We reported last Friday that Nigeria’s Central Bank has directed financial institutions to close every account engaged in cryptocurrency deals. The Central Bank of Nigeria (CBN) on 7thFebruary, 2021, explained in a press release the reasons it gave this directive: financial institutions desisting from transacting in and with entities dealing in cryptocurrency.

In the press statement, the CBN mentioned it felt it was needed to provide to the general public, further justifications about its position.

The press statement started with the CBN explaining the nature of cryptocurrencies. It stated that “Cryptography is a method of encrypting and hiding codes that prevent oversight, accountability, and regulation. While there are a number of cryptocurrencies now in circulation, Bitcoin was the first to be introduced in 2009, and now accounts for about 68 percent of all cryptocurrencies.”

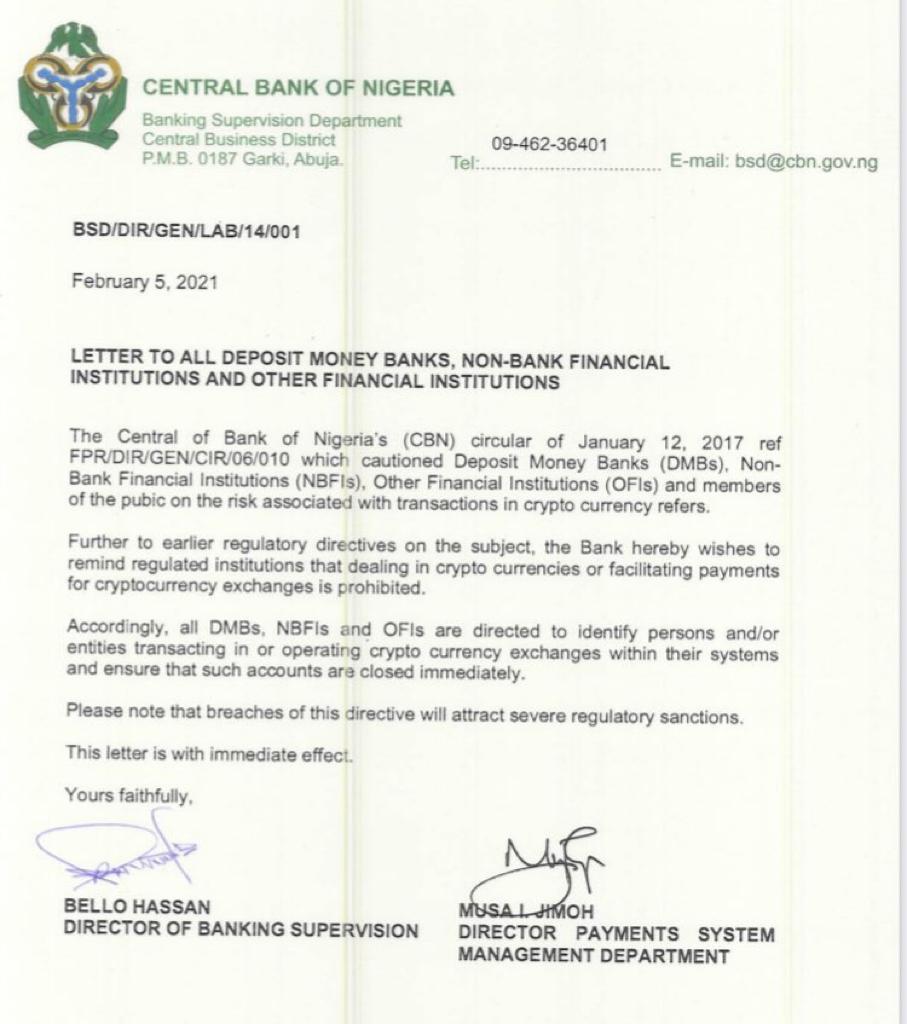

Defending the circular it released on February 5, the CBN reminded that the recent restriction is not a new thing, and is a reminder of the earlier circular dated January 2017. It said “It is important to clarify that the CBN circular of February 5, 2021, did not place any new restrictions on cryptocurrencies, given that all banks in the country had earlier been forbidden, through CBN’s circular dated January 12, 2017, not to use, hold, trade and/or transact in cryptocurrencies.”

The CBN also stated that cryptos prohibition was not a Nigeria only thing since several other countries globally have certain levels of restrictions on financial institutions facilitating crypto transactions. Countries like China, Canada, Taiwan, Indonesia, Algeria, Ecuador, Saudi Arabia, Bangladesh, etc. All making similar announcements (to the CBN’s) on the significant risk transacting in cryptocurrencies portends – risk of loss of investments, money laundering, terrorism financing, illicit fund flows, and criminal transactions.

The apex bank of Nigeria further mentioned the fact that some of these cryptocurrencies are issued by unregulated and unlicensed entities which brings up the question of legality. According to the bank, cryptocurrencies have also been used to finance several illegal activities including terrorism and money laundering. It said “The question that one may need to ask therefore is, why any entity would disguise its transactions if they were legal. It is on the basis of this opacity that cryptocurrencies have become well suited for conducting many illegal activities including money laundering, terrorism financing, purchase of small arms and light weapons, and tax evasion.”

According to the CBN, a significant amount of people use bitcoin for speculative purposes rather than payment. In its words, “More also, repeated and recent evidence now suggests that some cryptocurrencies have become more widely used as speculative assets rather than as means of payment, thus explaining the significant volatility and variability in their prices.”

In concluding, the apex bank reemphasized its responsibility to protect investors from the high probability of loses that might arise from dealing in cryptos. The bank said it would continue its education to Nigerians on cryptos disadvantages to the financial system.

Nigeria in focus:

Population: 200.9 million (2019)

GDP: $448.12 billion (2019)

GDP Per Capita: $2,229 (2019)