Inclusion Times reported earlier this week that Flutterwave raised $170 million in Series C and attained a unicorn status in the process, becoming the third fintech company unicorn on the continent. GTBank, as the fintech community was busy celebrating this news, out hunting for fintech talents.

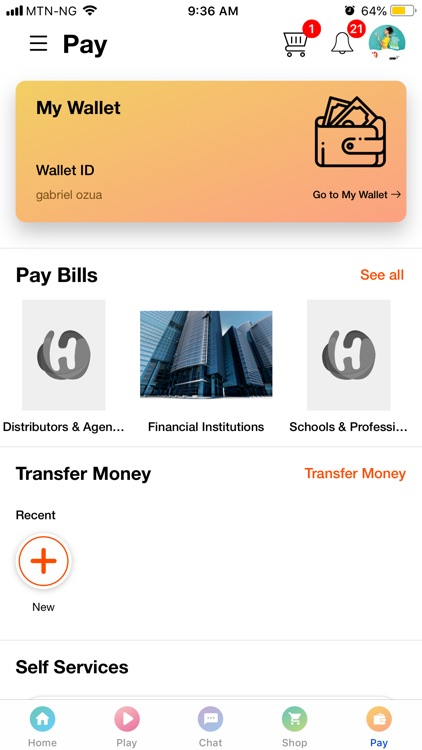

The bank is hunting for talents for Habari Pay, its s0on-to-be payments company. BusinessDay found a vacancy advert on LinkedIn where GTBank described HabariPay as a young start-up on the path to building a truly pan-African payments unicorn.

The bank noted, “We know we can do it – with a high-impact founding team and the backing from a multinational financial services company.”

Another company in the eye-sight of GTBank is Paystack. Paystack was acquired in 2020 by Stripe, a global payment company, in a deal valued at $200 million.

GTBank, Sterling Bank, and Access Bank have all applied for a holding company structure license and they are expected to take-off at least by the second quarter of 2021.

When approved, the three banks will be joining the likes of UBA, First Bank, and Stanbic IBTC which already operate holding company structures. The difference will be in the individual objectives of the institutions.

GTBank's CEO, Segun Agbaje, has never made a secret of the bank's ambitions for the payment services in Nigeria. The license - holding company structure - is expected to unlock the tap for big investments in payment services.

There is no limit to how far GTBank is willing to go to secure a prime share of the payment market in Nigeria and Africa, for Agbaje. This will likely include acquiring the top-of-the-class technology equipment to ensure that HabariPay hits the ground running from day 1.

GTBank noted in the vacancy position for Product Owner, “You will have access to best-in-class engineering tools and resources to enable you to solve truly complex problems and develop game-changing payments solutions for the African market. We prioritise agility, we fail fast, we invest faster and we drive value for customers.”

There are doubts though, by some experts. According to them, the bank’s ambitions and willingness to deploy enormous resources may not necessarily see it through to unicorn status nor controlling the major share in the payment market in Africa.

One major barrier is Agbaje saying Habari will go it alone which could test GTBank’s ability to deploy quickly and meet high customer expectations doing so. Traditional banks do not have the best record for moving quickly and getting things done as fast customers demand them.

Furthermore, GTBank does not have an impressive record in managing customer expectations. Its bank branches across the country still overflow with customers who often leave with different experiences. However, the bank has had a long experience in growing electronic payments.

Nigeria in focus:

Population: 200.9 million (2019)

GDP: $448.12 billion (2019)

GDP Per Capita: $2,229 (2019)