The Central Bank of Kenya has reaffirmed its supervisory rule in Kenya's digital financial ecosystem by officially announcing the country's new regulations for digital lenders. Intending to tackle unethical practices in the collection process, high-interest rates, privacy invasion through the personal data of customers or users, the Apex bank through the Anti-Money Laundering (AML) and Combating the Financing Terrorism (CFT) Act, has outlined provisions for customer protection and credit information sharing.

Predatory lending and debt-shaming borrowers have been an issue beyond the borders of Kenya and are found all across the African continent. Kenya's central bank hopes to return sanity and stability into the system and rescue over 2 million users through these new regulations. Lending companies will be required to apply for licensing from the Apex bank, which requires these companies to accept the new rules, thus eliminating issues around high-interest rates, invading users' privacy and all attempts of extortion. Users in the country can hopefully regain confidence in the process of loan acquisition and the entire financial system in Kenya.

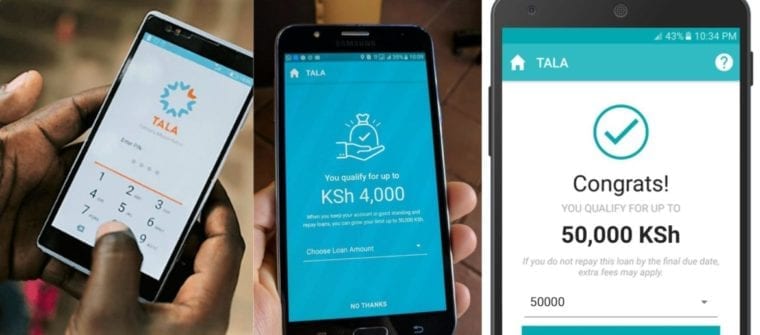

Digital lending is instrumental to boosting financial inclusion in Africa, as it provides struggling African masses with quick and easy access to credits. Knowing this, the WatchDogs of Kenya's financial sector aims to improve transparency to maintain the growth of the Fintech industry and the drive for financial inclusion. Moving forward, the presence of the Apex bank will ensure major players like Branch, Tala, M-Coop, M-Shwari and IMoney will operate under strict financial discipline

Kenya in focus:

Population: 53.77 million in 2020 as compared to 52.57 million in 2019

GDP: $98.84 billion compared to $95.5 billion in 2019

GDP per capita: $1,838 in 2020 compared to $1,816 in 2019