The fintech sector is gaining massive traction all over the world, even Africa is not left behind.

According to a KPMG report titled "Pulse of Fintech H1’21’ report", total fintech investment reached $98bn from 2,456 deals in the first half of 2021 exceeding the $87bn raised in H2 2020.

The report highlighted the following reason for the strong start to 2021;

- wealth of dry powder

- COVID-related digital acceleration

- An increasingly diverse range of fintech hubs and subsectors.

- Robust activity in almost all regions of the world contributed

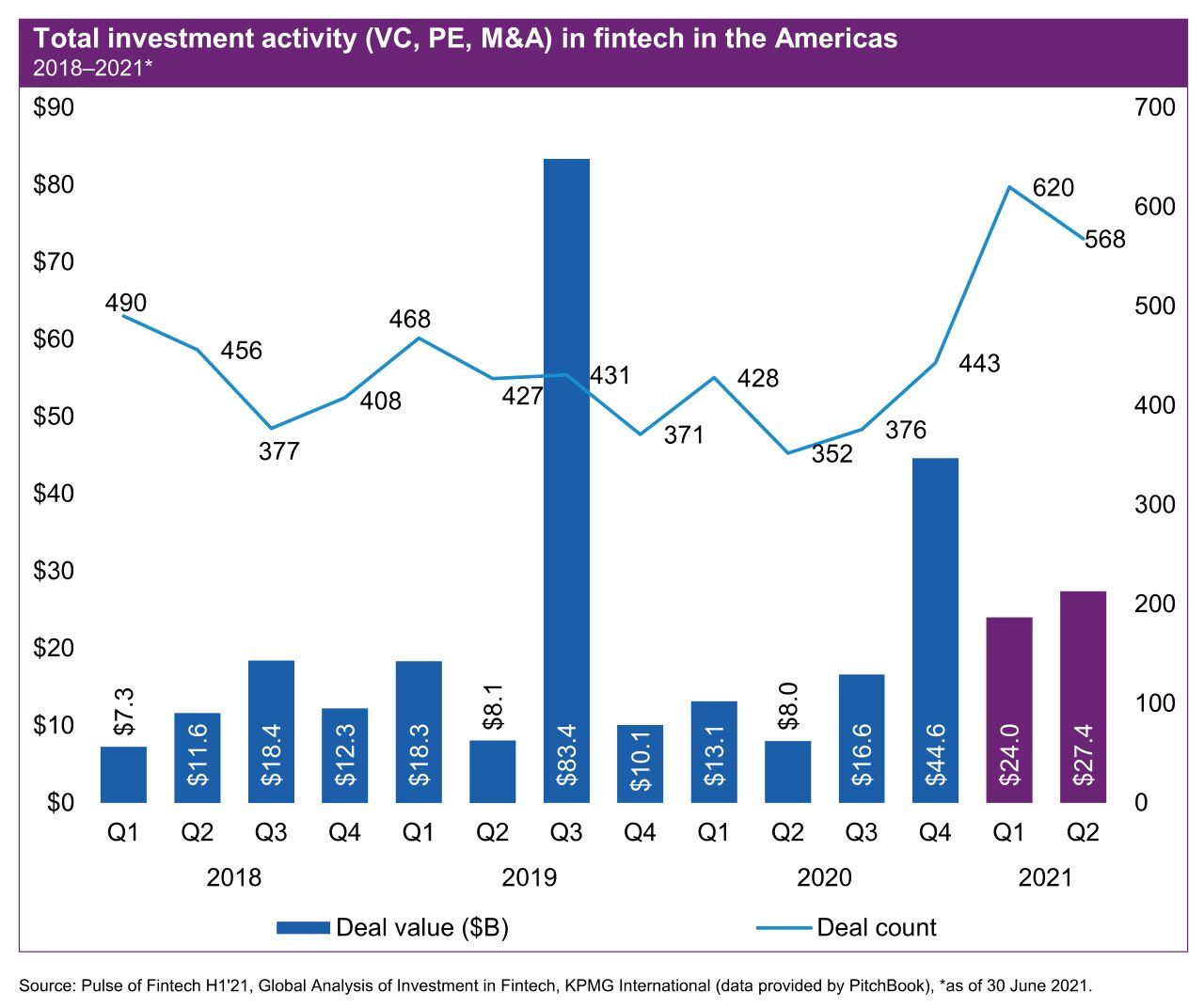

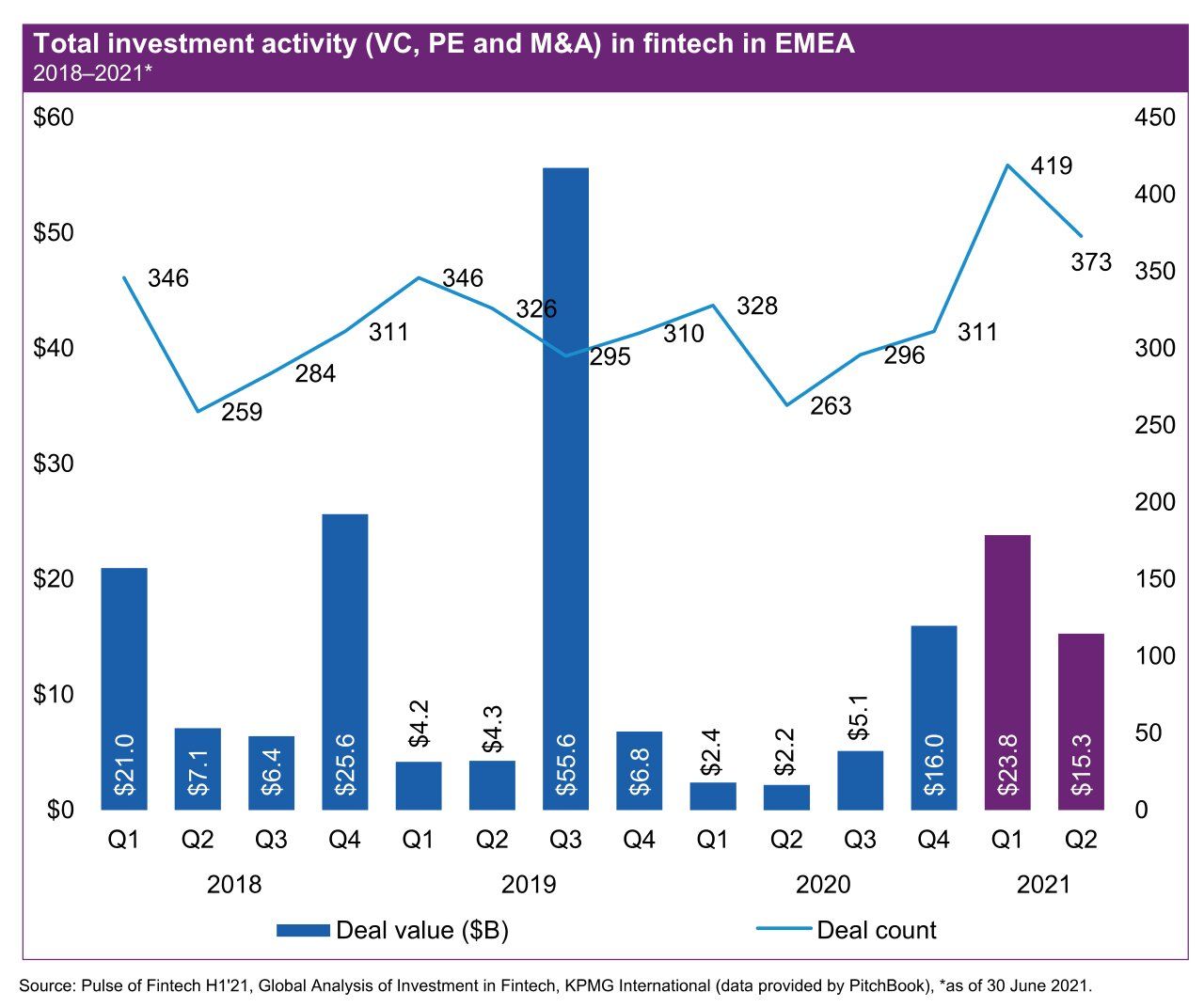

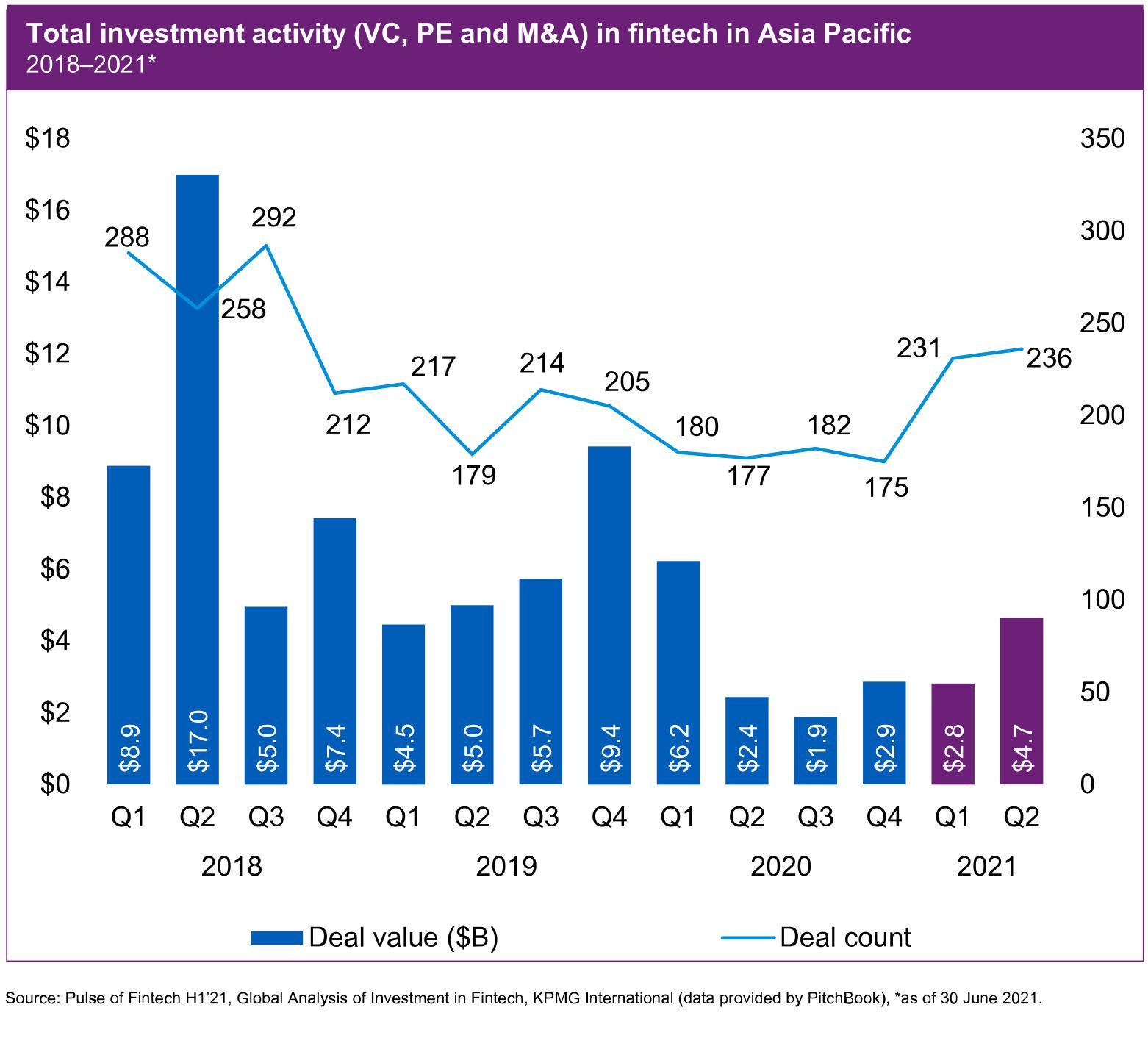

Breaking down this figure, America received the highest investment, followed by the EMEA and ASPAC.

Fintech investment in the Americas reached $51.4 billion in H1’21, with VC investment accounting for $31 billion — shattering the previous annual high of $24 billion set