In a space of five years, Nigeria’s fintech companies have raised over $600 million in funding, attracting 25% ($122 million) of the $491.6 million raised by African tech startups in 2019 alone – second only to Kenya, which attracted $149 million. The period under review is 2014- 2019.

This information is contained in a recently published report by McKinsey titled “Harnessing Nigeria’s Fintech Potential.” The report highlighted the combination of youthful demographic, increasing smartphone penetration, and concerted efforts to driving financial inclusion as factors that interplay to produce conducive and thriving enabler or platform for the fintech firms in Nigeria.

The report outlined some of the feedback against fintech companies ranging from poor user experience, underwhelming value-added from using some of the financial products, low returns on savings, and limited access to investment opportunities.

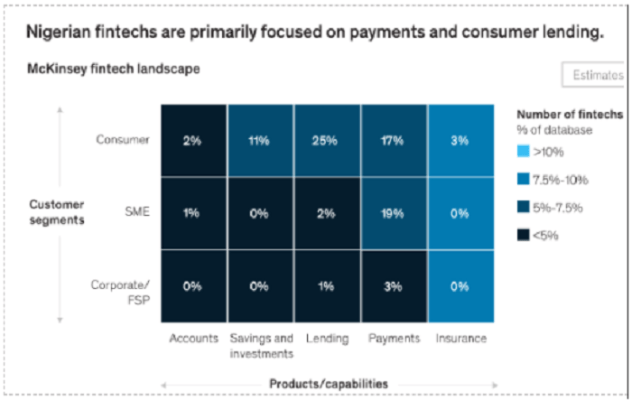

The report also showed that Nigerian fintech companies are primarily focused on payments and consumer lending, having allotted an aggregate of 39% on payments to consumers, SMEs, and corporate FSP, and an additional 25% to consumer lending.

On the driving factors behind the increasing choice of payment and consumer lending as an area of concentration by fintech companies, a part of the report says:

“Fintech activity in lending is picking up, thanks to the fact that fintechs are able to leverage payment data to determine lending risk more easily, and utilize smartphones as a distribution channel... Banking fintech solutions have been fast followers here, with leading banks launching digital lending platforms like Quick Credit by GTBank and Quickbucks by Access Bank.”

In general, access, convenience, and trust have all played key roles in the increasing use of fintech products, further proven by the fact that, in the last six months, 54% of consumers have reported increased usage of their fintech products.

Case-In-Point

Fintech accounted for only 1.25% of Nigeria's retail banking revenues in 2019, signaling a room for development. Despite recording a growth of fintech investments in Nigeria to the tune of approximately $460 million in 2019, majority of these investments were from external investors. This was only a small fraction (1.27%) of the $36 billion invested in fintech globally.

The report opined that full optimization of fintech companies in Nigeria can stimulate economic activity, by creating a multiplier effect, and can drive progress towards development goals. Economic impact will primarily come from expanding revenue pools and attracting foreign direct investment to the country. The sector can unlock a various economic benefits by driving increased fintech productivity, capital, and labour hours through digitization of financial services.