Over the last two years, the fintech space has seen massive capital inflows and bloated valuations. The year 2021 saw the financial service ecosystem gained a strong momentum, with 193 unicorns created compared to "only" 51 in 2020 - dealRoom 2021 fintech report. Furthermore, that same year saw the rapid development of new segments such as BNPL, NFTs, neo brokers, crypto exchanges, and many others, all of which have since grown significantly.

Unfortunately, the booming fintech space experienced a tough journey last year (2022) and this was majorly tied to the continuous increase in competition, interest rate and a recessionary environment experienced globally. The impact of these economic factors on Fintechs has been catastrophic as we have seen a good number of promising fintechs lay off their staff as well as a fall in the valuation of these start-ups. A good example is Klarna, the European BNPL giant whose valuation fell drastically from $45.6b in June 2021 to $6.5b in 2022 cutting down her workforce by 10%. The damage was across board, with Stripe laying off 14% of its workers, impacting around 1,120 of the fintech giant’s 8,000 workforces. Chime also took the same route laying off 12% of her employee.

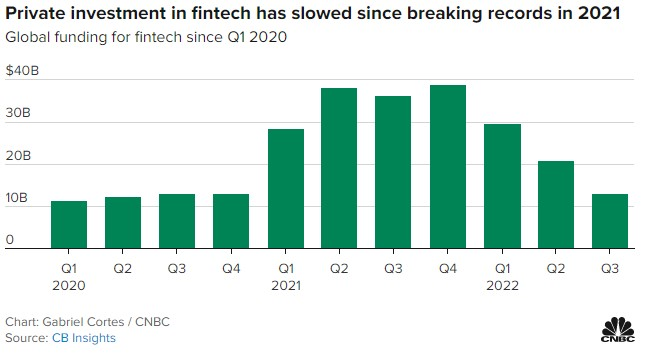

Investors are now feeling the pain after the fintech gold rush of 2021, which saw capital inflows of $131.5b nearly three times the $49 billion invested in 2020. However, with the performance of the sector, capital is no more cheap. The environment have become more difficult as investors have dramatically changed their demand. Unlike the regular vision and growth potentials, investors now want to see sound unit economics with a clear path to profitability.

Fintechs may struggle in 2023 as many would run out of cash, and would be forced to further reduce the number of staffs in order to stay alive. Some would be bought over or funded under onerous terms.

Now The Big Question - How can FinTechs redefine their future in 2023?

Fintech Founders must be ready to up their games in order to fit into the changing environment, This article is basically how to survive and possible best practice fintech founders should closely work with, the analysis below which is subject to constructive criticism were built on the basis of the data published by CbInsights, pitchbook, dealRoom, TechCrunch and Forbes etc.

- Value Added Services

Investors have been focused on the ability of the startups to create a viable PMF (product market fit) which is key in building strong user base. However fintech founders need to understand that capital is no longer cheap as usual and competition is increasing daily hence PMF is no longer enough and so therefore founders must introduce value added features into their products, this would give them the competitive advantage.

As earlier stated Product-market fit (PMF) isn’t enough anymore. Yes, you still have to find it, of course it would boost value and revenue, but then you need to build upon that and add new value. In 2023 startups should understand that to be sustainable and stay investable requires a lot more. New features should regularly be introduced into their existing product as this would not only build a solid user base but also make them unique and increase product traction.

2. Team Optimization:

This has become very imperative, following the amount of workforce that was cut off in the fintech space last year (2022). In as much as the main objective is to deliver better experience to client and improve on profitability startups can also do this without bumping up the team size.

Today you can embed just about anything from bank accounts to lending, trading, ERP functionalities etc. Providers making those APIs are investing significant time and money into making a high-end product. And you can go live in a few weeks and speed up revenue without bumping up the team size. The main objective is to have a good revenue and become a viable medium sized business positioned to raise money from equity financing in order to scale globally.

3. Business Model:

The fintech industry will start 2023 on a rocky foundation and it’s important that founders closely observe, that the model used fits the current situation. Last year has indeed been tough for fintechs and the tech business at large. Innovation will continue, but businesses which are heavily dependent on zero or low interest rate financing costs such as BNPL may have a tough year. In 2023 there will be deeper digital transformation not just the usual customer oriented solution even the back-office of the financial institution would also experience a good number of transformation, It is necessary for founder to regularly review the performance of their existing model to confirm that its capable of taking them to an unprecedented stage while factoring the changing nature of the space.

Personally, I feel 2023 will come with a lot of opportunities in the fintech space especially in Africa where there are many who are still unbanked and under banked. Consumers' needs, particularly Gen Z demand for financial services, will increase, and new back-office digital financial solutions will be developed.

However, funding is required to achieve these goals, and fintechs must be positioned to qualify for it. In 2023, VCs will conduct extensive due diligence, testing every unit economics and scrutinizing transaction quality to ensure that the business model is actually workable. Some fintech experts advise founders to keep an open mind about alternative means of funding, but it's important to note that startups with a compelling product and a clear/reasonable path to profitability can still access VC funds with favorable terms and conditions.