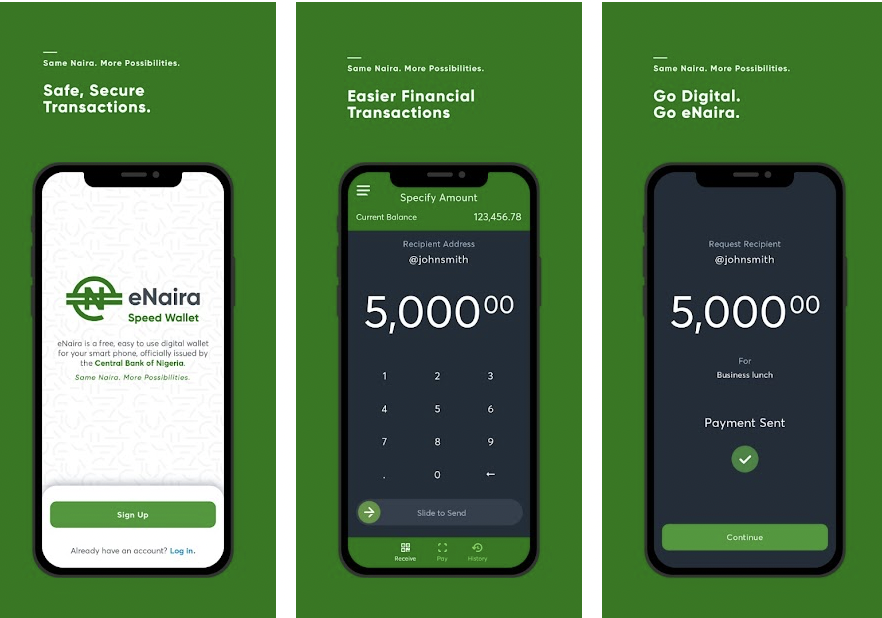

On the 25th of October 2021, Nigeria became the first African country, and one of the few in the world to roll out a Central Bank Digital Currency called e-naira, launched under President Muhammadu Buhari's administration in Abuja. The e-naira is a legal tender, the digital form of the physical Naira and maintains the same value as the Naira. The e-naira was launched to foster financial inclusion, and digital payments, pave the way to a cashless economy and ensure an efficient payment system in the country. During its launch, the CBN claimed an overwhelming interest in the digital currency from Nigerians nationwide.

Over one year since its launch, the e-naira remains unpopular among Nigerians, and many digital currency users in the country still need to be convinced of the importance of its existence. To promote the e-naira, the CBN has held several sensitisation programs. Just yesterday, the apex bank engaged the Bauchi business community on e-Naira and educated participants on bank policies and programmes. Despite all its efforts, the e-naira still faces certain barriers that make its future in the country uncertain. Here are some of those barriers:

Access to Mobile Internet:

The usefulness of the Central Bank Digital Currency and its advancement among Nigerians depends on access to the Internet. In Nigeria, only about 80 million of the country's 213 million population have access to the Internet. To improve the engagements on the e-naira, the CBN has to set up proper infrastructure to improve access to mobile internet connectivity and make data affordable.

Availability of Banking Services:

A huge financial gap still exists in Nigeria, with about 40 million adults in remote areas needing basic banking services. Fortunately, the rise of fintechs and agency banking has helped tackle the lack of easy access to banks by expanding their footprints and bringing their services closer to Nigerians. The CBN must work closely with these institutions to achieve its e-naira vision.

Lack of digital and financial literacy:

Many Nigerians are yet to be integrated into the country's financial industry, and some of those who engage in banking systems are low on financial and digital literacy. The CBN has shown commitment to improving the sensitisation of Nigerians via its e-naira campaign across the country.

Cryptocurrency

One of the major barriers to e-naira among digital traders and tech-savvy Nigerians is cryptocurrency. Many Nigerians rely on cryptocurrencies against rising inflation in the country. They find it difficult to look towards the e-naira, especially as it maintains the same value as the Naira.

Banking Apps

Many young Nigerians find no special need for the e-naira, especially as they can access the same benefits via a banking app. The CBN will have to look to create incentives on the e-naira that can attract this set of Nigerians.

As of last year, only about 1.15 million Nigerians had used the e-Naira. While the concept of the central bank digital currency is commendable as Nigeria prepares for a future of digital payments and a cashless economy. However, to succeed in digital payments like its Asian counterparts, the CBN must address these barriers to guarantee a future for the e-naira.