Introduction

In Nigeria, women have historically faced barriers that have excluded them from access to economic capital including financial, education and employment opportunities. More specifically, access to finance has proven to be difficult for women due to several hindrances including poverty, cultural barriers to land ownership, limited access to markets, and gender inequality.

Despite the advancement of informal savings collectives (E.g Esusu Cooperative Savings) that have accelerated access to finance amongst women, research shows that there is still a notable gender gap in overall financial access and usage: 42.9% of men saved during the preceding 12 months, compared to 37.6% of women.

The urgency of enhancing financial stability for women extends beyond the essential well-being of women themselves, it also yields positive ripple effects on men, children, households, and the entire community. From a global lens, advancing women's equality at different economic levels can potentially translate to an additional $12 trillion in global GDP by 2025, breaking this down at a national level, the impact is non-trivial to national and local economies - Financial Alliance of Women, reports a potential market opportunity worth approximately USD$760 million (equivalent to NGN 294 billion) in annual revenues if the women's market were to be addressed.

In order to uncover the state of financial well-being (stability) amongst Nigerian women, we surveyed over 93 Nigerian women living within the continent and abroad to learn about their savings and investment habits, as well as how financially stable they felt. This survey was based on some key hypotheses:

Our Assumptions

- Many women lack financial stability, which affects their ability to save and invest

- A significant income gap exists that limits women's saving potential

- Nigerian women encounter multiple obstacles when it comes to saving

The Survey Method

We leveraged Google Forms to create the questionnaire, and shared the survey across our social media platforms and groups. Our goals with this survey was to better understand: 1) The savings culture and experiences of Nigerian women, 2) What tools will help them save better, 3) The connections between savings culture and financial stability.

Caveats:

The data for this research is collected digitally via Google Forms published via several social media channels including WhatsApp, Instagram, and LinkedIn. The sample selection was via a self-selection model where the respondents themselves opted to undertake the survey. The data in this work and the findings may not be representative of Nigerian women in general since the respondents are within the demographics of the authors. However, it would be quite representative of the young/middle-aged urban & educated Nigerian woman. Due to the sensitivity of financial information, the data collected for this work was completely de-identified. Also, questions asked are subjective and use ranges rather than more precise values to collect responses on savings and financial stability.

