Following the Central Bank of Nigeria (CBN) announcement that Bitt Inc will be its technical partner for eNaira, scheduled for October 1, 2021, the CBN has presented the roll-out plan, operating model, use cases, and cost structure of the eNaira to the financial institutions. As part of this initiative, financial institutions, more specifically commercial banks, are tasked with promoting, marketing, and onboarding users. In addition, the banks will be partly involved in the distribution and enablement of transactions.

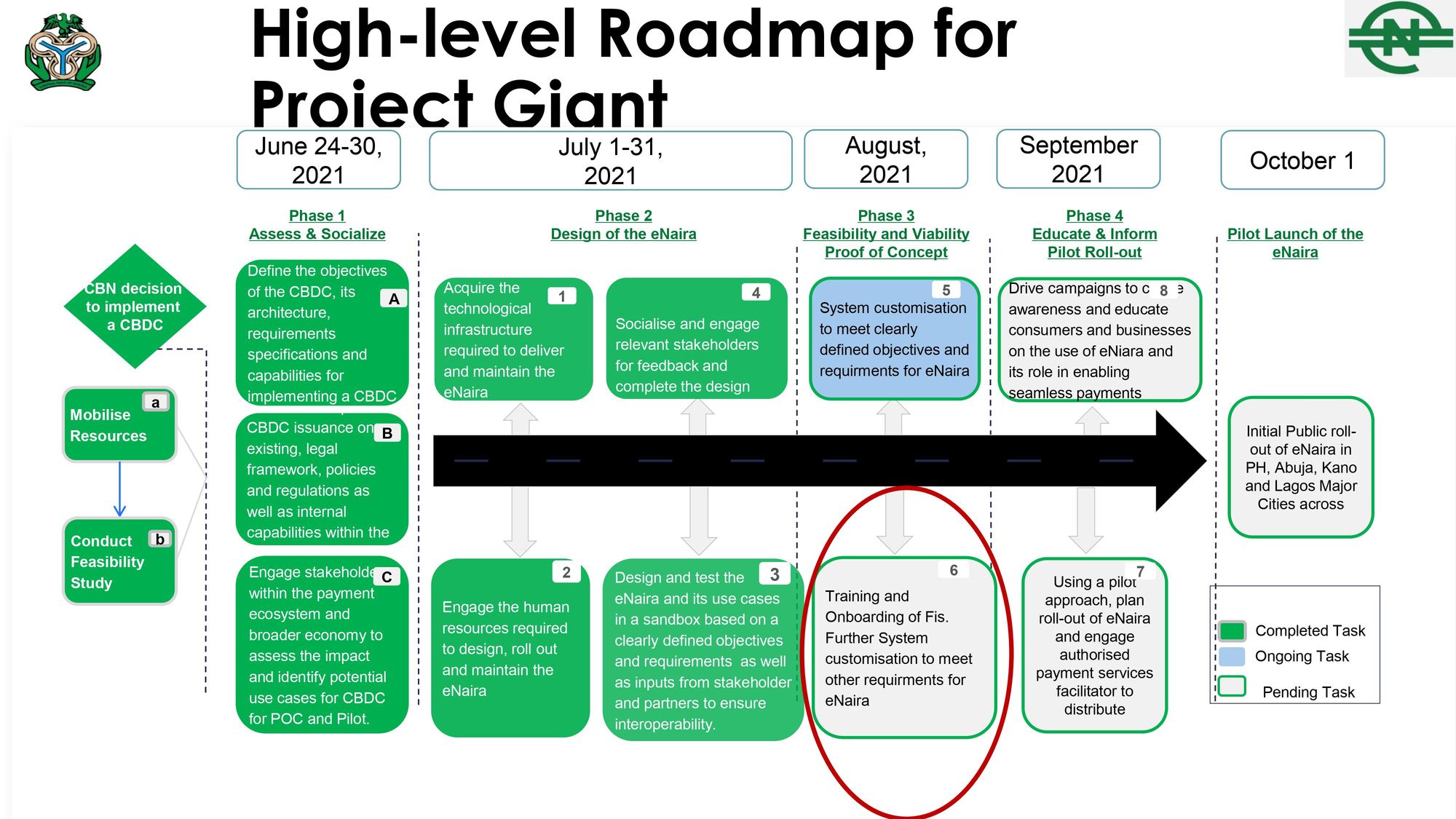

Roll-out plan

The CBN will roll out Nigeria's digital currency, eNaira, to the public on October 1, 2021 (Nigeria's Independence Day) as a pilot launch in Abuja, Kano, Lagos, and Port Harcourt (PH). According to the roadmap, the CBN has completed the design of the eNaira and is currently training and onboarding banks for the pilot launch. The October 1 launch date suggests that the CBN might have started working with Bitt Inc several months before the announcement as its technical partner.

