Access Bank's new strategy to reach the unreachable may have unlocked a new revenue stream for MTN Momo.

Undoubtedly MTN Momo has the largest number of active mobile money agents in Nigeria with over 108,000 mobile money agents as at March 2020. MTN's full-year audited financial report for the period, ended December 31, 2019, said the agent network served almost one million customers in the first four months of operation. MTN's mobile network agent reach, positions it to be successful with its Momo service.

In Q1 2020, while on a project in Senegal, I learnt of a subsidiary of Société Générale called Manko. Manko can be simply pitched as mobile money agents on wheels. Manko staff ride with motorcycles across local communities in Senegal, creating accounts, taking deposits and performing other banking services for customers.

Overtime, Manko which was set up to service YUP (a mobile money service owned by Société Générale) began to provide this service for other fintechs and banks. I found this to be an innovative income stream for Société Générale and I termed it mobile money agent-as-a-service.

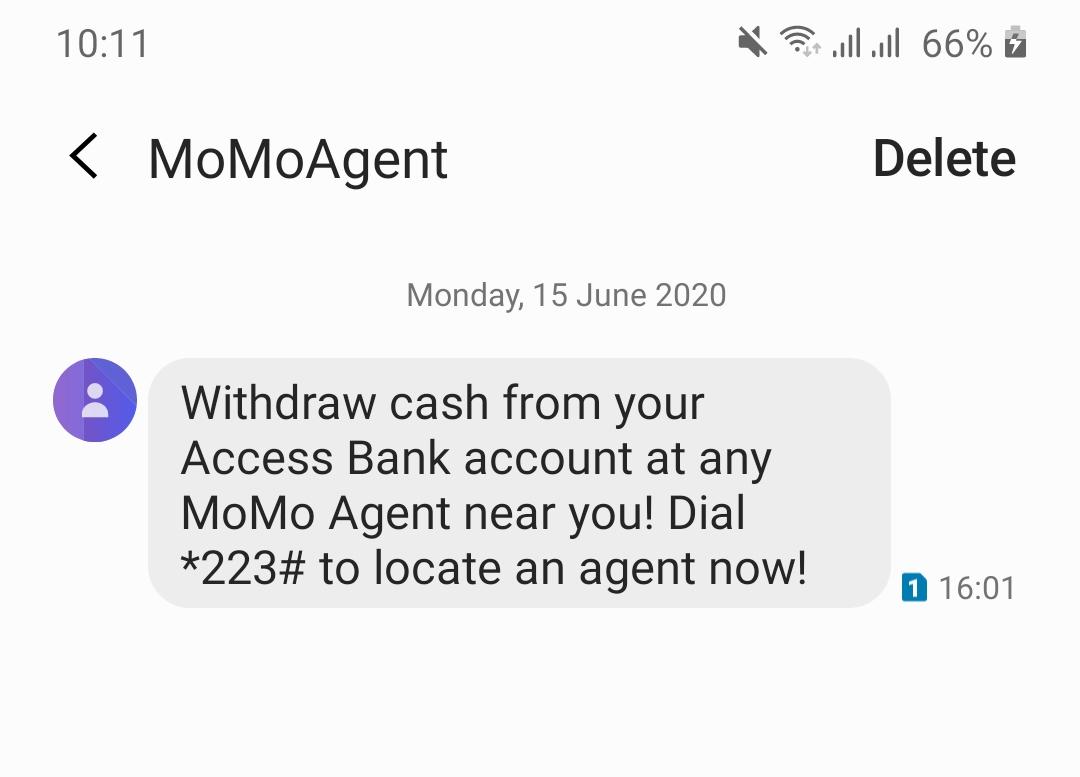

In an unprecedented manner, Access Bank has announced a partnership with MTN's Momo service allowing its customers to make withdrawals from MTN Momo agents across the country. At the moment I can confirm that withdrawal is the only service available, but it is expected that other services such as account opening would be in the works. Access bank's new strategy to reach more customers appears to be a leaf from the play book of Manko and its owner Société Générale in Senegal.

This comes a few weeks after Access bank was in the news for allegedly making plans to shut down a significant number of branches and fire an equally significant number of staff. It remains unknown if and when MTN will extend this hand of fellowship to other banks and Fintechs.