Nigeria-based fintech company Paystack is introducing virtual terminals, a new product that allows merchants to accept payments with bank transfers for multi-person businesses. This move is in response to the rising popularity of the “pay with bank transfer” feature among everyday customers, particularly in offline businesses such as supermarkets and restaurants.

In 2021, about 12% of payments on Paystack in Nigeria were made with a bank transfer. Two years later, that number has grown to 34%. Paystack is looking to position itself for faster growth, witnessing rapid adoption

of its “pay with bank transfer” feature.

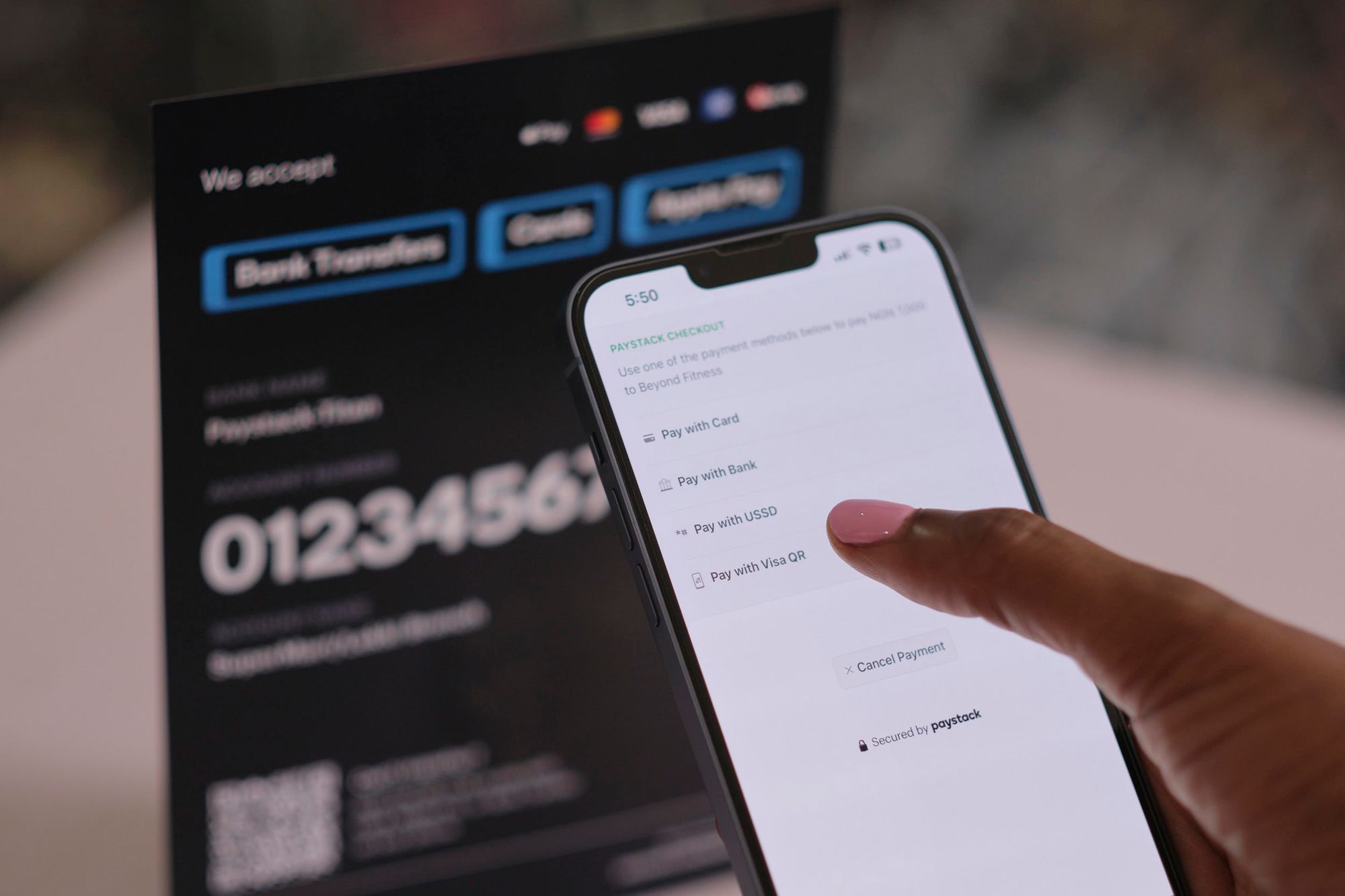

Paystack’s virtual terminal is a digital-only alternative to physical point-of-sale (POS) devices that have seen wide adoption in the country over the last few years. With the virtual terminals, Paystack seeks to reduce wait times for payment confirmation and provide a seamless checkout experience for customers. In addition to bank transfers, the feature supports QR code payments, foreign bank cards, and Apple Pay. Also, Business owners can assign virtual accounts to sales agents, allowing them to monitor and verify transactions without the need for manager approval or access to the business’ bank accounts.

