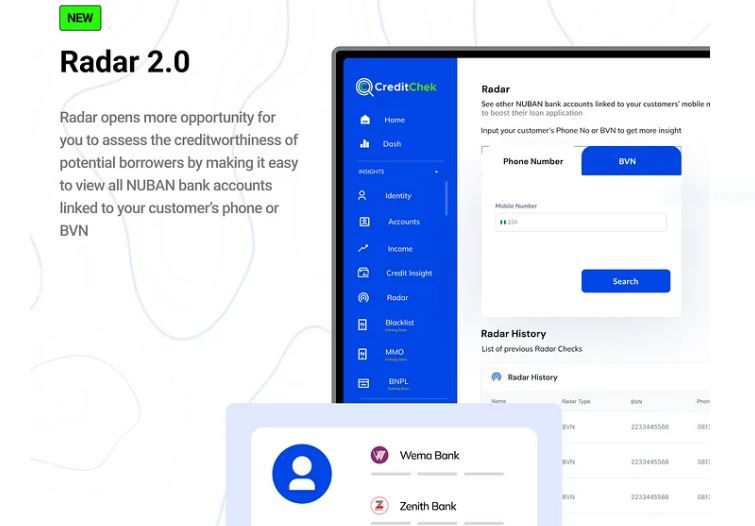

Nigeria's fintech startup CreditChek has launched a web app and API called Radar 2.o to assist lenders with insights to guide their credit risk models. Founded in 2021, the company thrives in checking and verifying customers' creditworthiness with a vision to help lending platforms in Nigeria with a reliable and accurate source for customers' credit profiles. A notorious challenge in the Nigerian fintech space are loan defaulters, many of which go unreported.

As a major barrier in Nigeria's digital lending industry is loan defaulters, who are in the habit of taking credit from multiple platforms and end up not meeting payment deadlines, providing falsified information, and ultimately breaching the terms of the agreement. For other borrowers, the country's harsh economic realities, which have increased the cost of living, have hampered their ability to repay their debts. On issues like this, the Creditchek web app will offer credit insights, that is, historical data from various sources on a borrower's debt or credit status. The platform will also provide Lenders with a customer's true identity to tackle personal data falsification. The lack of financial literacy is also why many Nigerians fail at loan repayments, as most individuals need to learn how to structure their repayment plans. With CreditChek, many lenders and borrowers will avoid clashes with embarrassing outcomes.

Regardless of the excuse, CreditChek will seek to validate its product and technology by ensuring it reduces the rate at which Nigerians default on their loans, as it would provide lenders with quality data that would help them set interest rates rightly. It will also seek to establish long-lasting partnerships with other companies in the fintech space in promoting financial literacy.

Focus Box

Company Name: CreditChek

Industry: Financial Services

Founded: 2021

CEO: Kingsley Ibe

Funding raised: $240,000 (2022)

Revenue: N/A

Customer base: N/A

Key countries: Nigeria, Ghana, Kenya