OPay, at a press conference held on March 1, 2021, unveiled its growth plan for the year after achieving a successful business year (2020).

The press briefing began with Joshua Yau, Managing VP for OPay in Nigeria, presenting the company's business updates.

According to Yau, OPay had its most impactful and transformative year yet amidst the pandemic, lockdown, and global uncertainty. He noted OPay as a payment company grew its total gross transaction value 4.5 times to over $2 billion in December. In his words, "The point-of-sale (POS) terminals deployed in its mobile money agent and merchant network represented roughly 1/5 of offline payments in Nigeria by year-end. Its mobile wallets have more than 2 million wallets with balances, totalling over $17 million.”

Iniabasi Akpan, OPay's Country Manager in Nigeria, gave a quick summary and review of OPay's operations and performance in 2020. He touched on how the company provided Nigerians convenient access to cash and job creation, driven by innovation.

According to him, “We helped to give easy-to-access financial services to close to more than ten million Nigerians in all corners of the country. Our agents serve a population that is far from bank branches and ATMs, often in the outskirt of cities, suburban areas, or rural areas. We believe that the impact we have made so far could not have been without our most important partners – our agents and merchants. By providing their customers with convenience, they were able to earn a solid income with many expanding their businesses, even in the difficult pandemic.”

Oladipo Omogbenigun, VP, Payments Solutions and Corporate Partnerships, saod that OPay's growth plans in 2021 relies on developing and deepening their strategic partnerships in the financial ecosystem with banks, regulators, card schemes, payment processors, payment service providers, and other key players.

Furthermore, He shared OPay's plans to partner and support banks to scale deposits this year - since by regulation, it is required for OPay to safeguard it wallet deposits with established banks.

Oladipo also talked about OPay debit cards scheduled to launch this year. "The cards are the first of their kind and will be directly linked to Opay wallets. This will further bolster our gospel of financial inclusion. Opay wallet users will be able to use the cards on ATMs, POS terminals at merchant locations and e-commerce sites," according to Mr Omogbenigun.

He added that OPay has launched CreditMe - giving easy access to credit to all wallet users at the point of purchase. According to Oladipo, OPay has also just launched standardized loan products to their agents and merchants based on their (OPay and agents/merchants) relatioship. "We think access to savings and loans through our partners is the critical step in true financial inclusion beyond just accessing cash,” Mr Omogbenigun said.

Dotun Adekunle, VP, Product and Engineering, shared plans around empowering offline payments and encouraging online businesses.

In his words: “We have innovatively built technological workarounds to ensure higher network availability on our systems without compromising speed and quality of service, this despite ecosystem challenges that would have led to incessant downtimes”.

He noted that “Our goal is to make payments integration easy and simple so developers and innovators of digital products can focus on building the core functionality of their products.”

About OPay:

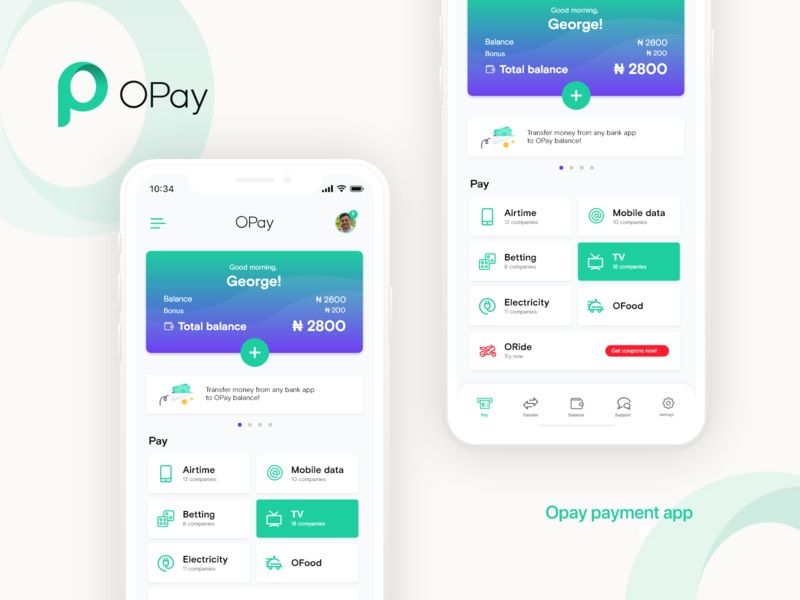

OPay launched its mobile payment service in Nigeria in August 2018, creating an infrastructure on which the company is now also adding new services. The agent-centric mobile payment operation focuses on reaching the massive unbanked population of Nigeria. OPay’s vision is to rapidly support the realization of Nigeria’s vision for financial inclusion for everyone through the use of global-leading technology.