Digital lenders in Kenya are against the 20% excise duty charged on interest and fees, on top of other taxes, arguing that it has raised the cost of credit and stifled innovation in the fintech sector. The 20% excise duty proposal is contained in the Finance Bill 2024, which is expected to be published before 30th April 2024.

The excise duty, initially enacted in 2022, is applied to “fees” but extends to both interest and fees. It is due upon loan disbursement rather than upon repayment. Industry players argue that this setup results in excise duty being levied on unrealised revenue, disregarding the sector’s prevalent default rates.

Kenya’s digital lenders contend this disadvantages fintech companies in the credit market. Traditional financial institutions like banks are not subject to excise duty on interest and fees, thereby discouraging fair competition.

In addition to higher default rates, digital lenders in Kenya have been forced to adapt to growing regulations by charging even higher rates, thus adding additional default risk to the debtor.

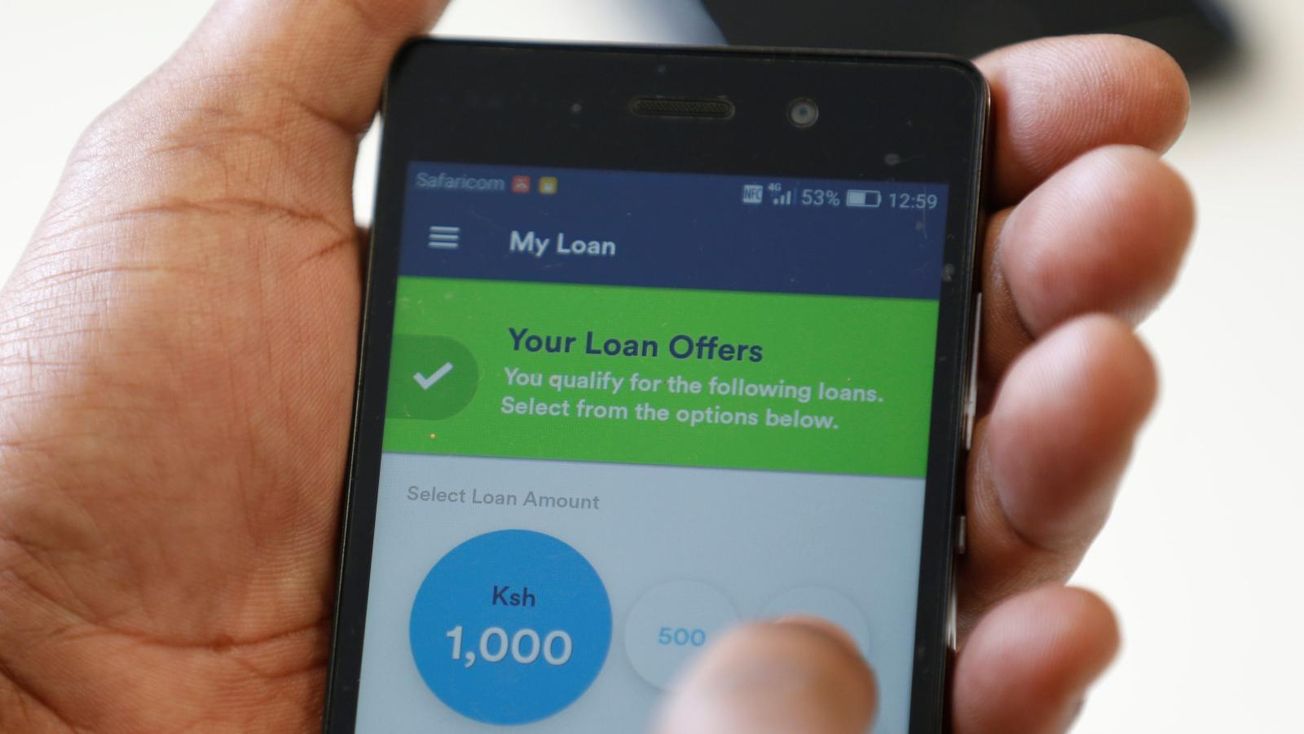

These new policies have also made access to credit costly for about eight million citizens who cannot access the formal or conventional forms of credit and disrupt consistency in tax collection. The dispute over excise duty is anticipated to lead to a scenario where digital lenders transfer the increased cost to borrowers.