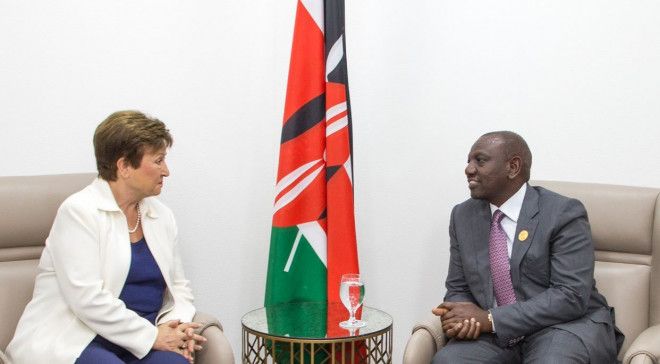

Kenya has agreed with the International Monetary Fund (IMF) to receive $976 million in financial support. This funding is contingent on completing the seventh review of Kenya's economic program under the Extended Fund Facility and Extended Credit Facility.

The agreement also includes access to zero-interest loans, bringing the total IMF support to about $3.60 billion. Additionally, if the second review under the Resilience and Sustainability Facility is completed, Kenya will receive an extra $120 million.

The main goals of this agreement are to ensure Kenya can manage its debt, handle financial risks, and strengthen its financial sector. Key actions include expanding the tax base, improving tax collection, and making public spending more efficient.

The Central Bank of Kenya has also made positive steps by controlling inflation and building foreign exchange reserves. Kenya's economy grew by 5.6% in 2023 thanks to a strong recovery in agriculture and services.

However, recent floods have created new challenges, highlighting the need for better disaster management. Despite these issues, inflation has decreased, and market confidence has improved, leading to more capital inflows and a stronger shilling. The IMF emphasizes the need for Kenya to continue implementing fiscal measures to maintain economic stability and manage its debt effectively.