The Respondents

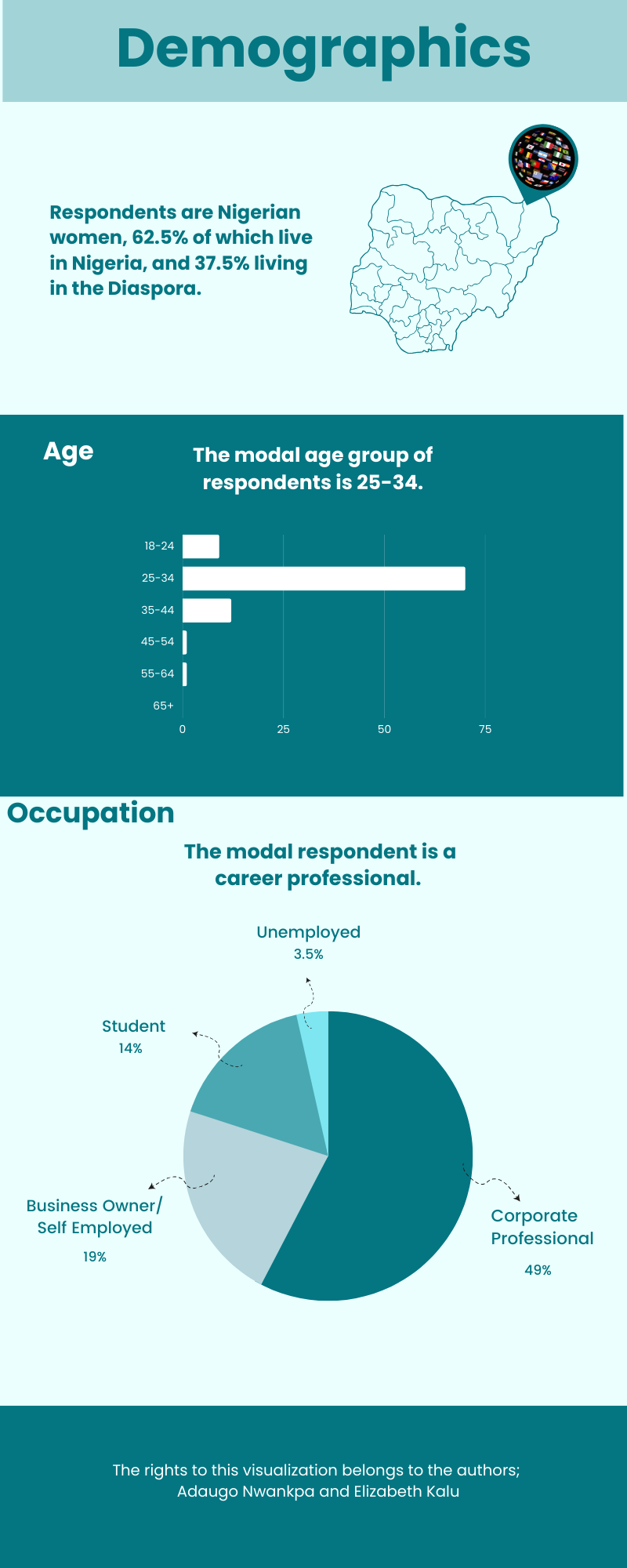

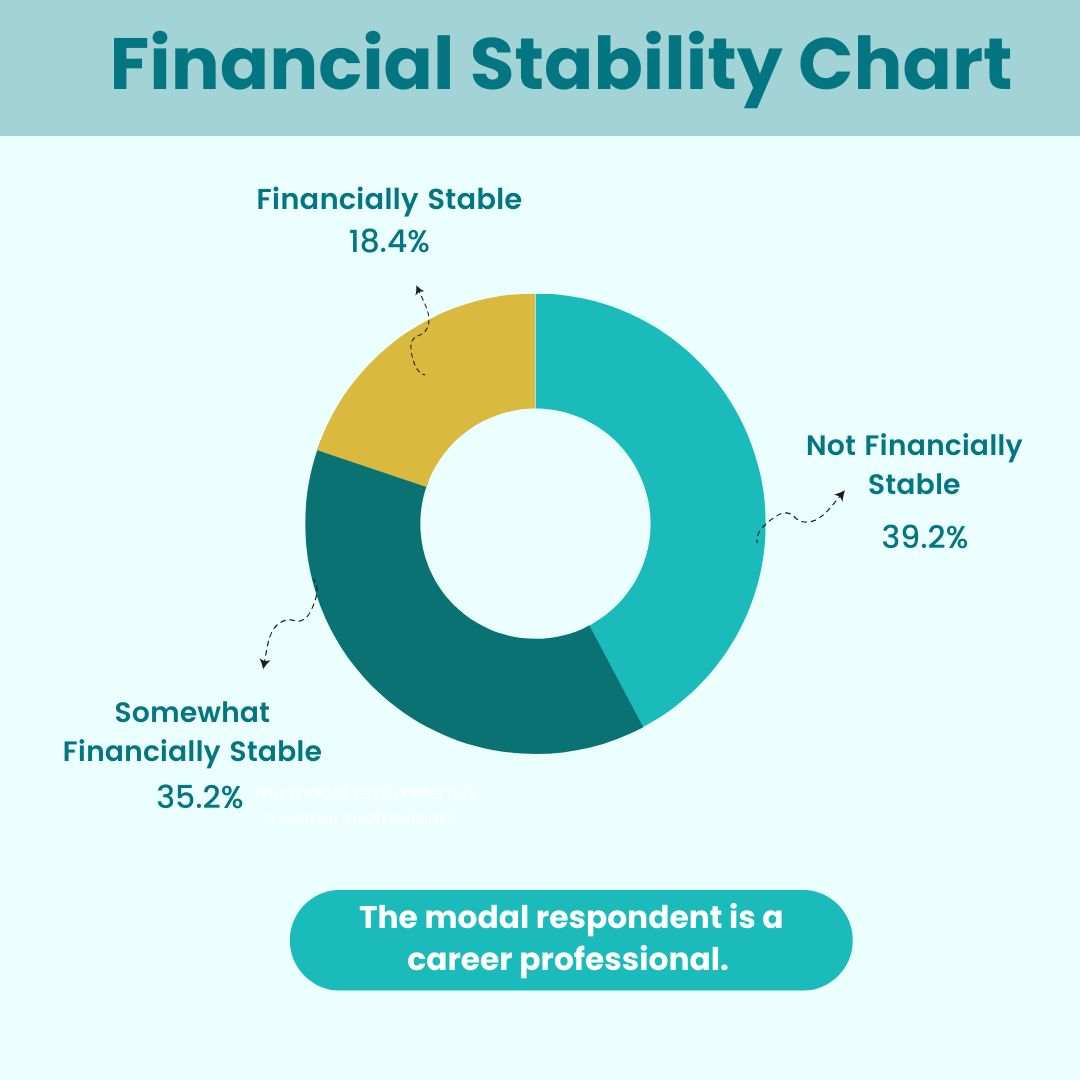

Respondents to this survey were Nigerian women, 62.5% of which live in Nigeria, and 37.5% of living in the diaspora. The modal age group of respondents is 25-34. The occupation distribution of respondents was also unimodal with the modal respondent being a career professional.

Overview

In the context of this research, we define financial stability or well-being as a condition in which an individual can satisfy their present and ongoing financial requirements while also possessing sufficient cash or investment opportunities to feel confident and secure about their financial future.

In understanding financial stability, we recognise that there are several components such as income, savings, expenditure, debt, investments, etc that can contribute directly or indirectly to a person’s financial stability, however, for the scope of this work, we limit it to savings.

We zero in on the nature and role of savings in financial stability because to a large extent, savings is pivotal–being a key mirror of total income and financial habits, savings also impacts the investment capacity of an individual. While this survey does not capture the total income of respondents, we dived in to find out how much these women save in US Dollars (savings conversions are done at official exchange rate during the time of this survey).

Key Survey Findings

Financial Stability:

A majority 39.2% of our respondents reported that they are not financially stable, another 35.2% think that they are ‘somewhat financially stable’ and only 18.4% of respondents think that they are financially stable.

Savings:

