Former CEO of Diamond Bank, Uzoma Dozie launched Sparkle, a fintech solution on June 2020.

A year ago, when I was in the recruitment process of an international microfinance bank in the Nigerian market as a product manager, I was asked to create a concept note for a new product in 24 hours. After my needs assessment, I learnt that there was no fintech solution in Nigeria that combines "traditional banking services with budgeting and expenditure tracking". I put this forward in my concept note and I scaled to the stage where I had to meet the CEO and send more credentials. Safe to say that I got the job but Genesis was fast to make an offer before I got one from the Microfinance bank. This is not the story!!!.

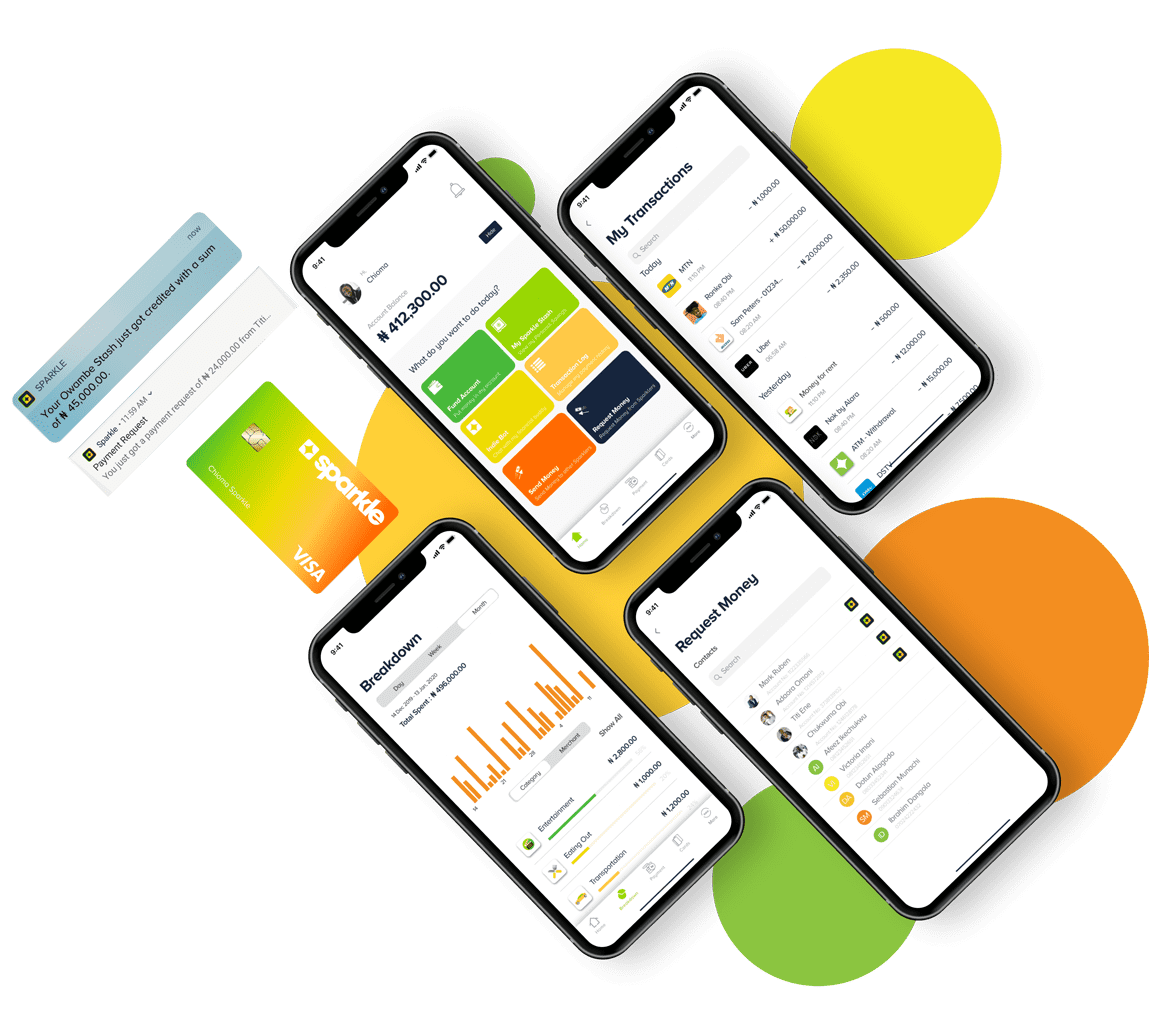

In a first of its kind position in Nigeria's fintech history, Uzoma's Sparkle combines "traditional banking services with budgeting and expenditure tracking" which I consider a millennial-generation focused capability. In the United States, Apple partnered with Goldman Sachs in August 2019 to launch the Apple Card. Apple Card also combines banking services with personal finance (budgeting and expenditure tracking). Apple Card remains active in the US only till date.

While Sparkle is positioned as personal finance tool, it boasts of other features such as an in-app chat bot called Indy, Sparkle Pay (payment link) and a unique feature that allows you to directly request money from your phone contact that already has a Sparkle account called a Sparkler. One would have expected that Interswitch's Verve will win the debit card deal but Sparkle went for Visa. The card is expected to be available soon alongside a couple of features such as QR payment.

Many have called this the second coming of Uzoma Dozie and it is therefore important to keep an eye on Sparkle which has over 10,000 downloads on Google Play Store in one month. It is equally important to see how it scales and most importantly how it will target the financially excluded.