Data points are not just numbers, they are real people. In an era of big data, it can be easy to be focus on the numbers, forgetting that behind the data is real people. To bridge this gap, over the past few weeks, we have documented anonymised stories of real women in our Moneying With Women series, uncovering how they really felt about their personal financial stability beyond the general data. Our findings have been interesting and before we continue to share the stories of these amazing women, we are sharing a midline update.

*Personal financial stability in the context of Moneying with Women is a measure of how an individual feels about their financial state. This is a subjective concept and seeks to uncover how the individual views themselves outside of comparative data. The metric is the Personal Financial Stability Rating (PSFR) measured on a scale of 1-10, where 1 means "I don't feel financially stable at all: barely surviving" and 10 means "I am very financially stable: flourishing".

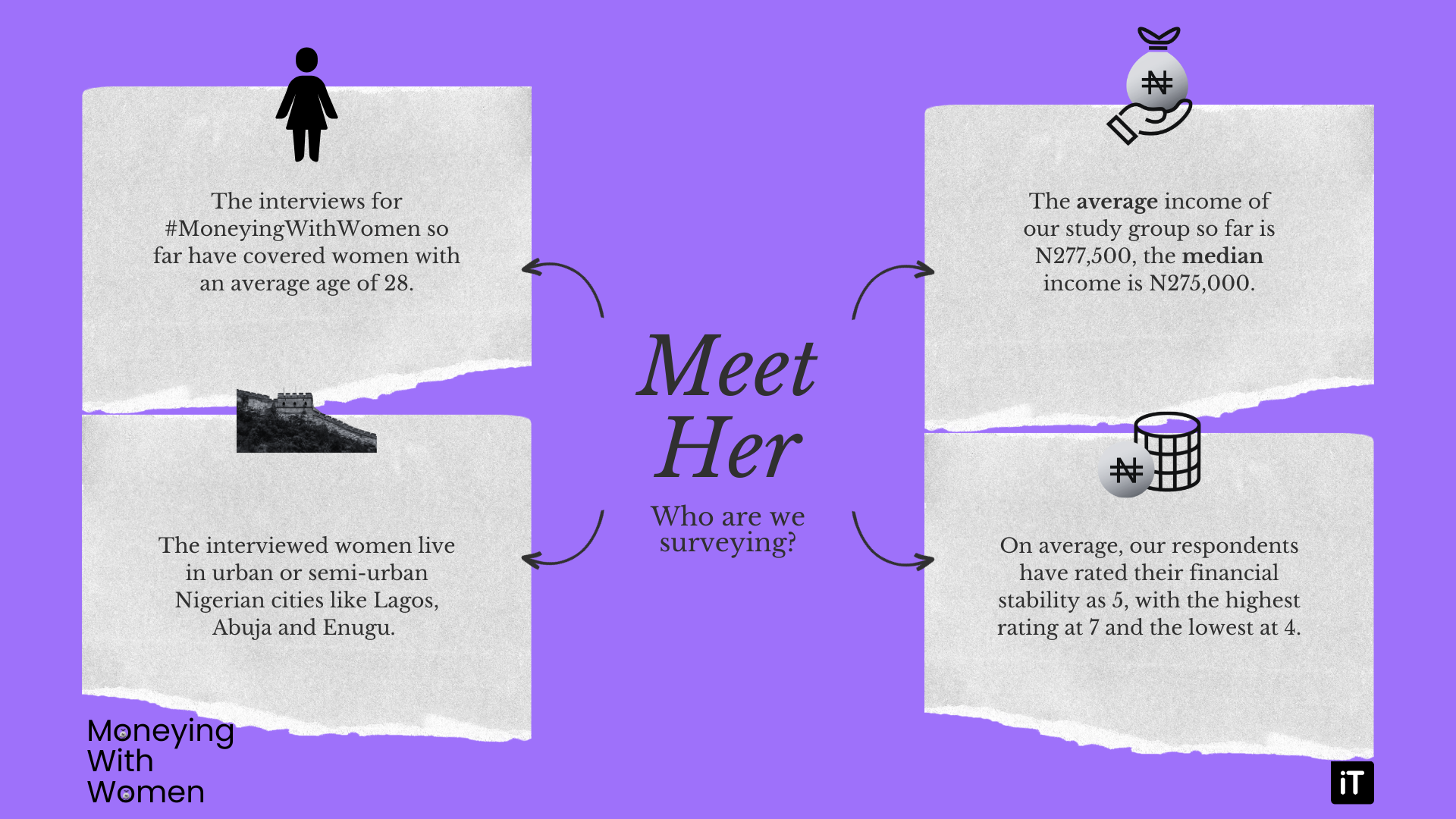

Who are we surveying?

Our survey captures women with a mean age of 28, both 9-5ers and business women alike from diverse sectors. The average income of our study group so far is 277,500, the median income is 275,000. On average, our respondents have rated their financial stability as 5, with the highest rating at 7 and the lowest at 4.

What we’ve found so far

We’ve had very interesting conversations, and if you haven’t read the series, catch up on all 4 previous episodes here. Here we list our top 5 findings on the series so far.

More Money doesn’t mean more happiness

In line with the popular cliche, one key finding of our interviews so far is that, more money does not buy happiness. So far in our interviews, the highest PSFR has come from the person with the least income. While we agree with a recent HBR article that more money might buy a life with more ease, we see that habits, backgrounds and the peculiarity of needs seem to shape a person's financial stability more than the income figure in itself.

Family background seems to play a key role

Whether good or bad habits, we see the family play a critical role in how the women in our study now relate with money. Jedidiah for instance tells us how she learnt budgeting and savings from her mother, in fact, she started saving as far back as when she was in nursery school. In almost every story, we find an significant impact of family on financial mindsets and money habits.

A need to earn more

Whether she’s earning N100,000 or N400,000 women just want to earn more. Is this the solution to the low personal financial stability ratings? We can’t say for sure. While workplace history has shown that women earn less on average, we also know that everyone, despite their gender, will be happy to earn more. Furthermore, we have also seen from our interviews that people who earn more do not particularly have higher PSFRs.

Pinked tools are MIA (Missing In Action) so far

In our interviews, we ask the women their Top 3 fintech tools. So far, no gender facing product has been mentioned out of the plethora of gender-banking tools that exist in the Nigerian fintech space. This signals a need to revisit the idea of gender-facing tools. Piggyvest and Risevest have also been mentioned most.

Most Interesting Find so far

So far, the highest personal financial stability rating [at 2 points higher than the average rating of 5] is from the lowest earning person in our survey [with an income about N117,500 less than the average income in the survey].

While our sample is rather small and our study sample is quasi-randomly selected and so we cannot conclude if lower earnings mean more happiness (which we doubt), however, we see this as a very interesting finding.

We believe that this high rating is a function of lifestyle and habits. You can read the specific story here.

Moneying with Women is an Inclusion Times series that dives into the financial stability of women from their own point of view. It uncovers habits, financial inclusion gaps and empowers women to take charge of their financial journeys.

Want to share your story? Send an email to adaugo@inclusiontimes.com