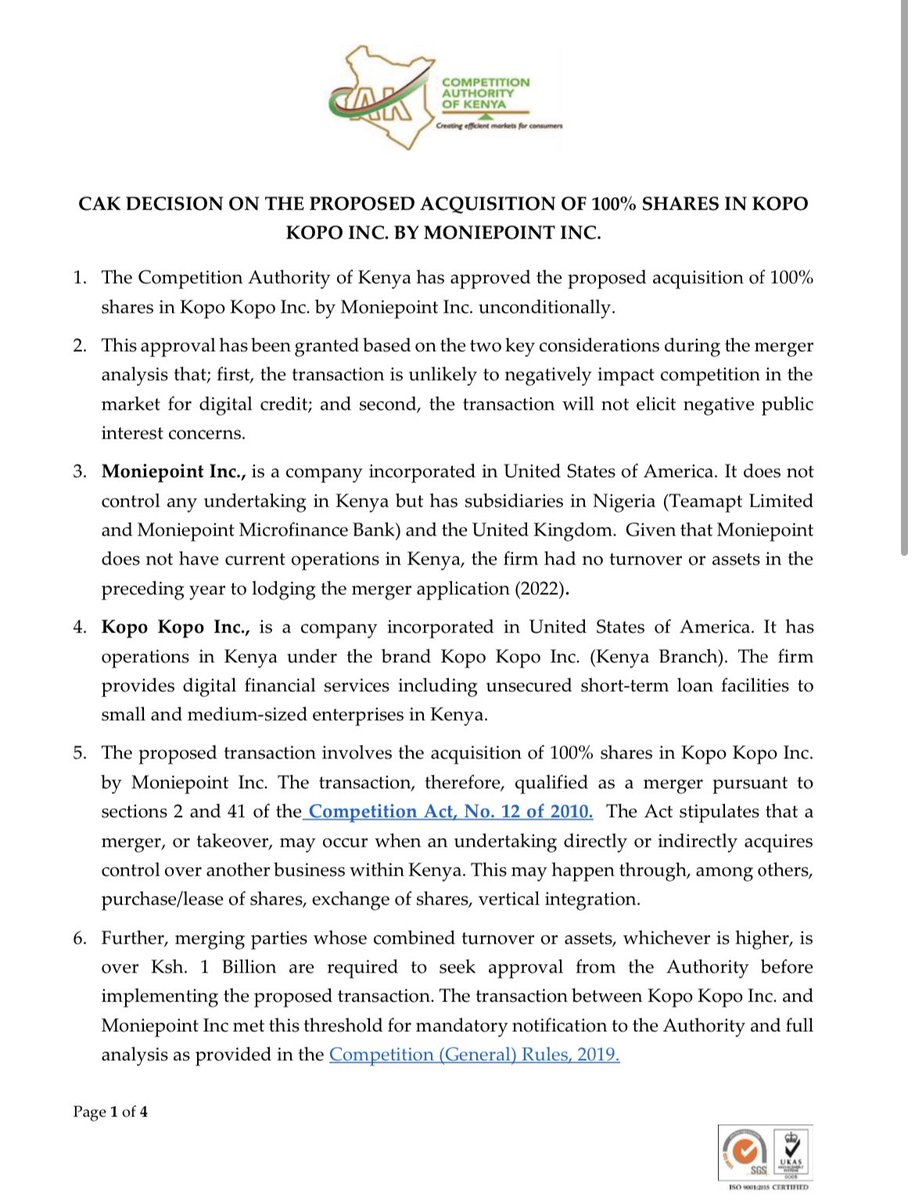

Nigerian-based fintech company Moniepoint Inc has completed the acquisition of renowned East African payments firm Kopo Kopo. Kopo Kopo was founded in 2011 by Ben Lyon and Dylan Higgins in Nairobi, Kenya. It provides digital payment solutions, access to credit, and other business tools through integrated software. Moniepoint has identified Kopo Kopo's digital financial solution as significant, especially its short-term loan offering for small and medium-sized enterprises (SMEs) in Kenya. Both parties recently got approval from the Competition Authority of Kenya (CAK), following their adherence to the authority's stipulated financial guidelines.

Moniepoint and Kopo Kopo share similar goals and visions to deliver unique, innovative solutions to tackle Africa's financial industry challenges. Hence, the acquisition could significantly impact both parties' business and boost Moniepoint's penetration into the East africa fintech industry. Noteworthy, Kopo Kopo has a competitive edge in providing credit to its clients in a digital lending industry dominated by Safaricom's M-PESA, the merger of both parties will give Moniepoint a chance at planting a solid foot in Kenya and also challenge the industry's big players.

Although a lot could change for both parties from now on, Moniepoint will likely leverage Kopo Kopo's existing products and services, thereby satisfying Kopo Kopo's existing user base and creating more exciting features that would hopefully compel new users across Kenya. This strategic acquisition will ultimately advance the financial inclusion drive in Kenya and East Africa as Moniepoint will look further to expand its reach beyond the shores of Kenya.

Focus Box

Company Name: Moniepoint

Industry: Payments, Financial Services

Founded: 2015

CEO: Tosin Eniolorunda

Funding raised: $450,000,000

Revenue: N/A

Customer base: 600,000

Key countries: Nigeria, United Kingdom