Amid much excitement, the Federal Reserve made a debut of its latest real-time payments system, FedNow, in July 2023. This cutting-edge platform aims to grant consumers and businesses swift and "instant" access to money transfers between financial accounts across banks. This development is particularly noteworthy since conventional banks have not traditionally operated 24/7 or allowed for same-day transactions and fund utilization.

While FedNow's introduction is groundbreaking, it's worth noting that the United States already has a pre-existing instant payment rail. The Clearing House (TCH) has been providing real-time payments (RTP) since 2017. Zelle (owned by a bank consortium and PayPal's Venmo) are popular participants in TCH's RTP network.

What are real-time payments (RTP)?

Real-time payments revolutionize the financial landscape by enabling swift transactions between bank accounts, processed, cleared, and settled within mere seconds. This round-the-clock availability, even during weekends and holidays, enhances the transparency and reliability of payments, instilling greater trust and confidence among consumers, banks, and businesses in managing their finances.

Where else is real-time payment active?

In 1973, Japan's Zengin system pioneered real-time payment processing, but it wasn't until 2018 that it became available 24/7. Switzerland followed suit in 1987, and the momentum escalated around the beginning of the 21st century.

Presently, over 70 countries spanning six continents have embraced real-time payments, exemplified by initiatives like Brazil's Pix, Nigeria's NIBSS, and Portugal's MB Way. ACI Worldwide's March 2023 report reveals an impressive $195 billion transaction volume in 2022, marking a remarkable year-on-year growth of 63%. Notably, India's Unified Payments Interface platform, launched in 2016, leads the pack as the largest market with $89.5 billion in transactions, closely followed by Brazil, China, Thailand, and South Korea.

In comparison, the United States' entry into the real-time payment landscape with RTP in 2016 might be considered relatively late to the game. However, even more intriguing is the slow adoption rate and the emergence of a competing service launched by the government

Having established the above, this op-ed will aim to answer two key questions.

- Why is the adoption of instant payments rails by banks low?

- What are the driving reasons behind the US Federal Reserve's decision to launch FedNow?

Question 1: Why is the adoption of instant payments rails by banks low?

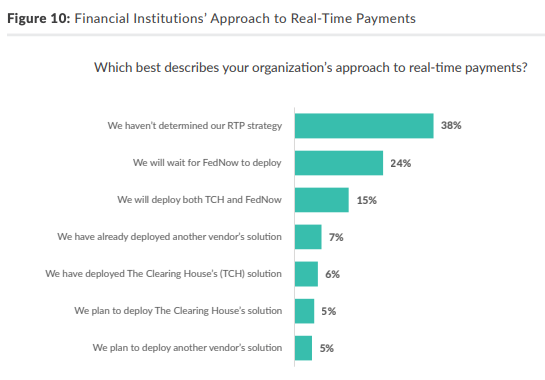

Banks do not have a strategy or timeline for instant payments

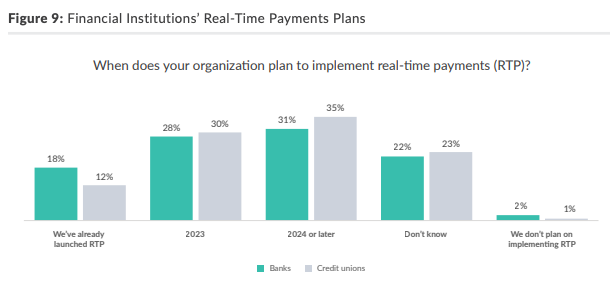

According to a survey conducted by Cornerstone Advisors among banks and credit unions, the outlook for real-time payments adoption appears moderate. Less than 50% of banks and a mere 42% of credit unions anticipate offering real-time payments by the conclusion of 2023. Surprisingly, nearly a quarter of institutions remain uncertain about the timeline for implementing this service.

In 2022, the United States boasted a substantial financial landscape, encompassing 4,853 federally insured credit unions and 4,135 FDIC-insured commercial banks. Despite this vast number of financial institutions, the RTP network's reach was comparatively limited, consisting of only 285 banks and credit unions, accounting for a mere 3% of the total addressable market, which comprises 8,988 financial institutions.

Banks want to Receive and not Send

In the United States, the adoption of real-time payments is being influenced by a critical factor: the discrepancy between the 'send' and 'receive' capabilities. While many early service providers plan to accept real-time payments ('receive'), only a few have intentions to enable the 'send' functionality.

This issue poses a significant challenge, as the success of real-time payments relies on a balanced ecosystem. Industry stakeholders have highlighted the importance of "send-side" products, which align with customer preferences. For instance, users may seek instant reimbursement from their insurance service providers or make quick payments to small businesses, but these transactions cannot materialize if banks do not offer the 'send' capabilities. The obstacle stems from the fact that fees for money transfers are typically borne by the sender rather than the receiver. This asymmetry needs to be addressed to foster broader adoption and create a seamless experience for real-time payments.

Instant Payments = Faster Fraud

An essential aspect to consider is how instant payments can potentially diminish the opportunities for detecting and reversing fraudulent transactions once they have occurred. As seen with the emergence of various new technologies in the financial services sector, fraudsters are quick to adapt and find innovative ways to exploit these advancements.

Real-time payment systems, in particular, have given rise to novel forms of fraud, such as authorized push payment fraud. This type of fraud occurs when a fraudster deceives their victim into transferring funds to their account by assuming the identity of a legitimate payee, often posing as a reputable business or entity. The immediacy of real-time transactions can make it challenging to identify and reverse these fraudulent activities promptly. To safeguard against such threats, continuous efforts are needed to stay one step ahead of fraudsters and bolster security measures within the realm of instant payments.

The three points discussed above shed considerable light on the potential motives behind the Fed's development launch of FedNow.

Question 2: What are the driving reasons behind the US Federal Reserve's decision to launch FedNow?

The Fed wants control and visibility

In the ever-evolving global economy, central banks are taking a progressively proactive approach by implementing innovative applications at various levels. This strategic shift appears directed towards curbing the potential supremacy of private platforms, such as bank consortiums, companies like PayPal, and even cryptocurrencies. Additionally, this proactive stance empowers central banks to reinforce their regulatory abilities and exercise greater control over the broader economy.

The Fed has the power of Mandate

When a government or authority imposes a mandate for the use of a particular service, it instils a sense of urgency and increases the likelihood of widespread adoption among entities. This is because people are generally more inclined to comply with a mandate rather than voluntarily adopting a new service. In the case of the US Federal Reserve, they can leverage a mandate to require all banks and credit unions to participate in the network, activating both the 'send' and 'receive' capabilities by default. Nonetheless, the option to use alternative services like RTP could still be provided, as long as these alternatives ensure seamless interoperability for their customers.

The Fed can afford to make payments cheap

Brazil's PIX, introduced by the country's central bank, has demonstrated remarkable cost-effectiveness for banks and their customers, making it an attractive choice for nearly all Brazilian banks. This favourable aspect, among others, swiftly led the banks to offer their depositors access to the system.

Drawing from government resources, the Federal Reserve possesses the capacity to offer low-cost or even zero-rated (free) payment services. This approach could drive strong adoption by both banks and users, mirroring the successful pattern observed with Brazil's PIX.

Disclaimer: This Op-ed is not financial, investment or product advice. It is a synthesis of publicly available information as referenced.