NatWest, in what it claims is an industry first, will allow businesses to send payments directly to their customers through Open Banking technology, without needing their (customers) bank details.

This feature aims to replace the use of bank transfers and checks when sending money to customers, and will allow for instant payments to be made when issuing refunds or customer service payments, and also for specific uses such as compensation payments and emergency cash requirements.

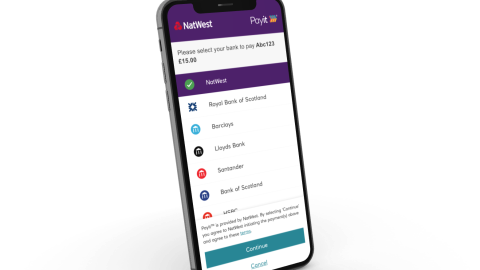

This feature is available within NatWest's flagship Open Banking payments services, Payit by NatWest. Payit was launched in early 2020, and initially allowed businesses to collect payments from customers online using Open Banking.

James Hodgson, head of Payit by NatWest says: “The need for businesses to send their customers money often occurs at the most crucial moments, and yet the typical methods can be slow, inefficient and expensive. We’re aiming to transform that experience with Payit, which now allows businesses to send payments that are credited to customer accounts in a matter of seconds, and all without the need for their bank details”

According to him, the bank is currently working on plans to enhance its Open Banking compatibility by launching an API proposition, allowing merchants to integrate Payit directly with their own technology infrastructures.

About NatWest:

NatWest is a major retail and commercial bank in the United Kingdom. According to the company's website, they are the biggest supporter of the business sector – banking around 1 in 4 businesses across the UK and Ireland, from start-ups to multi-nationals.