Recently, I picked up my econometric textbook to lecture two students on the subject. One topic I taught them was regression analysis, and I introduced the symbol E(Y|X) to them, which is very important to what we are working on.

The symbol E(Y|X) is the conditional expected value of Y given X. The mean or predicted value of Y is dependent on X. In passing, it is important to note that X is called the independent variable and Y is called the dependent variable.

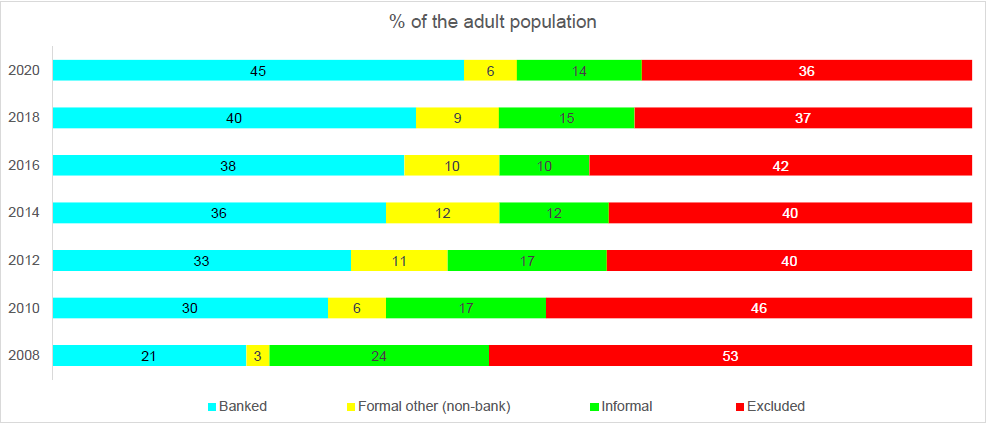

Before you get bored of my write-up (I hope you enjoyed your little trip into the world of economics...You are welcome), I think I should lay the foundation for my discussion going forward. According to a recent publication by EFInA, financially excluded Nigerians increased from 36.6 million in 2018 to 38.1 million in 2020.

"While the percentage of financially excluded adults decreased slightly between 2018 and 2020, the actual number of financially excluded adults increased from 36.6 million to 38.1 million, as population growth outpaces the rate of financial inclusion growth." EFInA Access to Financial Services in Nigeria 2020 Survey

The above data suggest that there is cash on the table for Fintechs to explore. To quote Jacqueline Jumah,

“…The opportunities to accelerate financial inclusion through scaling digital financial services are obvious, considering what is happening in other jurisdictions…” Jacqueline Jumah on EFInA recent publication.

An opportunity conditioned on financial capability

Is financial exclusion an opportunity for fintechs? Yes. However, this opportunity for me is conditioned on the financial capability of Nigerians. If this is an econometrics model, the opportunity posed by financial exclusion is a dependent variable, while financial capability is the independent variable.

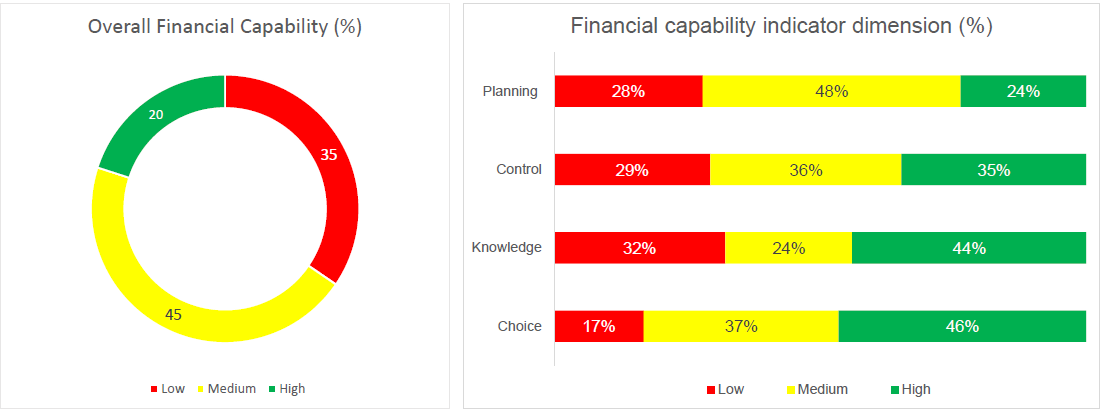

According to the findings, the majority of Nigerians have low to medium financial capability. Thirty-five per cent of Nigerians have low financial capabilities, while forty-five per cent of Nigerians have a medium capability level. Nigerians with high financial capabilities are the lowest with twenty per cent.

In passing note that Financial capability is an average of the financial planning, financial control, knowledge and skills and making financial choices dimension. (EFInA 2020 Survey)

Why Fintechs should focus on improving Financial Capability?

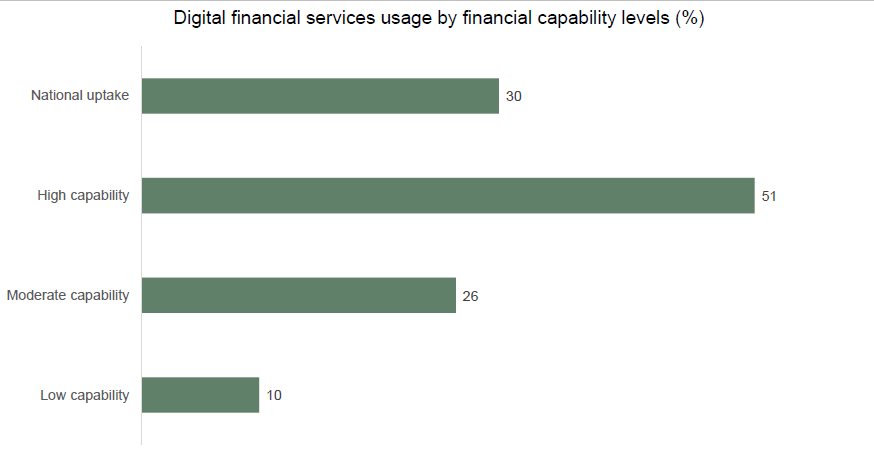

EFInA publication shows that there is a positive correlation between our digital financial services and financial capabilities. According to the findings, Nigerians with high financial capability used more financial services. The higher the level of financial capability levels, the higher the use of financial services. Thus, fintechs should focus on improving the financial capability of Nigerians.

The result above shows why emphasis must be placed on improving financial capability levels. The use of financial services by Nigerians with high capabilities stands at 51 per cent, while the use of financial services by Nigerians with medium capability level stood at 26 per cent. Finally, financial services usage by Nigerians with low capability stood at 10 per cent.

One way fintechs can tap into the opportunities created by financial exclusion is by scaling financial capabilities, as that would lead to an increase in the use of digital financial services.

Nigeria in focus

GDP: $448.12 billion compared to South Africa's $351.432 billion in 2019

Population: 200,963,599 compared to South Africa's 58,588,267 in 2019

GDP per capita: $2,229 compared to South Africa's $6,001 in 2019