'Eureka! Eureka!' (I have found it! I have found it!). Those were the words Archimedes shouted on the street as he ran to the King to tell him of his invention. For Abraham Ojes — the co-founder of Collect Africa, his Eureka moment came from the need to solve how retailers could pay lenders.

Abraham is a three-time founder; he has launched Zend, Saya and most recently, Collect.

Just like most startups, Saya evolved. Abraham discovered that one of the most significant pain points for wholesalers was credit. With that information, he developed another product called Saya credit. Saya credit is a Buy Now, Pay Later (BNPL) solution between retailers and wholesalers. This particular business unearthed another problem — “payments”. Abraham had to figure out the best way to help these wholesalers collect money from retailers.

Abraham figured out direct debit to help solve the issue. The next step was how to incorporate direct debit into Saya Credit. It was this idea that led to Abraham's newly launched startup, Collect Africa.

Frequent regulatory changes and unclear financial sector licensing procedures means that the survival of Fintechs, eventually, is hanging in the balance. Despite these challenges, there are over two hundred fintechs in Nigeria, and investments in this sector stand at $1 billion, an EFInA report revealed.

Inclusion Times talked with Abraham Ojes, Collect Africa co-founder and CEO, on what it takes to launch a fintech company in Nigeria.

How did you end up building Collect?

Abraham: Wale Martins (co-founder and CTO) and I started Collect as a direct debit solution. To achieve this, we have integrated with Mono and Okra. They are platforms that allow customers to link their bank account to Fintechs or bank apps.

Some banks that were not available on Okra were available on Mono. We combined the capabilities of both platforms to serve our customers, and that was how Collect started.

We talked to our early adopters, getting quick feedback on what they think about the platform and how their customers responded. The most prominent feedback was the need for other payment methods on our platform. Recall that when Collect started, the only payment method was a direct debit method.

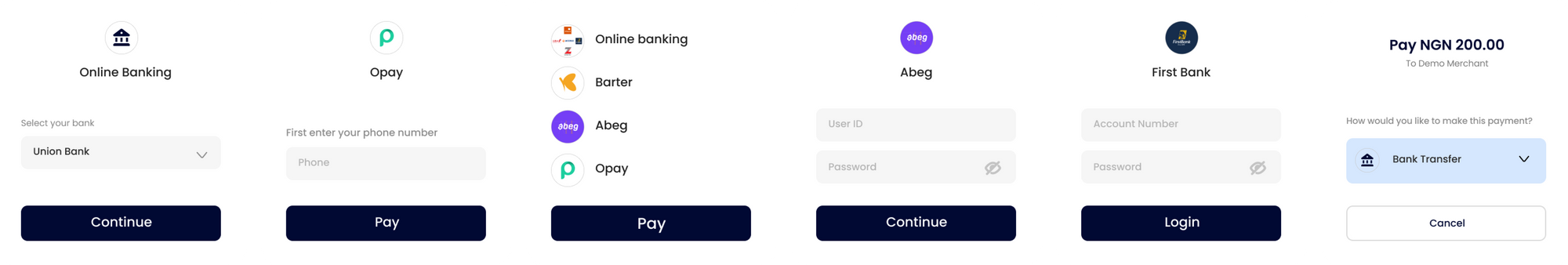

Most merchants wanted other payment methods. They wanted things like bank transfers, wallets, USSD, QR, and other alternative payment methods, and that was how Collect expanded into a full-suite alternative payment platform. Collect is not focused on cards; we are focused on scaling the adoption of other alternative payment methods like USSD, bank transfers, online banking, wallets, and Buy Now Pay Later (BNPL) for online and offline payment.

What is Collect Africa? What is the core value proposition?

Abraham: Collect Africa is a payment platform that allows merchants to collect online and offline payments via several channels. With one simple API, we process payments via bank transfers, wallets, online banking, QR, USSD.

The USP (Unique Selling Point) for Collect is an alternative payment platform that allows merchants to connect different payment methods to their eCommerce site to unlock new revenue, increase customer satisfaction and help them focus on their business.

What industry challenges and market frictions spurred the mission behind Collect?

Abraham: The challenge was adding different payment methods. We needed to connect to numerous payment gateways. Hence, we integrated into the backend of Opay, Barter by Flutterwave, Mono, and Okra. We have done the heavy lifting for our merchants. Now the merchants do not need to integrate with our service providers anymore. With one single API, the merchant can easily incorporate these different payment methods into their website or apps and do settlements in one place.

We have made more sense of a very fragmented payment space and ensured we give the merchants just the suitable payment methods to satisfy their customers' core purpose.

