It is 1956, Nigeria just discovered crude oil. There could not have been a better time as the buzz around the country's independence was gaining momentum. Four years later, Nigeria gained its independence. Although what followed was a series of crises - politics, and the infamous civil war, there was no doubt that the country was an economic powerhouse in the region. This was evident in Nigeria's exchange rate as the price of the Naira to USD was below one dollar between the period of 1960 and 1985, an average of $ 0.687 according to World Bank data.

Fast forward to 2021, data on Nigeria's exchange rate shows a different dynamic. Between 1960 and 1986 (the exchange rate in 1960 was 0.714, while in 1986 it was 1.755), the exchange rate increased by approximately 145 percent. The rise in the exchange rate between this period (1960 -1986) seems astronomical until we look at the exchange rate for another 26 year period - 1986 and 2012. According to World Bank's data, the exchange rate between this period increased by approximately 8,889 percent. In summary, the Naira had a high market value between 1960 and 1986, and signs of a drop in the value of the Naira surfaced post-1986. What does this data say about Nigeria's economy? What we are seeing as portrayed by the exchange rate data is the dutch disease syndrome - a case of continuous dependence on one sector

"What we are seeing as portrayed by the exchange rate data is the dutch disease syndrome - a case of continuous dependence on one sector"

So...What is the Dutch Disease Syndrome?

The Corporate Financial Institute defines it as a concept that describes an economic phenomenon where the rapid development of one sector of the economy (particularly natural resources) precipitates a decline in other sectors. How?

A trip back to the early 60s revealed that Agriculture was the mainstay of the Nigerian economy. For example, when we compare the sectoral contributions of the agricultural sector to the oil sector in the 60s, agriculture was king. Similarly, non-oil export as a percentage of export in the 60s was high compared to oil as a percentage of export.

Although data shows that the percentage of oil to non-oil export was low in the early sixties, non-oil export has dropped consistently since then. This implies the development of one sector (oil sector) and the decline in other sectors (non-oil sectors), thus, the Dutch Disease Syndrome in play.

The Problem - A fall in Naira's value and rising inflation rate dichotomy

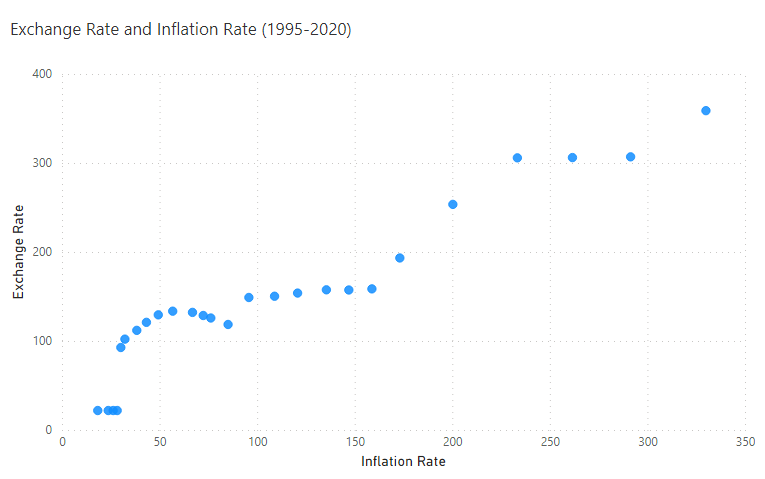

According to available data, the Naira to the dollar is at an all time high, showing an upward trend from 1998. Similarly, data on Nigeria's inflation rate suggests that the price level has also been on an upward trajectory. This leads to an important question, Is the continuous increase in price level (Inflation) caused by a similar increase in exchange rate?

Economists attribute a persistent increase in price level to rising cost of production and excess demand. When inflation is caused by an increase in the cost of production it is called a cost push inflation. On the other hand, when the cause of inflation is demand, it is called a demand pull inflation. So, what can be attributed to the cause of Nigeria's inflation?

In my own opinion, Nigeria's high inflation rate is a play around exchange rate dynamics. How?

Nigeria's high inflation rate is a play around exchange rate dynamics

Macroeconomic equilibrium in an open economy suggests that aggregate demand and supply must be equal. A change in any of the factors affecting aggregate demand will cause the price level to increase or decrease and of course the exchange rate is one of those factors. Exchange rate in an open economy affects aggregate demand through investments, exports and imports.

Let’s start by taking a look at how the exchange rate affects investments - FDI. The strength of a country's currency will determine if it will attract investments or not. Although there are other factors that might be affecting FDI, a country’s currency is definitely a key determinant. Investopedia describes this phenomenon better. 'Investing in securities that are denominated in an appreciating currency can boost total returns, while investing in securities denominated in a depreciating currency can trim total returns.' This statement gives us an insight into why investment in the country is low. Nigeria is not an exception to this, as data from macrotrends and CBN statistical bulletin suggests that there is a negative correlation between inflows and the exchange rate.

The volume of imports as well as export is also affected by movements in the exchange rate. All things being equal, when the value of a currency appreciates, export decreases, while import increases and vice versa. This is because it is more expensive to export than to import. The increase or decrease in the value of a currency is a function of demand and supply for that particular currency which in turn depends on export and imports.

The statement above explains the Nigerian situation. Data from Macrotrends shows that since both variables peaked (Import peaked in 2011, while export peaked in 2012), export has continued to decline while import is almost at its peak - negative trade balance. There exists a kind of negative relationship between Nigeria's exchange rate and trade balance.

In all, despite the effect of exchange rate on the trio of export, import and investment, it is important to note that the trio also have an effect on exchange rate, as an increase in FDI, export, and a decrease in import has the tendency to increase the value of a currency. This is because the increase in both FDI and export leads to an increase in the demand for a currency, and a fall in imports leads to an decrease in the supply of the currency.

Nigeria's exchange rate has consistently driven aggregate demand downwards courtesy of its effect on the three variables mentioned earlier. If you are familiar with the theory of demand and supply, such decrease ought to cause a fall in price and ultimately a fall in output. Yes, this is very true, the outcome is the same for the macro economy - aggregate price decreases, while output decreases. I think I have been able to explain the reason behind Nigeria's recessionary problems, however, this is just a part of the story. The poor value of the naira implies that the cost of importing raw materials and even finished goods has become really high. With inflation and unemployment rate sitting pretty high, we have a phenomenon called stagflation - high inflation, and low aggregate output which transcends to high unemployment.