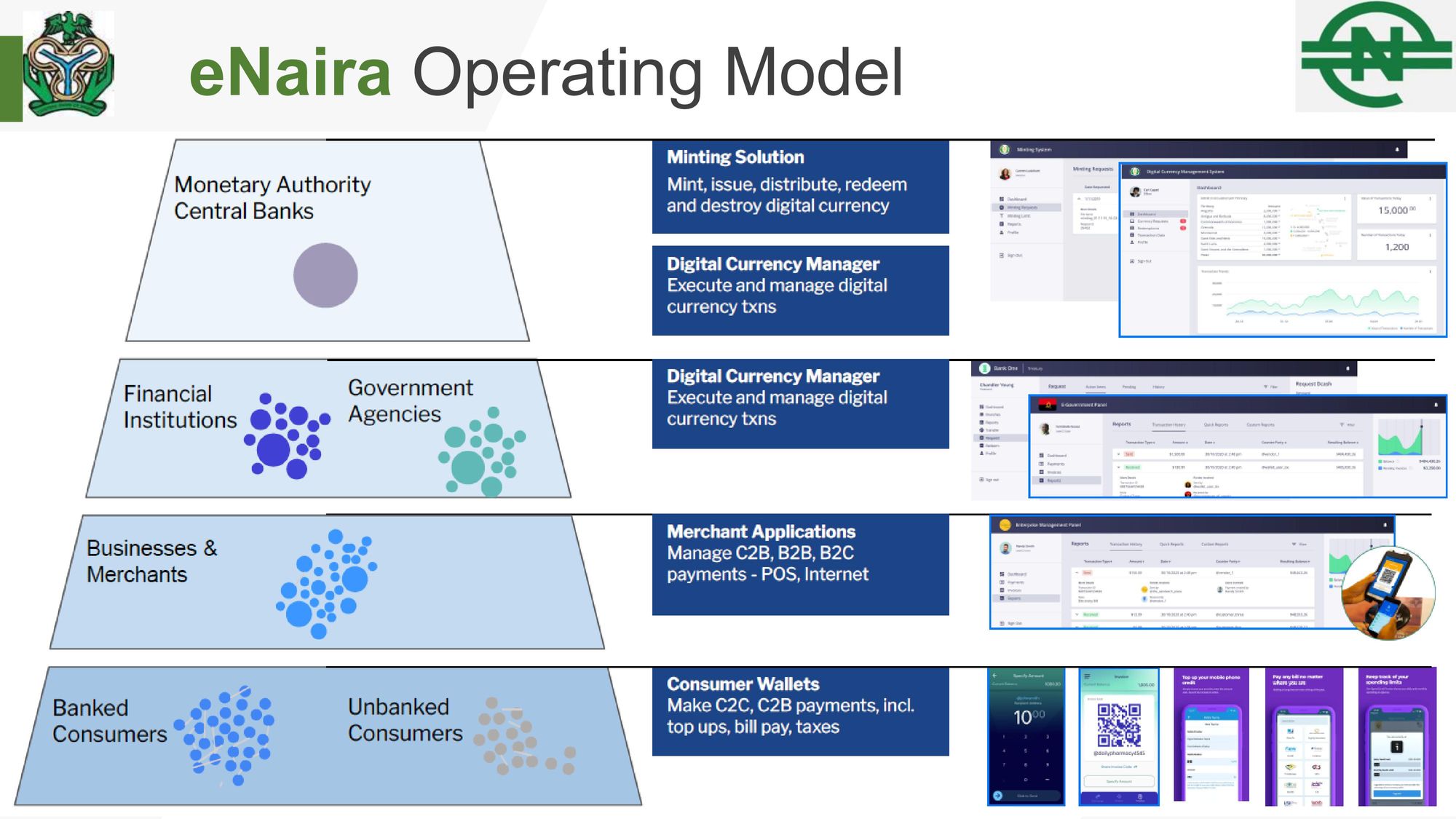

Operating model

The eNaira will include all stakeholders, from Regulators to business and retail customers. The central bank will retain the right to mint, distribute, redeem and destroy the eNaira. To distribute the eNaira, the CBN has created the eNaira wallet — the last mile digital wallet for consumers to use eNaira for payments and transfers. Typically, a central bank would not be involved in last-mile currency distribution and payments. However, the CBN has confirmed that banks can create an eNaira wallet later, but the initial rollout will go ahead with the CBN-owned wallet. Therefore, users automatically open an account with the CBN if and when they sign up for the eNaira wallet. This will turn the regulator into a competitor and provide the CBN a first-mover advantage over the banks.

Use cases

On October 1, all banks will send an email and SMS with a code inviting customers in the cities mentioned above to open an eNaira wallet. The customer service staff at the bank's call centers and branches will also support this effort. Following the promotion of the service, persons that sign up would be able to do the following:

- Crediting the eNaira Wallet from Own Account.

- P2P (Person to Person): users can send from an eNaira wallet to another individual's eNaira wallet or bank account.

- P2B (Person to Merchant/Business): users can pay from an eNaira wallet to a merchant's eNaira wallet or bank account.

- B2P (Merchant to Person): business users can pay from an eNaira wallet to an individual's eNaira wallet or bank account.

- G2P (Government to Citizen): Governments can pay from its eNaira wallet to users eNaira wallets and bank accounts

- FX deposit to eNaira: Remittances through International Money Transfer Operators (IMTO) such as Western Union can be paid into an eNaira wallet.

Although the CBN has indicated that agents can fund an eNaira wallet, the CBN has stated that eNaira can't be cashed out as Naira through an ATM or agent. However, users can transfer to a bank account and cash out.

