Cross-border payments for Africans are still a source of pain. It is plagued with three significant issues; restrictions in terms of use, long transaction completion time and exuberant fees. Finding solutions to these problems serve as the basis of Lemonade's business model.

"Today, many Africans face challenges while trying to interact with the global economy, manage their finances, and provide support to friends and family—wherever they are." Ridwan Olalere, CEO and founder of Lemonade finance

Founded in August 2020, Lemonade is a cross-border payment platform tailor-made for Africans, not just in Africa but everywhere—home or abroad.

"For us, remittance is a natural first step to solving these challenges as it provides the infrastructure and the cross-border financial network that will become the backbone and engine that drives the full suite of financial services that Lemonade will soon offer" Ridwan Olalere.

Solving cross-border transactions is a big problem on its own, but the company is making progress. The company now have its product- The lemonade app, available for users in Canada and Nigeria.

Nigerian users on the Lemonade app can transfer to mobile money accounts in Ghana and mPesa accounts in Kenya, and the transaction will be completed in minutes.

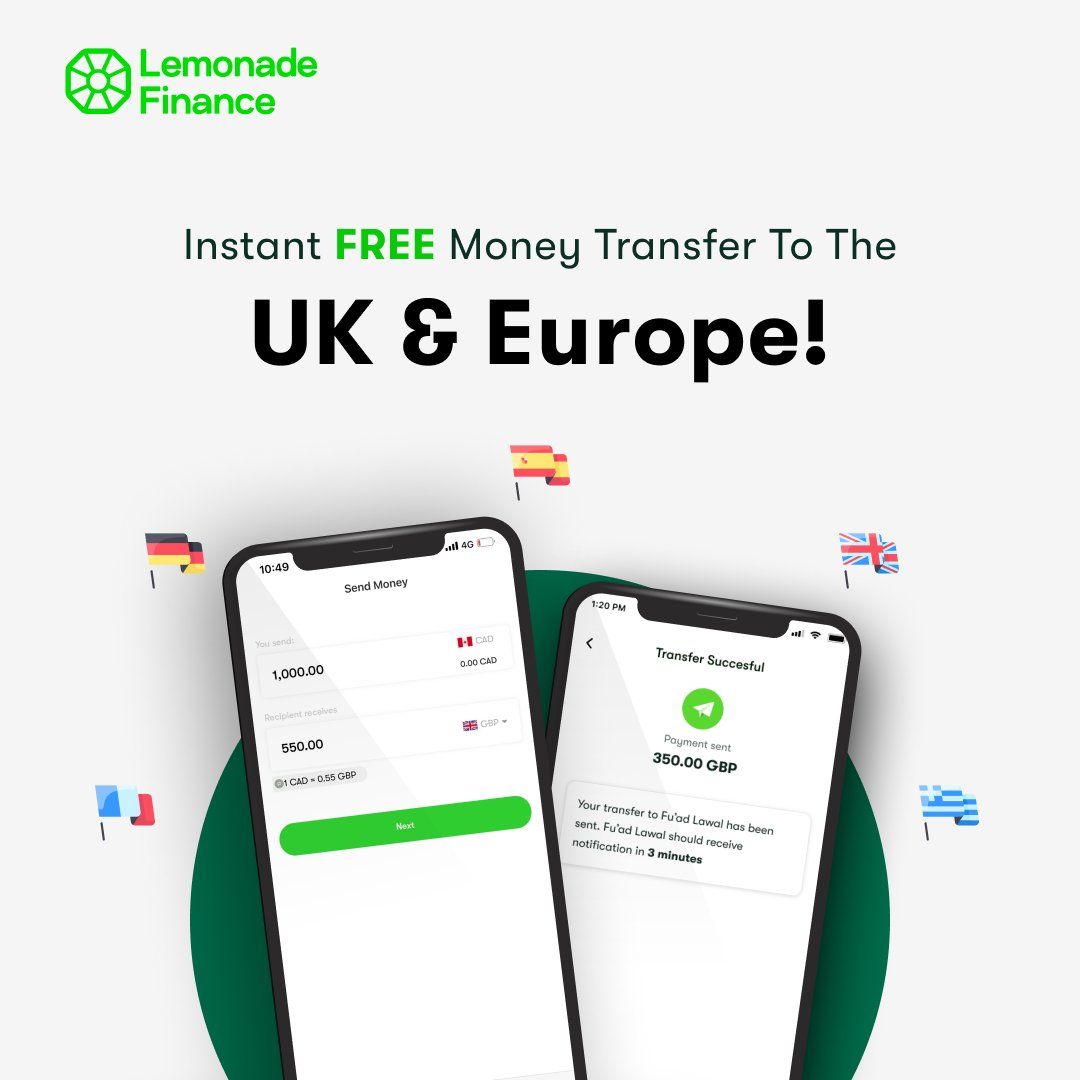

Recently, the Lemonade app got a refresh, enabling customers in Nigeria and Canada to instantly send funds to any bank account in the UK or Europe.

Hello #LemonadeFamily 💚

— Lemonade Finance (@LemonadeFinance) April 2, 2021

We're thrilled to announce that you can now make Instant Money Transfer To The UK & Europe for FREE! 🎉

Jump into our history books - be one of the very first to try the new feature now!

Start: https://t.co/I3EWTLLVSP#LemonadeBorderlessTransfer pic.twitter.com/8ILfIxtc2w

At sign-up, users can send ₦30,000 ($73) to any bank account in the UK or Europe. After BVN verification, the daily limit goes up to ₦100,000 ($244) per day. On completing approved-ID verification, the daily limit is increased to ₦2,000,000 ($4,894).