If you are in the fintech space, I guess like me, you would have come across the recurring theme – “we want to bank the unbanked”- used by Fintechs. The business models of these fintech startups are pretty impressive. Kuda bank, Flutter wave, Paystack, Fairmoney, to mention a few. Combining the business model of these guys (Fintechs) and the financial landscape of the Nigerian economy would explain why the investment in Fintechs startup is on the rise.

Speaking of the country’s financial landscape, EFInA’s report suggests a massive opportunity for Fintechs in Nigeria as financially excluded Nigerians increased from 36.6 million in 2018 to 38.1 million in 2020. In the words of Tomilola Majekodunmi - founder of Bankly, “We haven’t scratched the surface. [Traditional] banks have done what they have done…but we still have 100m [people] to go. And we are not talking about the bottom of the pyramid, who need economic inclusion before they even need financial inclusion.”

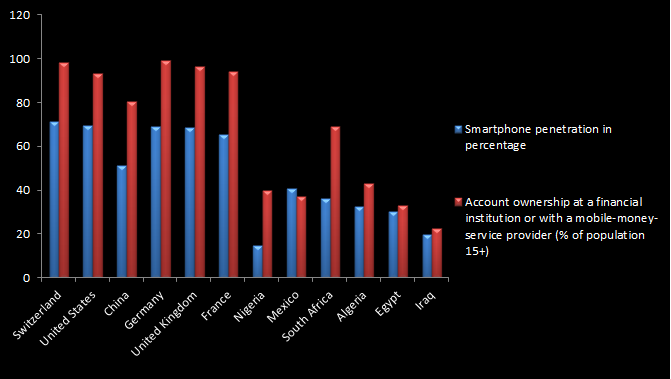

The core value of Fintechs in Nigeria is promoting financial inclusion, and one way they hope to achieve this is through the digitization of financial services. On the global landscape, there is enough evidence that suggests digitization improves financial inclusion. Below is a diagram showing smartphone penetration with financial inclusion in different countries. We can see that financial inclusion in countries with high smartphone penetration rates is high compared to countries with low smartphone penetration.

Does digitization improve financial inclusion? Yes. But how about the means to it?

In developed countries, where financial services are highly digitized, three key features can be seen; High smartphone penetration rate, Internet connectivity, High literacy rate. This is what I call the means to financial service digitization.

In the case of Nigeria and other African countries, the trio of smartphone penetration, internet connectivity, and literacy rate is very low. Although scaling up the three means is a function of the government, fintechs can play a role in scaling at least smartphone penetration and literacy rate. Even if the government can solve the problem of smartphone penetration and internet connection, how about literacy rate. This leads to two questions

1. How can people with no formal education make use of these digital products?

2. How can fintechs convince people to use these products?

The latter is not a phenomenon common in Nigeria alone, but it could be seen in other countries. An example is Indonesia. An article on the rest of the world gave an insight into this problem. In this write-up, Meaghan Tobin, Adi Renaldi, and Jihan Basyah explain how Indonesia's tech giants are battling to bring roadside stalls online. There has been some progress to cut the story short, but the problem is convincing people to use these products.

“There’s still a long way to go because, at the end of the day, you still need to talk in person with the small vendors and educate them about the benefits of using digital apps. It may take a long time.” Adhinegara at CELIOS from the article Indonesia’s tech giants are battling to bring roadside stalls online

There is every need for Fintechs to educate people without formal education on how to use this product. Even some literates are illiterates when it comes to the issue of finance. Ivie Folashade Osobase talks about this phenomenon in this article.

Why is this important?

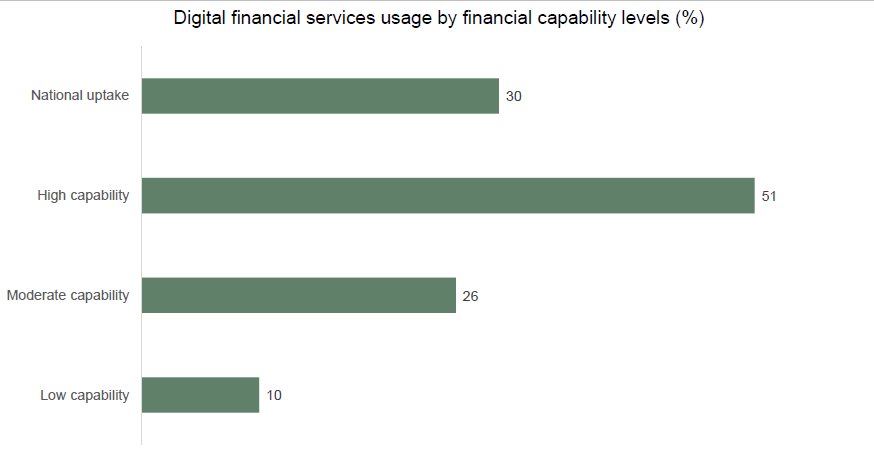

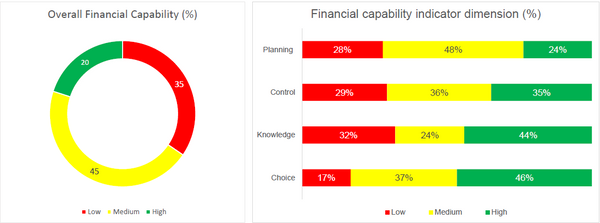

An Efina report shows exactly why scaling financial education is very important. According to this report, financial capability is an average of the financial planning, financial control, knowledge and skills, and making financial choices dimension. The higher the level of financial capability levels, the higher the use of financial services. The study revealed that Nigerians with high financial capability used more financial services.

However, Nigerians with high financial capability are low when compared to Nigerians with moderate and low capability, the report shows. Thirty-five percent of Nigerians have low financial capabilities, while forty-five percent have a medium capability level. Nigerians with high financial capabilities are the lowest with twenty percent.

BNPL - a tool for improving financial inclusion

Smartphone penetration in Nigerian is still low. Although this is not the primary reason why the financial inclusion rate is low, a prime suspect would be the level of income. However, smartphone penetration's role in improving financial Inclusion should not be underrated - check the financial inclusion and smartphone penetration chart above.

Buy Now Pay Later is not very common in Nigeria, as there are no clear market leaders at the moment. If this service becomes widespread, it could improve access to smartphones and also improve financial services.

Take a little trip around the world of BNPL, and you would come across names like Klarna, Zip, AfterPay, who are big players in the game. While the core product of these firms is BNPL, Fintechs within Nigeria can incorporate this product into their model or partner with BNPL to scale smartphone penetration, and thus financial Inclusion. A product that comes to mind is Safaricom's smartphone device financing plan, Lipa Mdogo Mdogo.

Nigeria in focus

GDP: $432.294 billion in 2020 compared to $448.12 billion in 2019

Population: 206,139,587 in 2020 compared to 200,963,03 in 2019

GDP per capita: $2,097 in 2020 compared to $2,229 in 2019