If a person needs a loan, they can go about it by applying for loans from a bank or fintech startups that offer such products. Another way is to speak to a friend or family relative about your need. Building on this idea, imagine a platform where you can link up with people like you who are willing to give loans but not Fintechs or banks. We refer to this idea as peer to peer lending, and CRED, an Indian fintech company, has launched a similar product called CRED Mint.

CRED mint allows users to lend to one another at an interest rate of up to 9% annually. According to the startup, "at up to 9% interest, CRED Mint will help these users, India's most creditworthy individuals, to be rewarded for responsible financial behaviour with a smarter way to make idle money work for them. CRED members can apply for early access to Mint."

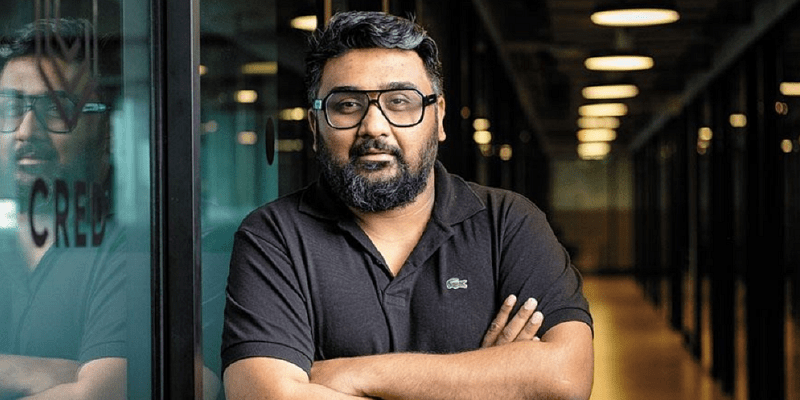

Kunal Shah, founder and chief executive of CRED, said the startup is rolling out this feature, dubbed CRED Mint, initially to some users after testing this internally for months.

"We're super excited about this because it's the first time our community members will be able to invest in one another directly. It's going to focus on high-quality, low-risk, but much better, inflation-beating returns you can get on your money," he told TechCrunch in an interview.

For CRED Mint, the startup has partnered with LiquiLoans, an RBI-registered P2P NBFC. CRED is looking to partner with more players, Shah revealed. Users can invest between 100,000 Indian rupees ($1,345) to 1 million rupees ($13,450) in about two minutes and also request a withdrawal at any time with no penalty.

"The withdrawal process is fully online, and the money with interest will be returned to the investor within a working day. As a digital platform, CRED reduces friction, inefficiency, commissions and overheads to pass on higher earnings for members," the startup said.

Peer to peer lending has been around for some time now, meaning CRED's Mint is not the first in the space. However, CRED's latest feature stands owing to its ability to solve one of the biggest challenges this category faces: defaulters. According to some estimates, more than 20% of individuals taking a loan in a peer-to-peer service don't pay it back.

CRED's Uniqueness

CRED members have a credit score of 750 or higher, making them the most trustworthy audience to provide financial services. A user has to have a credit score of 750 or higher on CRED to join the app. The startup said, "We do believe that the product-market fit of our offering is very strong. We believe that this could set a new benchmark for what fintechs should be doing," said Shah. CRED also does lending itself — which is available to limited members — and has disbursed about $269 million to customers in loans."

"Even at the scale of CRED Cash, the default rate has historically been less than 1%. To reduce risk further, the invested money will be routed directly to an escrow account held by CRED's NBFC partner, LiquiLoans, and diversified across 200+ borrowers on average," it added.

Founded two years ago, CRED has a customer base of 7.5 million, with an average of 200,000 Indian rupees ($2,685) sitting in their savings accounts, the startup claims. The Bangalore-based startup recently closed a series D round of $215 million at a valuation of $2.2 billion, making CRED the youngest startup to attain Unicorn status.

India in focus

GDP: $2.262 trillion compared to $2.871 trillion in 2019

Population: 1.38 billion in 2020 compared to 1.366 billion in 2019

GDP per capita: $1,900 in 2020 compared to $2,100 in 2019