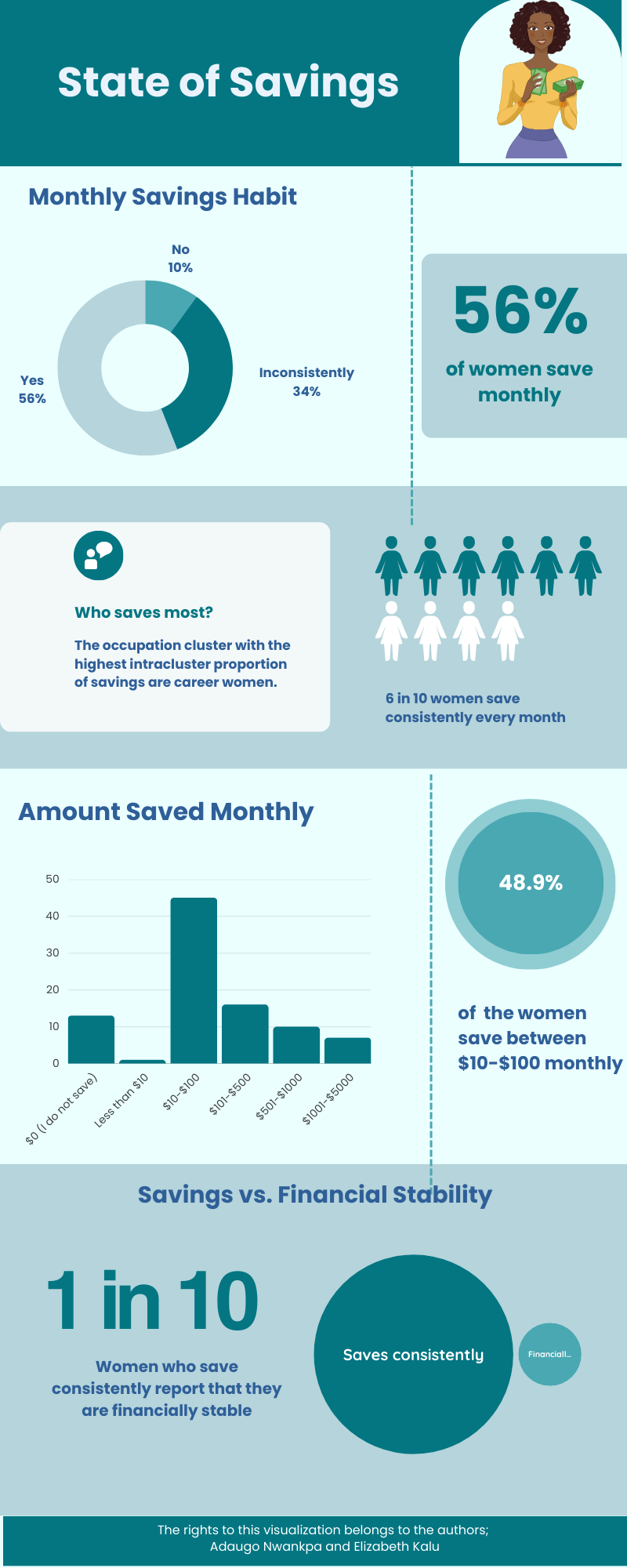

In this study, our primary focus is on the financial stability of women, with a particular emphasis on the savings practices of Nigerian women. Our findings reveal that 56% of respondents save consistently each month, while 34% save but not consistently, and 10% do not save at all. Within the group of those who consistently save (56.3%), only 18% of them consider themselves financially stable. Furthermore, the majority of women (56.3%) save an amount ranging from $10 to $100 per month.

The Savings Motivators:

Even though financial stability is reportedly low within our sample, we see that these young Nigerian women are keen on building wealth for the future. From the data we observe investing being a significant motivator to saving with 70.6% of our sample noting that their top savings goal was to start investing. Following closely is the goal to build an emergency fund at 65.1%.

Technology and Savings Habits:

Technology exerts a substantial influence on the savings habits of the surveyed women, with an overwhelming 78.6% expressing that it has had a positive impact on their saving practices. Among the technological tools mentioned, Bank Apps, PiggyVest, and WhatsApp Savings Groups emerged as the most popular. The primary factors contributing to their popularity among respondents are the excellent user experience, automated savings features, and the provision of educational content.

Social Media and Financial Stability:

Often, we think of social media as a two-edged sword in the way it affects lives. Interestingly, social media has a profound positive impact, accounting for how 65.6% of our respondents learn about personal finance.

Family and Financial Stability

In diverse ways, family backgrounds and expectations shape the financial stability of women. 61.6% of our respondents identify family as a key place they learn about personal finance. Conversely, a lot of respondents also identify family and family-related obligations as a barrier to savings. “Moneying with Women”, explores in a bit more detail the role of family in financial habits and financial stability.

Barriers to Savings/Financial Stability

Amidst a global economy marked by instability and ongoing efforts to achieve gender-pay equality, numerous challenges hinder the progress of young Nigerian women on their path to financial stability. Among these challenges, our survey identifies low income as a primary barrier. Although we do not delve into the underlying causes of low income, we recommend upskilling and venturing into entrepreneurship as viable avenues for increasing earnings, an avenue we will expand on in our next article.

Other factors identified in the survey which also significantly impair financial stability include rising costs of living, family obligations/needs, and unforeseen circumstances like health issues, and emergencies.

Key barriers to saving that were highlighted from our respondents include;

- Unplanned/unforeseen circumstances

- Low income

- Family obligations & needs

- High cost of living

Embarking on the path to financial stability is akin to the proverbial journey of a thousand miles that begins with a single step. The initial step involves pinpointing one's current financial situation and revealing any existing disparities, a task accomplished by this article.

Written By: Elizabeth Kalu and Adaugo Nwankpa