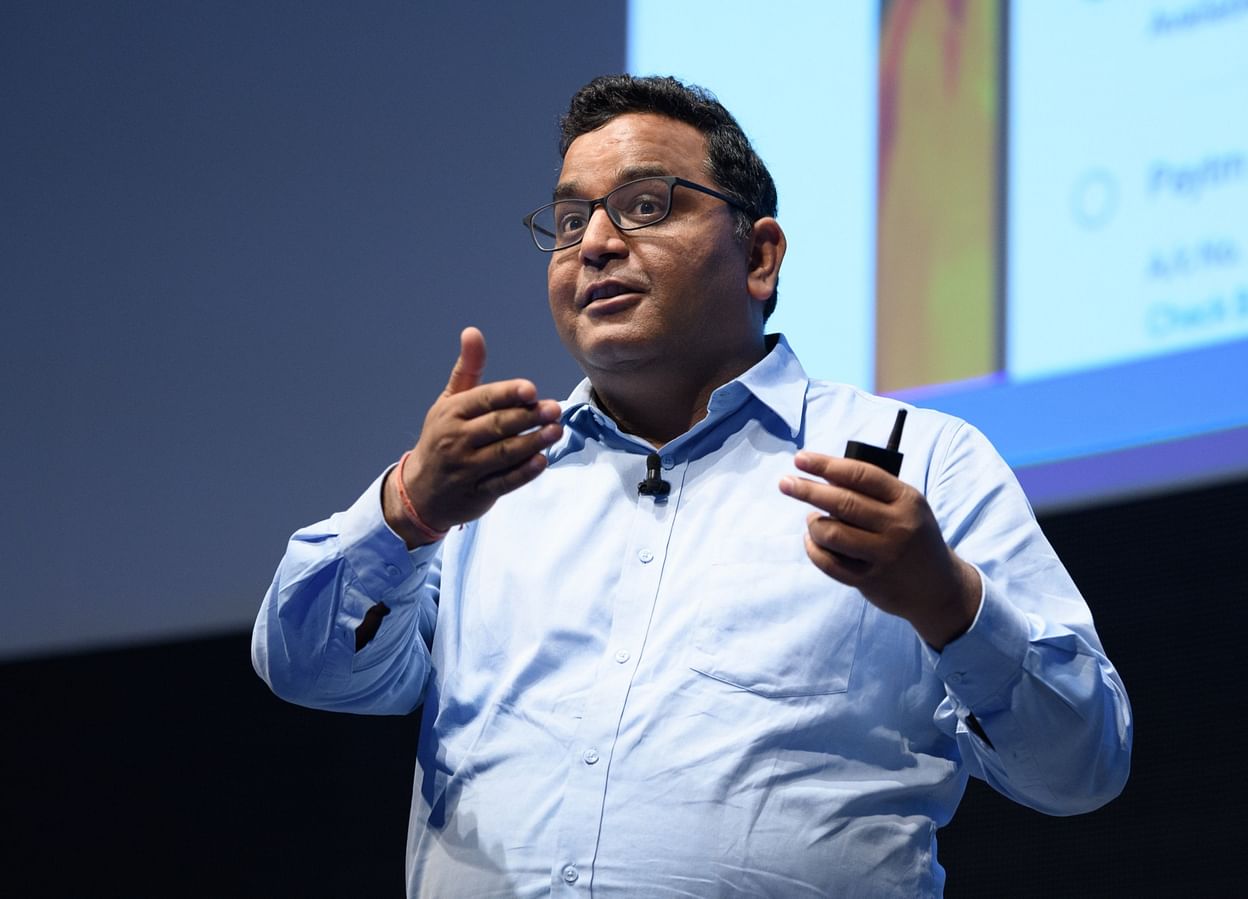

India’s most valuable startup Paytm, and its co-founder and CEO, Vijay Shekhar Sharma, announced on Monday they have reached an agreement to acquire insurance firm Raheja QBE for $76 million as the financial service provider looks to capitalize on the nation’s booming insurance market.

This acquisition is being undertaken through QorQl Pvt. Ltd, a firm in which Sharma owns the majority stake, while Paytm owns the remainder. Reports say that it was an all-cash deal.

Raheja QBE, with its insurance services offerings to cover an individual’s health, home, vehicles, and provide protection on commercial properties, and workplace injuries has so far been owned by Prism Johnson (51%) and QBE Australia (49%.), However, it will now totally be owned by QorQl, which is set to acquire 100% stake in Raheja QBE.

According to Paytm, whose services are used by tens of millions of Indians each month, the acquisition will help it to “democratize general insurance services” in India, as they aim to expand Raheja QBE's customer base of 41,000 customers, to which it sold 69,000 new policies in the financial year that ended in March 2020.

Continuing the mission to drive financial inclusion in our country, we are happy to announce that we will be acquiring a 100% stake in Raheja QBE General Insurance.

— Paytm (@Paytm) July 6, 2020

According to ICRA, only 3% of India's 1.3 billion people currently access insurance services. Analysts say that digital firms like Paytm could be crucial in democratizing these services.

And even though scores of startups and established banks have launched products to win this market in recent years, Paytm looks set to be the one to do it, how well this insurance service arm will sit into its range of, including a digital bank, online lending.

“This move will help the insurance business scale up to new heights by leveraging the large customer base and innovative products offered by Paytm,” said Vijay Aggarwal, Managing Director of Prism Johnson, in a statement.

The acquisition is subject to customary conditions, including approval from the Insurance Regulatory and Development Authority of India (IRDAI).

It is still to be seen how long it might be before African fintechs jump on this boat by venturing into the insurance market, or if they will jump on the boat at all.

Macroeconomic View of India

India is a lower middle-income country in South Asia; the second-most populous country in the world (with a population of 1.353 billion). As at 2017, India's life expectancy stood at 69.73, matched by a literacy rate of 74.37%. Furthermore, her current GDP per capita stands at about $2,338 and ranked 118th in the world, according to World Bank, slightly higher than Nigeria's GDP per capita of $2,222 (ranked 131st in the world).