neo-bank. Focused on offering digital financial solutions, Telda has rolled out free prepaid cards powered by MasterCard.

Driven by its passion for a digital economy, Telda wants to introduce about 67% of Egypt's population who remain unbanked into the financial industry and offering a better financial experience Telda has sought to offer free prepaid cards. Users will enjoy making payments online using this Telda's card without having a bank account. Thus, breaking the barriers to accessing financial services as Telda's app allows every user to manage their accounts with features and tools that make navigating easy.

Telda aims to play a significant role in transforming Egypt into a fully digital economy by initiating the large migration of many young Egyptians into an advanced financial ecosystem. The Central Bank as a regulatory body will strive give grassroots companies like Telda the space to rise into boosting Egypt's financial inclusion mission by setting up innovative policies.

Egypt in focus:

Population: 102.3 million in 2020 as compared to 100.4 million in 2019

GDP: $363.1 billion compared to $303.1 billion in 2019

GDP per capita: $3,547 in 2020 compared to $3,019 in 2019