The Nigerian Banking sector is one of the most competitive sectors in the Nigerian economy and perhaps the most profitable. Despite having about 23 deposit money banks in the country, only a dozen are listed on the Nigerian Stock Exchange (NSE).

In this report, we take a cursory look at the performance of listed banks in Nigeria based on their net profits.

Corporate Profits are often viewed positively or negatively depending on how you view the impact of capitalism. For banks, it can attract scrutiny if it comes at the expense of small businesses or the wider economy. The banks considered reported a total profit after tax (Net Profit) of N436.9 billion at the end of June 2019. This compared to N415.5 billion recorded in June 2020 indicates a 5% decline.

Though banks have often been criticized for reporting fat profits at the expense of the wider economy, it is better off having profitable banks than unprofitable ones. The more profitable banks are (consistently) over time, the more robust they are to support economic growth.

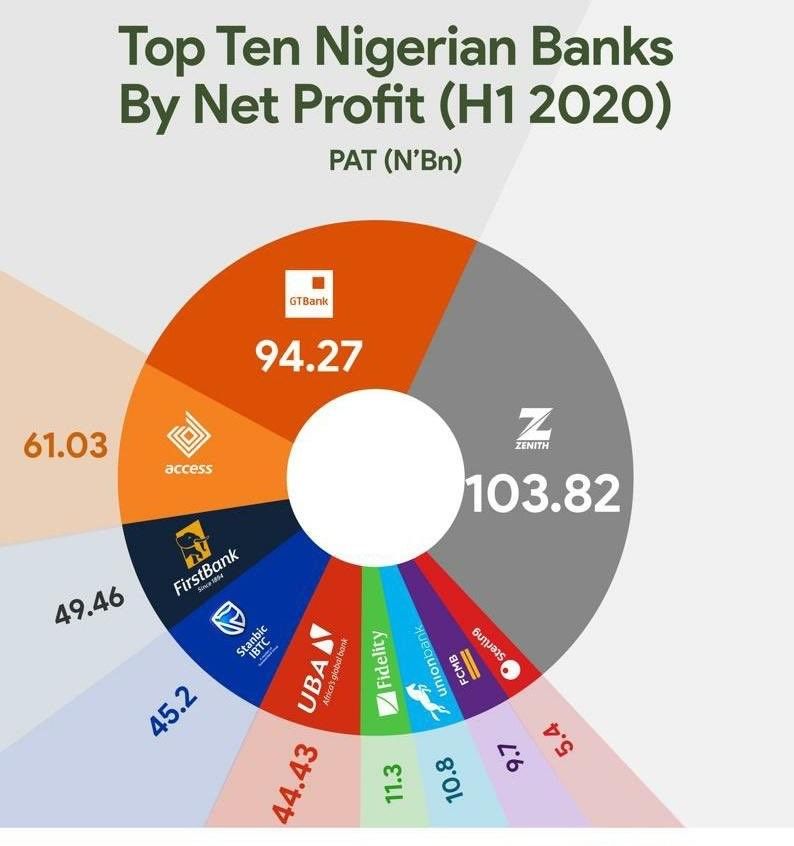

Banks that declared the most profits.

First Position – Zenith Bank, N103.8 billion.

Second Position – GT Bank, N94.2 billion

Third Position – Access Bank, N61 billion.

Fourth Position – First Bank – N49.4 billion

Fifth Position - Stanbic IBTC Bank - N45.2 billion

Sixth Position - United Bank of Africa - 44.3 billion

Seventh Position - Fidelity Bank - 11.3 billion

Eighth Position - Union Bank - 10.8 billion

Ninth Position - First City Monument Bank - 9.7 billion

Tenth Position - Sterling Bank - 5.4 billion

Zenith Bank and GT Bank appear to be in a world of their own as their reported profits are significantly higher than their closest rival. In the second quarter of 2020, the gap between the profits of both were close; with N103.8 billion in profits for Zenith Bank and N94.2 billion for Zenith Bank.

In terms of the most improved bank based on profitability growth year on year, the winner goes to First Bank with a 55.95% rise in profits to N49.4 billion from N31. billion. In a period where the profits of a majority of the banks considered dipped, Stanbic IBTC managed to grow its profit 24.7%.

Nigeria In Focus:

Population - 206.6 million (Compared to South Africa's 59.6 million)

GDP: $504.57 billion (Compared to South Africa's $369.85 billion)

GDP Per Capita: $2,465 (Compared to South Africa's $6,193)