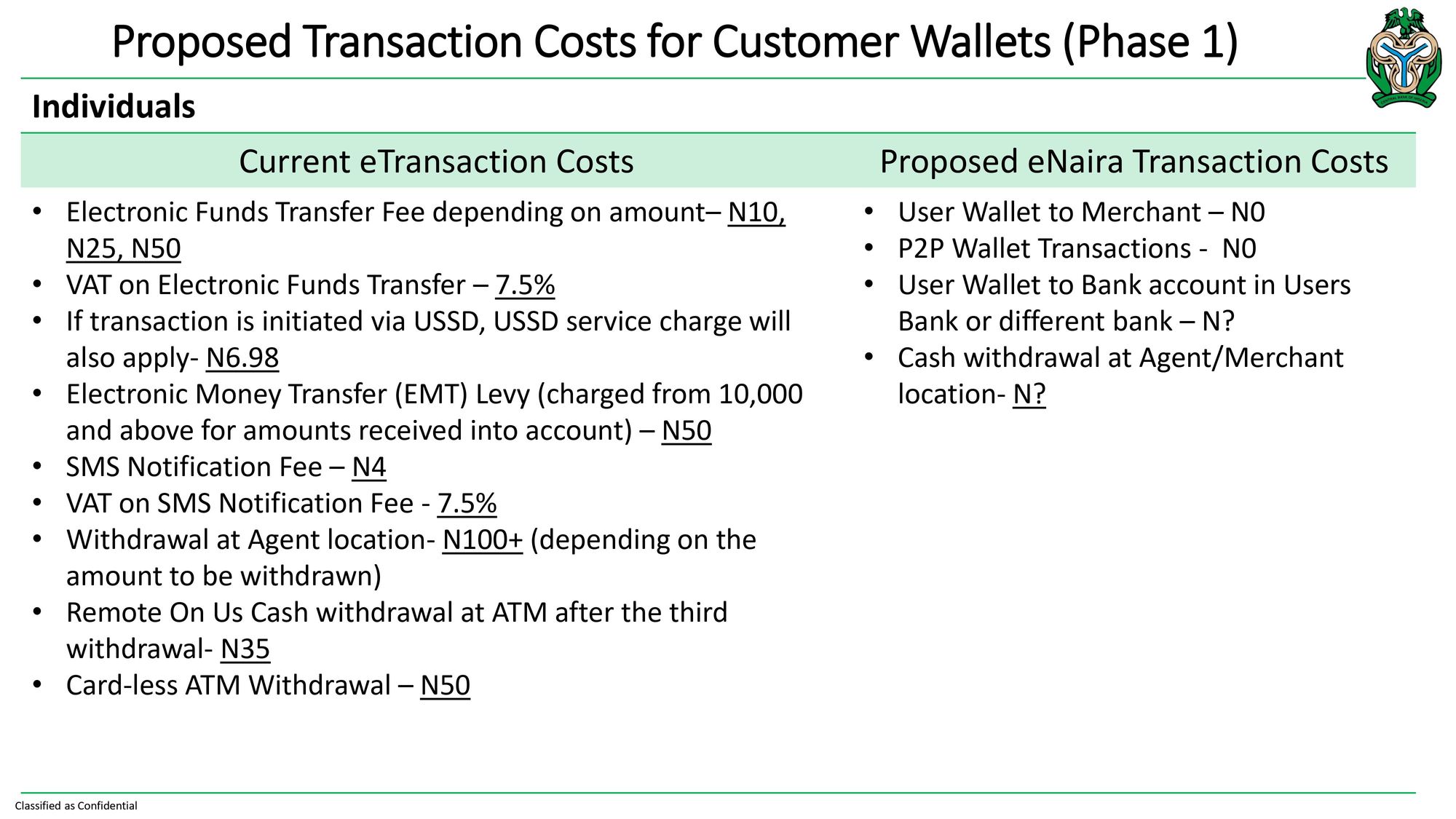

Cost structure and sustainability

Typically, financial institutions' revenue is characterized as net interest income and non-interest revenue. Net interest income being interest on loans, less interest paid on customer deposit, while non-interest revenue represents fees and commission on transactions (SMS alerts, transfer fees, etc.). Access Bank Nigeria recorded NGN 29.9 billion (USD 73 million) from non-interest revenue (e-channels and e-Business income) in 2020, a 37% growth from 2019. However, the CBN clearly stated that there would be no fees (NGN 0) on common use cases (P2P and P2B transactions). This will grossly affect the bank's non-interest revenue. In addition, this presents uncertainty in the business model and sustainability of thriving payment fintechs in Nigeria. According to Inclusion Times Data, payment companies represent 21% of all fintechs in Nigeria.

In conclusion, from a supply side, the CBN will own the infrastructure, platform, customer, and data. The eNaira wallet will provide the CBN a first-mover advantage, constitute direct competition to the banks, and pose a sustainability threat to the payment fintechs in Nigeria. On the consumer side, the overarching point is that the government will have direct access to citizens' historical financial information; in exchange, users will enjoy free transactions.

Although the CBN has confirmed the National Identification Number (NIN) as the unique customer identifier for tier 1 eNaira wallet, what remains unclear is what the CBN will do differently to use this initiative as a financial inclusion tool. The CBN will roll out eNaira through the banks to existing banked persons in major cities, where financial inclusion is considerably higher than peri-urban cities.