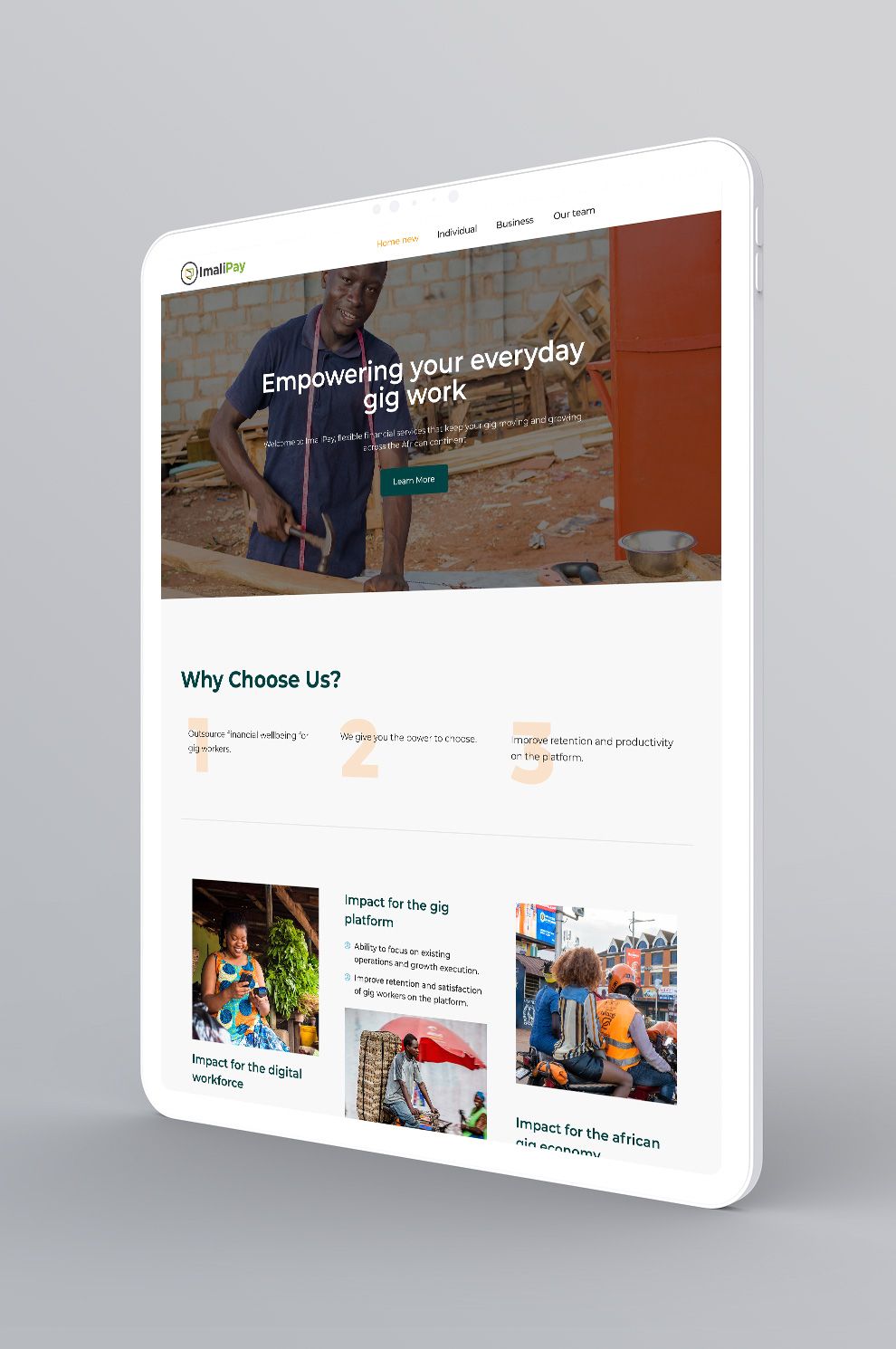

A recently launched fintech based in Nigeria and Kenya, ImaliPay seeks to empower gig economy workers (temporary and freelance workers) by providing financial services specifically tailored to their needs.

The firm is out to help gig workers to create and build an alternate credit score related to their performance on the channel, which would allow them access to suitable financial products and services on the ImaliPay platform.

The platform will likewise assist gig workers to save part or all of their income for medical emergencies, school fees or other financial emergencies. The platform will also provide convenient access to services that will allow their clients to remain productive and earn an income over time.

With an app downloadable from Google Play for Android users and AppStore for iOS users, the platform co-founded by Oluwasanmi Akinmusire and Tatenda Furusa is on a fast-growth trajectory and has plans to launch in South Africa later this year.

Nigeria In Focus:

Population - 206.6 million (Compared to South Africa's 59.6 million)

GDP: $504.57 billion (Compared to South Africa's $369.85 billion)

GDP Per Capita: $2,465 (Compared to South Africa's $6,193)