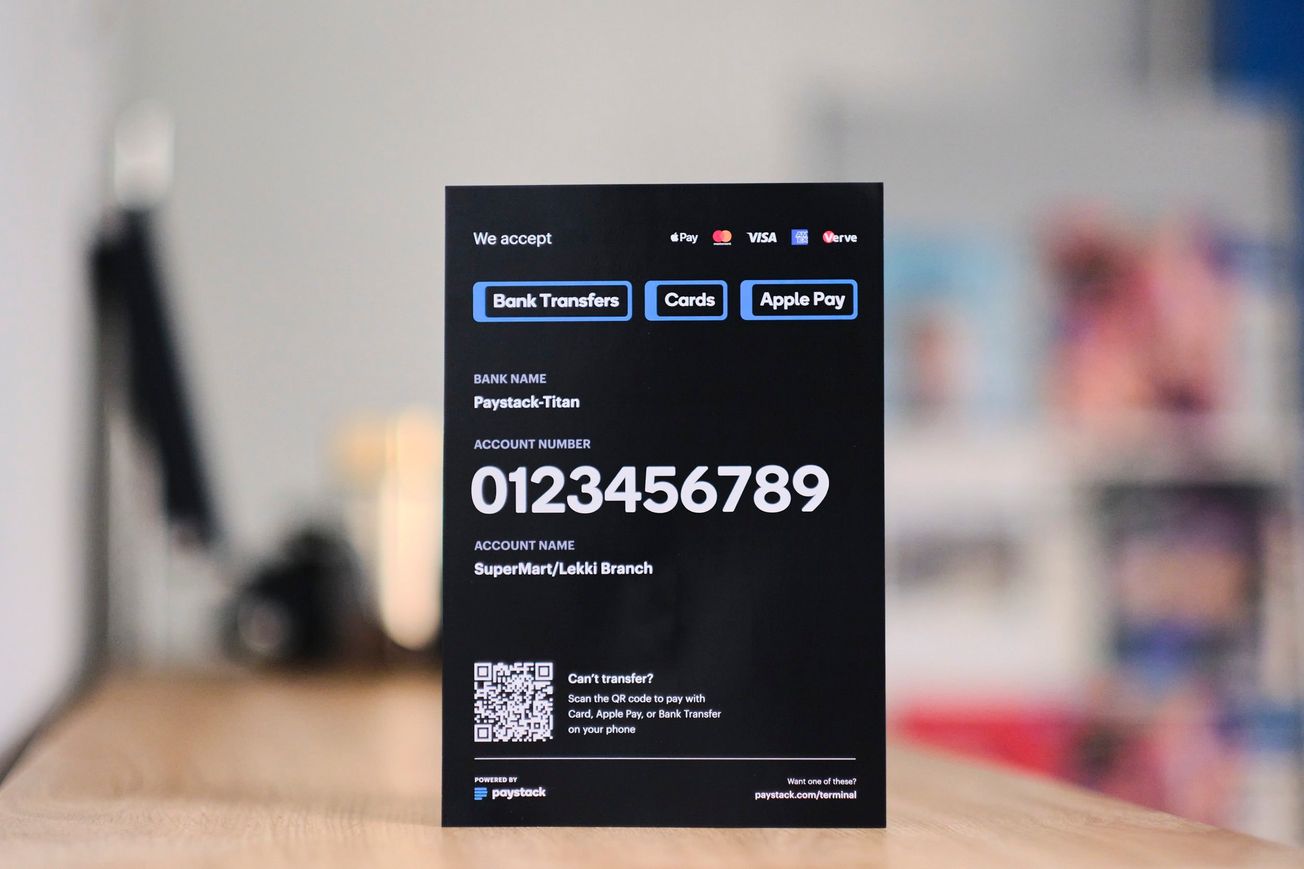

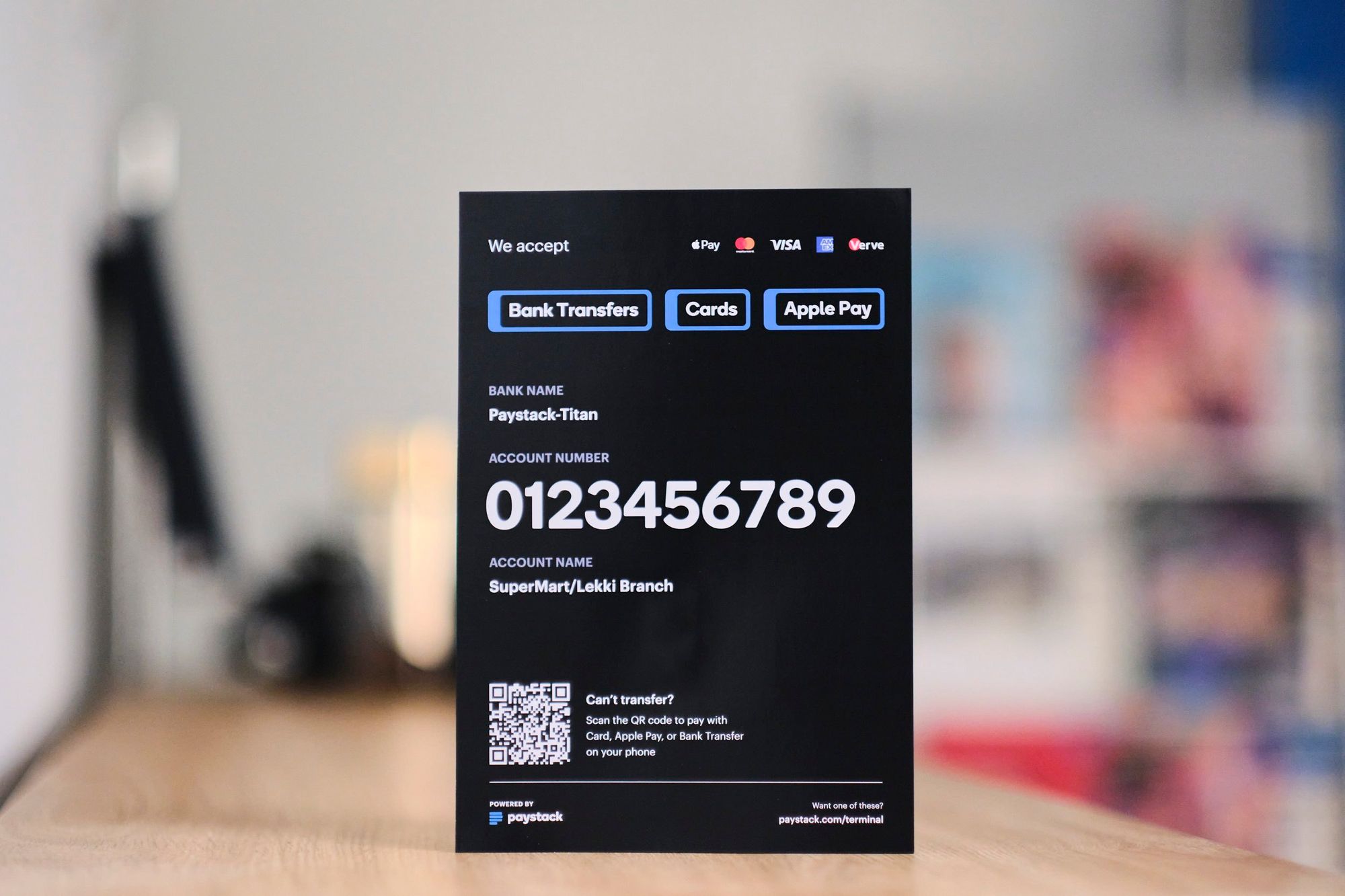

In addition, each Virtual Terminal account also comes with a beautiful, autogenerated poster, which you can print from the Paystack Dashboard and prominently display to inform the customers about the wide range of payment methods available to them.

This launch of virtual terminals is Paystack’s strategy for expansion. Paystack is also investing in improving its products to provide better tools for bank transfer payments as it intends to extend its services beyond web-only payment collection. Paystack, which U.S. fintech Stripe owns, re-entered the offline payments market late last year with the launch of the Paystack Terminal, a point-of-sale device. Now, the fintech is doubling down on this market with virtual terminals and bank transfers.