in 2020. The continued innovations in financial technology, combined with the dramatic increase in the use of digital offerings, has made fintech one of the most active sectors of investment, both from a VC perspective and from an M&A standpoint

Total fintech investment in the EMEA region continued to surge, with over $39 billion invested in H1’21, compared to 2020’s total of $26 billion. The region also shattered its previous annual high for fintech VC investment, attracting $15 billion in H1’21, compared to $9 billion during 2020.

Total fintech investment and deals activity in the Asia-Pacific region saw a solid rebound in the first half of 2021. After falling to $4.7 billion across 357 deals in H2’20, H1’21 saw $7.5 billion in investment across 467 deals. Total fintech investment and deals activity in the Asia-Pacific region saw a solid rebound in the first half of 2021. After falling to $4.7 billion across 357 deals in H2’20, H1’21 saw $7.5 billion in investment across 467 deals.

Refinitiv topped the chart for the top 10 global fintech deals with a whooping sum of $14.8 billion, followed by Robinhood ($3.4B), Verafin ($2.75B), Itiviti Group ($2.6B), Divvy ($2.5B) and SoFi — $2.4B. Below is a list of the top 10 global fintech deals.

- Refinitiv — $14.8B, London, UK — Institutional/B2B — M&A

- Robinhood — $3.4B, Menlo Park, US — Wealth/investment management — Series G

- Verafin — $2.75B, St. John’s, Canada — Institutional/B2B — M&A

- Itiviti Group — $2.6B, Stockholm, Sweden — Institutional/B2B — M&A

- Divvy — $2.5B, Draper, US — Payments/transactions — M&A

- SoFi — $2.4B, San Francisco, US — Lending — Reverse merger

- Nubank — $1.5B, Sao Paulo, Brazil — Banking — Series G

- Paysafe Group — $1.45B, London, UK — Payments/transactions — Reverse merger

- Acima Credit — $1.4B, Sandy, US — Lending — M&A

- BTC.com — $1.3B, Los Angeles, US — Blockchain/cryptocurrency — M&A