Starling bank on Monday secured £50 million from Goldman Sachs.

A month ago, in a series D funding round led by Fidelity Management & Research, the company raised £272 million at a valuation above £1 billion.

"Securing the support of another global financial heavyweight demonstrates the strength of demand from investors and represents yet another vote of confidence in Starling. Goldman Sachs will bring valuable insight as we continued with the expansion of lending in the UK, as well as our European expansion and anticipated M&A." founder and chief executive Anne Boden.

The latest move by Goldman Sachs to invest in Starling Bank "marks an extension of the oversubscribed round, taking the total raised to £322 million.

"Starling is one of the leading and most innovative digital banks in the UK, with an ambitious technology-first leadership team and addressing a deep market opportunity. We are delighted to be supporting their growth with this investment and believe the company has sustainable long-term earnings potential. " James Hayward, managing director at Goldman Sachs.

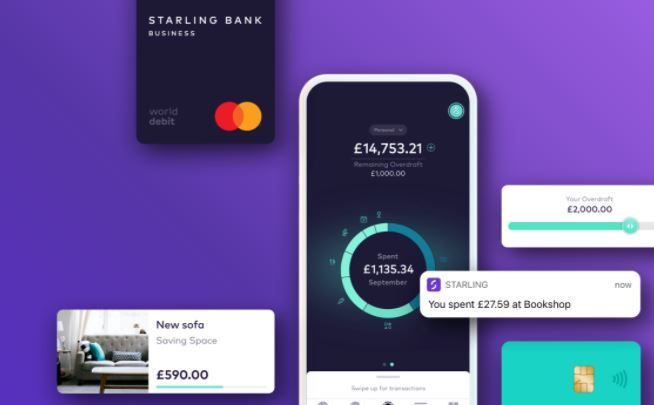

Since the bank's debut in 2017, the company boasts a customer base of over 2 million and is one of the few challenger banks to have turned a profit in the past year.

In the past, banks like City bigwigs Lloyds and JP Morgan have shown interest in Starling. Last autumn, JP Morgan talked about buying Starling while Lloyds was interested in its technology.

According to Starling bank, the new funding would be used to support its "continued rapid and now profitable growth".