Twitter, particularly, went agog when the news of Elon Musk becoming the world's richest man broke, with plaudits pouring in from all over the world. The news felt even more inspirational for many who considered how meteoric his rise up the global personal wealth rankings has been.

The South-African born business mogul was the 37th richest man in the world as at this time last year, and then the 31st as at mid-March 2020 with a net worth of just under $25 billion. Then, astoundingly, in what is probably the fastest wealth growth in history, Musk became the world's 5th richest person by July 2020 with $74 billion.

Not stopping there, he surpassed Facebook CEO Mark Zuckerberg (worth $96.9 billion today) to become the world’s fourth-richest person in early November, and then overtook Microsoft cofounder Bill Gates (worth $122 billion today) to clinch the number three spot. One month on, Musk breezed past French luxury tycoon Bernard Arnault (worth $154.8 billion today) with a net worth of $177.2 billion to become the second-richest person in the world.

His glory moment however came last Wednesday (although Forbes didn't report it until Friday) when Musk’s net worth went up further by $12.5 billion, thus totaling at $189.7 billion, to make him the richest man on earth, and $5 billion richer than Amazon CEO, Jeff Bezos.

And while Tesla’s skyrocketing share price, which rose more than 720% in 2020, and has gained another 20% in the first week of 2021, will take much of the credit for the norm-shattering feat that seen the Tesla and SpaceX CEO get $165 billion richer since March 2020, the man is worth his place above the sun at the moment.

For one, the enigmatic entrepreneur's focused disposition in the face of achievements speaks of a man on a defined and intentional mission. Besides, the days when he slept in the office -- not so he could spend the maximum time at work, as is often the case these days, but because he couldn't afford an apartment to go home to, are probably still fresh in his memory, helping him maintain an understanding of life that goes beyond his new membership among the world's wealthiest.

Speaking to Forbes about his net worth via an email last year, Musk had said:

"I really couldn't care less. These numbers rise and fall, but what really matters is making great products that people love."

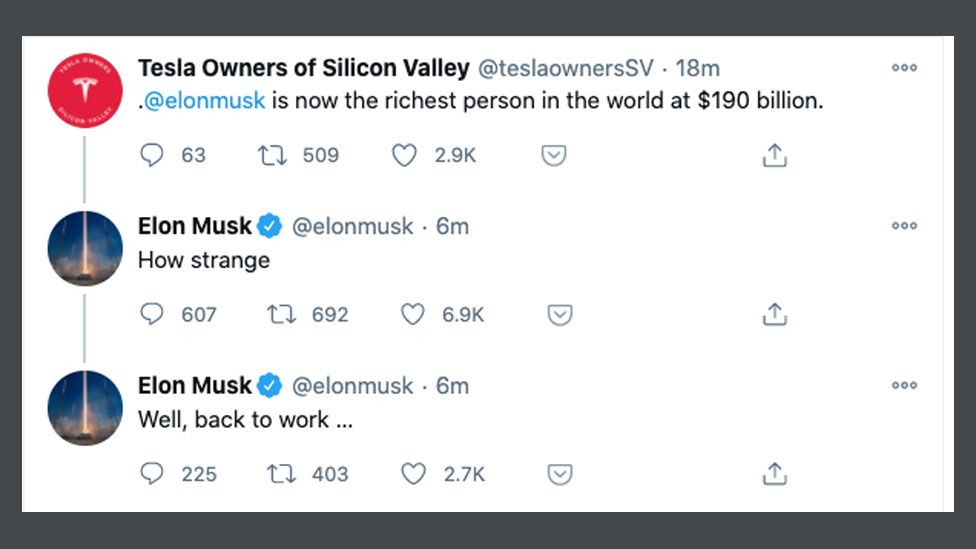

Similarly, his reaction on Twitter, when Tesla Owners of Silicon Valley reported his new wealth status, speaks volumes of a man who remains undeterred (by praise or criticism, which he is no stranger to, by the way) from his ultimate mission to create legacy products for humanity, and has gone "back to work" straightaway.