Can you tell us the journey so far from ideation to product launch? What were the challenges, what were the factors you considered in the development of Collect Africa?

Abraham: Collect Africa started with direct debit based on the loan repayment use case for credit companies. Initially, Collect aimed to help loan companies automate repayment through direct account debit. We knew we could do more because direct debit as an alternative payment method was unpopular. Not many of our clients were paying with direct debit on their accounts online or offline today. It's quite a new payment method in Nigeria and Africa.

We have now added more payment methods based on feedback from our customers. What you see today is a full-scale platform that can easily integrate into any payment method and offer that to the customers with a single API. For direct debit to work, we have to integrate with ALL banks. The challenge we faced earlier was integrating with other banks that all have unique APIs instead of a single API for the industry enabled by open banking.

Nigeria has 22 commercial banks, so you can imagine the stress of integrating with each bank and its different API structure. We faced many pushbacks from these banks, and it was almost becoming impossible. Until we decided to work with Mono and Okra, they know most banks, and we currently switch between them.

In the past, we have seen regulations wreck some business models. Can you tell us about the business model and plans to deal with such shocks? Abraham: Yeah, our business model is that we charge the merchants a transaction fee on every transaction, based on the payment method they use. We charge a pay method fee or a transaction fee which is probably similar to making API calls today.

Around regulation, we are not a payment processor. We don't process payments as Collect. We route the payment processing to the providers themselves to process and do settlement seamlessly for the merchants. We don't in any way process payments for the merchants. The payment processing is routed to the providers like Flutterwave, Opay, Barter and the likes.

When I say that we are operating on a different layer, we are not a payment processor. We are an API platform built on various providers.

According to Inclusion Times data, over 200 fintechs are active in Nigeria, and 20% of these Fintechs engage in payments. Why do you think Collect is the right product for a market like Nigeria?

Abraham: There is a need for more alternative payments in Nigeria. More than 50 per cent of Nigerians are unbanked, and only about 90% of those own or have access to a debit or credit card. There is a considerable gap. The payment fintechs are focused on cards and bank transfers or a mix of both.

Where the opportunity lies for us is in direct debits. We are looking at scaling the adoption of these alternative payments methods online or offline. We are very focused on this full scale. Collect is not ONLY about the popular payment methods.

It is about scaling the adoption of new payment methods to ensure the increased participation of the unbanked.

The Regulatory Incubation Program launched by the SEC kicked off this month. Has Collect made any move to sign up for the program?

Abraham: We have not signed up yet; we are currently reviewing it.

What advice would you give to Fintech startups?

Abraham: It is challenging to advise at this time. We just launched, we are trying to figure out a lot for ourselves at the moment. We are huge on figuring out our product and distribution. I don't think I have anything to say to Fintechs. But if you are trying to build in this space, ensure you are solving a huge pain point for your customers, and you understand what it takes to create the right product and distribute the product.

Is there any seed round soon, and how have you managed financing?

Abraham: We are a team of six at the moment, inclusive of the founders, software engineers and business development executives. We are currently self-funded, but are presently raising our pre-seed round now. We are yet to close, but yes, we are raising pre-seed funding. Furthermore, we are part of the 8 African fintech startups selected for the GreenHouse Lab accelerator programme. That gives us access to USD 10,000 towards our pre-seed round.

What is the most challenging part of being CEO of a fintech startup?

Abraham: Yeah, there are many challenges. Figuring out how to scale our product and distribution, and at the same time, have my eyes and ears out for regulators.

But I think the most exciting thing for me as CEO is to see merchants use our product. Not only that, but it's what brings you so much joy despite the hard work, the pain we go through daily. You are doing a lot every day, from managing the team to managing the product itself, sales, distribution, and regulators.

What is Collect's growth plan – in terms of product, tech, markets?

Abraham: We see a significant and fantastic case for Buy Now and Pay later at the moment. Lenders power most BNPLs. We are currently running a lot of tests around BNPL. I think our BNPL should be live before the end of the quarter.

On the consumer side, we are looking at building more consumer payment infrastructure, which I think we lack in Nigeria. Consumer payment is not where it is supposed to be in Nigeria; it's still challenging to pay offline at the moment.

The big vision for Collect is to solve payments problems for both the merchant and consumers. To make sure that the consumer's pain point is solved, and it's easy to pay anywhere, either offline or online.

"If you can receive SMS, if you can send money from one place to another, you should be able to pay for anything" Abraham

It's one of the biggest problems for us to solve at Collect, figuring out the massive adoption of these payment methods and the right technology to power them.