In many African countries, there is a culture of saving money rather than relying on credit. This is partly because access to credit can be limited in some areas, and interest rates on loans can be very high. As a result, many people prefer to save money over time to make purchases or investments.

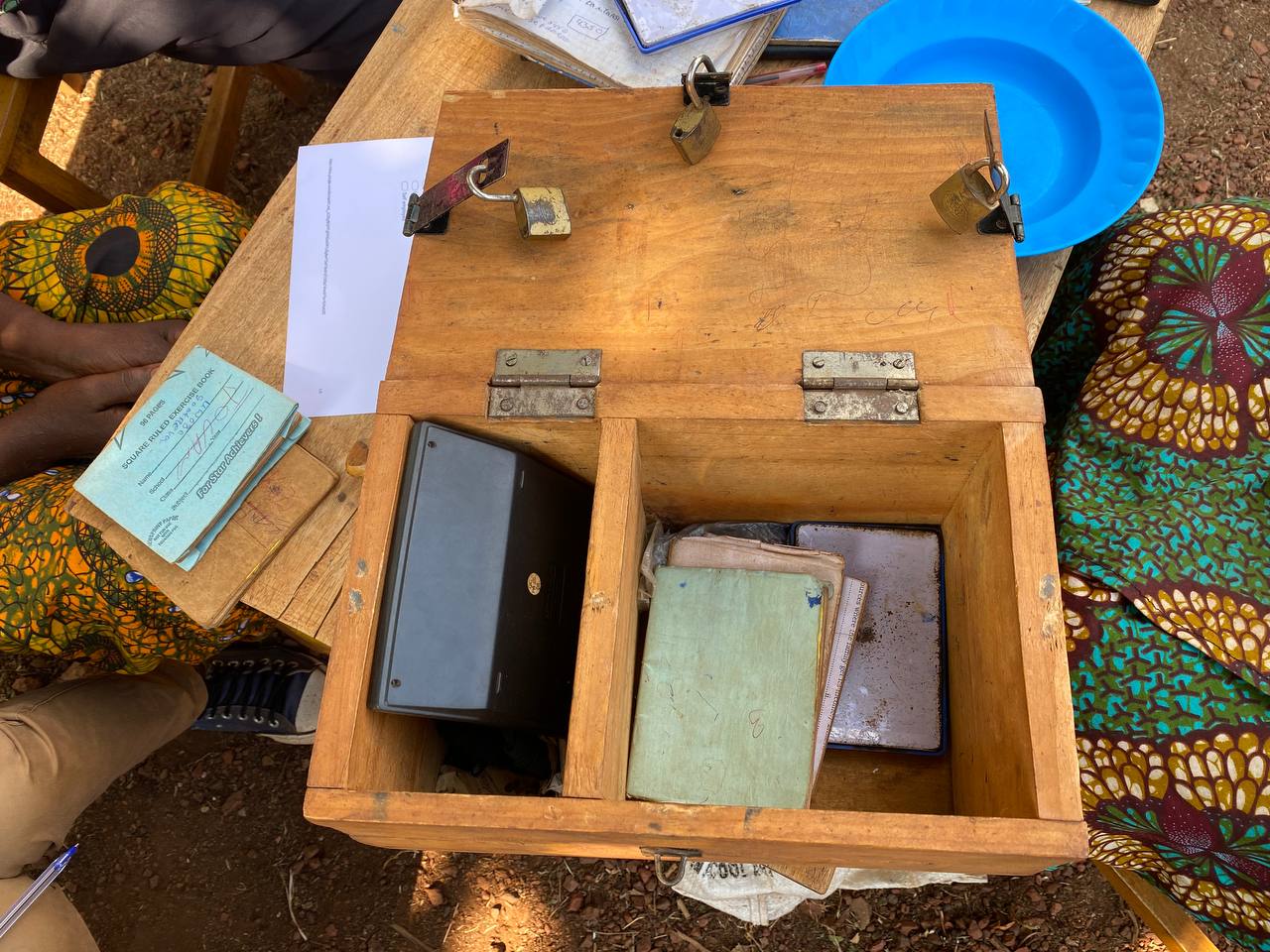

In some African cultures, saving money is also seen as a way to demonstrate financial responsibility and to provide for future needs, such as education, healthcare, or retirement. In addition, many communities have informal savings clubs, savings groups or rotating savings and credit associations (ROSCAs) that allow members to pool their resources and save together for a common goal.

The pre-existing culture of savings has informally established a strong foundation for Save Now, Buy Later, thereby making Buy Now, Pay Later schemes unappealing to the region.

"Save Now, Buy Later" hereinafter referred to as SNBL is a model of payment where a customer makes a payment upfront or gradually saves up the required amount to make a purchase later on. This is different from the "buy now pay later" model, where customers are offered credit or financing options to purchase goods or services immediately and pay back the amount in instalments over time.

In the SNBL model, customers are encouraged to save up for purchase by setting aside money over a period of time until they have enough to make the purchase outright. This approach can help customers avoid debt and allow them to make purchases without worrying about interest rates, fees, or credit checks.

However, the SNBL model requires more discipline and patience from customers than the BNPL model, where customers can immediately obtain immediate gratification and enjoy their purchases immediately. Additionally, the BNPL model may offer incentives or rewards to customers who use their financing options, such as cashback or loyalty points.

There are African fintechs and merchants that have deployed the SNBL model to provide alternative financing options for customers. One example of a merchant that offers SNBL is Wakanow. Africa's largest travel booking platform. The SNBL feature "Pay Small Small" allows intending travellers to save towards their ticket purchase.

In Kenya, Tala is a fintech company that offers microloans to customers based on their creditworthiness and financial behavior. While Tala does offer credit products, they also encourage customers to save money and build their financial resilience through their "Rebuild" feature, which allows customers to save money towards specific financial goals.

An interesting spin to the SNBL venture space is that it presents Piggyvest an enormous opportunity. PiggyVest is a Nigerian-based fintech company that offers savings and investment products, including a "SafeLock" feature that allows customers to save money and earn interest on their savings while locking it away for a set period of time. Piggyvest can therefore offer SNBL service to merchants and ecommerce platforms, who will in turn offer it to their customers. Piggyvest will increase their deposit base, charge the merchants a small fee and, of course, invest or lend out the funds in line with regulations for a fair return. This sort of service would have saved Wakanow the resources deployed to build and manage their SNBL in-house.

Ultimately, the decision to save or use credit will depend on a variety of factors, including financial resources, personal values, and access to financial services.