The World Bank estimates that Nigeria is home to about 202 million individuals as of November 2020. A key regional player in West Africa, the country accounts for about half of West Africa’s population.

To drive financial inclusion in Nigeria, the Central Bank of Nigeria (CBN) has granted licenses to different payment system operators in Nigeria. These operators, their licenses, and their functions will be addressed in this article.

Banks

The primary function of a bank is to receive deposits and make loans, as a licensed financial institution.

There are currently 26 government licensed banks in Nigeria, grouped into commercial banks, merchant banks, and non-interest banks, each with its own license requirements.

Starting a commercial bank in Nigeria requires you to take the following steps that have been summarized.

- Check for the availability of the proposed bank name with the Corporate Affairs Commission (CAC).

- Apply to the central bank for an approval in principle.

- Have a 25 billion naira minimum share capital and register the company.

- Apply to the central bank to get an operating license.

Payment Service Banks

PSBs are a new category of banks in Nigeria with a focus of bringing into the financial system, the more excluded and marginalized population. It is characterized by smaller scale operations in comparison to a traditional bank, and the absence of credit risk i.e. it doesn’t give loans.

PSBs licensing requires a non-refundable 2.5 million naira fee for application and licensing, and a 5 billion naira capital base.

This year, the CBN granted licenses to 3 PSBs to start operations. Hope PSB, Moneymaster PSB, and 9PSB.

Mobile Network Operators

These are organizations classified as infrastructural providers, providing infrastructure that enable processing, switching, and settlement facilities for mobile money services. Examples are telecommunication companies like MTN, Airtel, Glo, and 9mobile.

Mobile Money Services

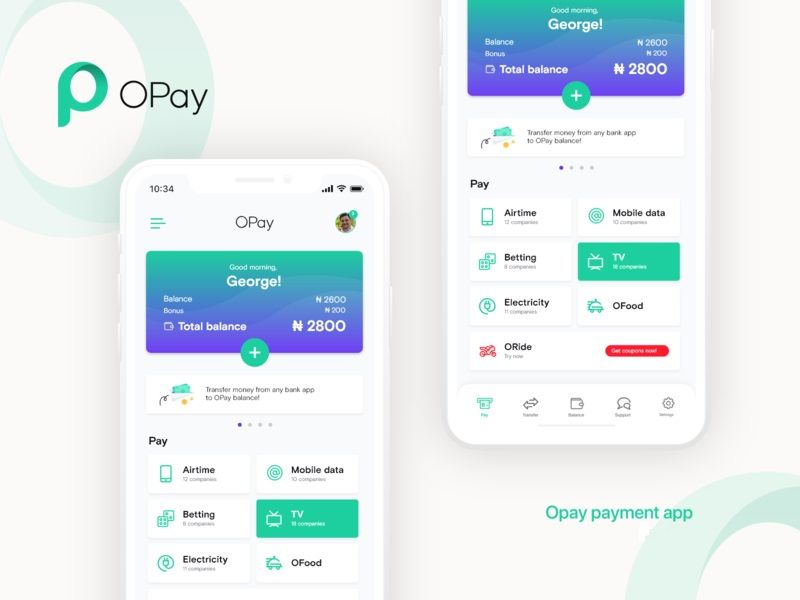

Classified by CBN's new payment system license category under Mobile Money Operations (MNOs), mobile money services are done by companies providing technology used to pay for goods or services using portable electronic devices like a smartphone or a feature phone. Examples are Momo, Firstmonie (belonging to First Bank), Paga, Opay, and Palm Pay.

The minimum capital requirement for this license is 2 billion naira.

Super Agents

Super agents are companies licensed by the Nigerian central bank to recruit agents for the purpose of agency banking i.e. community banking by providing services on behalf of banks.

To become a super agent, the minimum requirements are:

- Registration with Corporate Affairs Commission (CAC).

- Being an existing business that has been operational for at least twelve months.

- Having a minimum shareholders’ fund, unimpaired by losses of 50 million naira.