See the Twitter conversation below:

Interestingly, knowing that Tesla is currently not only the world's most valuable car company (with a $304.5 billion market value), but also worth more than Ford, Ferrari, General Motors and BMW combined, many often ask: How did Musk manage that in so little time?

However, as much as that is a valid question to ask, it doesn't capture the whole story of Elon Musk's investment journey. And that is why I'd say that the real question to ask is: How do I set up my investment portfolio the same way Elon Musk does?

If you'd like some answers to this question, I'd suggest you go by these four basic rules.

1) Balance Out Your Financial and Emotional Portfolio

Achieving what Musk has been able to achieve with Tesla and SpaceX, amongst his other investments, will require an exceptional level of focus and commitment. And that is probably what most people miss when they view what Musk is doing as scattered and fragmented across too many companies. To be able to put your all into building something from the ground up, you need to be incredibly efficient in how you use your time and be able to keep yourself exceptionally energized. And in that wise, it hardly ever helps to do nothing but that one job.

The beautiful thing about having a portfolio of activities, all of which you’re passionate about, is that on any given day, week, or month you have something going right for you. And that feeling of success and achievement you get from whatever is working helps to deal with those parts of the portfolio that aren’t. This happens at all levels, from CEOs to lone consultants. If you invest all your time and energy in just one activity/opportunity, you keep yourself at the mercy of the unavoidable oscillations and of that activity, which eventually translate into a financial - and emotional- roller coaster. Therefore, it is always a good idea to spread your financial and emotional risk over a variety of efforts; it will keep you motivated and energized.

2) Be In For The Long Haul

I think it has become apparent that Musk is investing in the long future; and in some cases, the very long future. But, true to our human nature, we are all tempted by the immediacy of short-term returns. We all love a quick hit.

However, looking at the ventures Musk is investing in; Tesla and SpaceX, for example, even though now very profitable, were never going to offer a quick hit. They are bets on a distant future, which is now gradually crystalizing.

Agreed, you may not be playing in Musk’s league of investments at the moment, but time passes just as fast for all of us, and if wealth buys you anything, it’s patience. But patience also buys wealth. Always have long plays as part of your portfolio of investments. Whether it’s your business, a brand, an equity stake in a long term business proposition, real estate, or all of the above, the long plays are most often the easiest to ignore but also the ones we most often wished we’d paid more attention to.

3) Go Where Others Fear To Go

Musk is solving problems that we all acknowledge, are mostly not willing to take on. One of the most constant truths among the super wealthy is that they go where everyone else fears to tread. While predictability gives comfort, it rarely pays off big. That however doesn't mean that predictable investments shouldn’t form part of your portfolio, it only challenges you to ask yourself whether you, like the wealth builders you look up to, are also considering any outlier-investments that may offer the greatest returns. It’s known as a hedge bet., and the best way to go about it is to allocate a certain percentage (however small) of your portfolio–preferrabley a percentage you’re willing to risk losing–to those plays that most people won’t touch.

4) You Are Your First and Best Investment

The overriding theme of Musk's rise, eventually, is Musk's investments in himself. And that is perhaps the greatest lesson we can all take away from Musk’s wealth building strategy. His unyielding commitment to invest in himself is constantly put on show by his nous for taking risks whose success or failure depend on his performance. The courage to even take such risks as Tesla and SpaceX in the first place speaks volumes of Musk’s belief and reliance on in his own abilities to shape his destiny, and very likely, of how much he has invested in those abilities.

Eventually, it is always a good idea to insists on not putting the responsibility for your success or failure as an investor (and as every other thing you might be) on anyone else but yourself. It is the Elon Musk way.

At the end of the day time passes just a fast for all of us, and while keeping sight of the here and now in terms of finances, spending, and investing is probably a necessary fact of our human existence, failing to balance that with the long term benefits of an investment strategy that bets long may also be the worst way to build a financially free future.