- Obtaining a letter of reference from a financial institution as part of documentation for license.

- Having a minimum of 50 agents.

An example of a super agent is Itex Integrated Services Limited, a Fintech company licensed in 2019. The license enabled the company to provide basic financial services like account opening, cash transfer, and cash withdrawal. Another example is MTN momo agent.

Agents

An agent is a person or entity providing financial services like cash depositing and withdrawals on behalf of a bank or Fintech company (like Paga), without being an employee of the bank or company. The person or entity is typically a small business looking to diversify revenue streams, using its own resources, premises, and a point-of-sale machine to provide financial services.

Becoming an agent in Nigeria is dependent on the requirement of the bank or Fintech company intended to work with. Generally, you need to be an existing business in a visible location and have an agreement with the bank or company you want to partner with.

An example of an agent is the roadside store close to you, that sells drugs, beverages, clothes, sim cards, etc. There is no defined product they sell. What matters is they are a visible small business with a physical location, addressing the needs of a community.

ATM Operators

An ATM is a machine that dispenses cash and performs other banking services like transferring money or airtime recharge when a bank account holder inserts a card. An ATM operator is the bank or company in charge of operating an ATM.

A December 2019 data for the year 2019 from Nigeria Interbank Settlement System (NIBSS) showed that the number of active ATMs in the country was 17,518. The volume of ATM transactions was 839.8 million, and the value of ATM transactions was over 6.5 trillion naira.

ATM licenses in Nigeria are issued to banks and independent firms. The licensing of independent firms began in 2009, with licenses issued to two companies named Chams Access Nigeria Limited and Cooperative Support Services.

Payment Gateways

Payment gateways process payments online for online retailers, e-businesses, applications, or the traditional brick and mortar, using credit or debit cards. Examples of payment gateway companies are Interswitch, PayU, Paystack, and Flutterwave.

Payment Solution Services (PSSs) is the license required to operate as a payment gateway company in Nigeria under CBN's new payment system license categories. Payment system companies in the PSS category may hold any of Payment Terminal License Provider (PTSP), Payment Solution Service Provider (PSSP), and super agents license, or the combination of the three. The minimum capital requirement for PSS is 250 million naira, PSSP, 100 million naira, and 50 million naira for super agents.

Payment Switch

Payment switch companies are transaction based companies that are built internally or off the shelf, and dynamically route payment transactions between multiple acquirers and PSPs.

The license requirement for this is switching and processing with a minimum capital requirement of 2 billion naira.

In 2019, an electronic payments company, TeamApt, acquired a switching license from the central bank of Nigeria. As a result, it became a payment switch in Nigeria, fulfilling its plans to enable AptPay, its payment infrastructure product, using the license.

Microfinance Banks

Microfinance is a way of providing access to capital to small entrepreneurs and small business owners. It fills the gap created by the inability of these businesses and entrepreneurs to have access to major institutions’ traditional financial resources.

In Nigeria, there are three categories of microfinance banks regulated by the Central Bank of Nigeria.

- Unit Microfinance Banks: Operational in only one location and does not have branches or cash centers. 200 million naira is the minimum share capital.

- State Microfinance Banks: Operational within a particular state and can have, only within the state subject to approval by the CBN, branches and cash centers. 1 billion naira is the minimum share capital.

- National Microfinance Banks: Operational in several states and can have several branches and cash centers within those states subject to approval by the CBN. 5 billion naira is the minimum share capital.

A number of startups in Nigeria’s Fintech ecosystem like Kudabank and Piggyvest generally register as microfinance banks. A unit microfinance license and a web platform allows the fintech to operate across Nigeria without meeting the requirements of a national microfinance institution or even a bank.

In the case of Kuda Bank, its bank account is provided through Kuda Microfinance Bank and its debit card is issued by Access bank, pursuant to a license from Visa International & Verve.

Nigeria in Focus

Population: 202 million (2020)

GDP: 448.12 billion USD (2019)

GDP Per Capita: 2229 USD (2019)