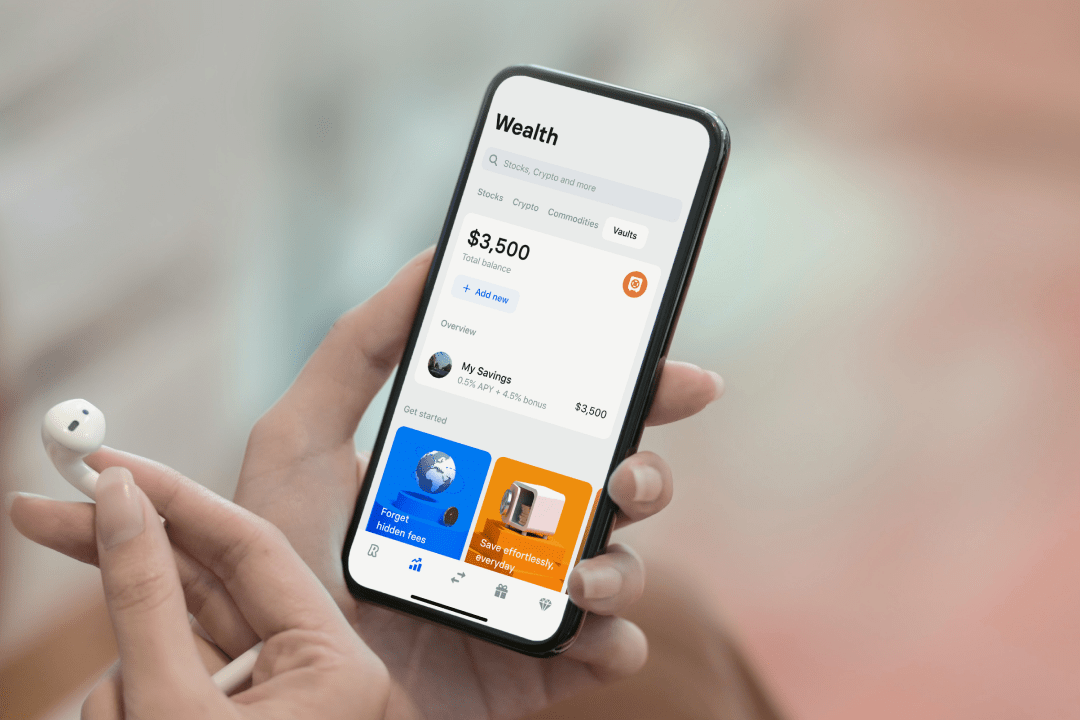

Britain's Revolut on Thursday announced a new 4.5% "bonus" on top of its base annual interest rates for American savers. It's an annualized rate that's calculated daily and pays out each month. Users subscribed to Revolut's "Premium" and "Metal" accounts — which cost $10 and $17 a month respectively — will get a 5% rate on their savings, while standard customers are entitled to a 4.75% rate.

The top 5% rate is far higher than the current market-leading 0.83% offered by online bank Vio, according to personal finance website Bankrate, and more than 50 times the 0.09% national average. Notably, Revolut isn't a typical bank but a so-called e-money institution that's partnered with a federally-regulated lender, Metropolitan Commercial Bank, which holds customer deposits on its behalf.

But instead of earning interest the traditional way through lending, Revolut says it'll pay out the 4.5% bonus directly from the revenues it makes on the fees it charges merchants every time a customer uses their card. It's worth noting that these interchange fees make up the overwhelming bulk — 63% — of Revolut's income.

"The model is designed to ensure that customers need to use Revolut as a primary spending card to benefit from the full rate," a Revolut spokesperson told CNBC."

Revolut's savings "bonus" still comes with a few caveats though. First, you can't earn the top 5% rate unless you're a paying user. Second, you'll only earn the additional interest on the total amount you've spent the previous month — so if you had $400 in your account the month before an interest payment but only spent $100, the 4.5% bonus would only apply to the $100.

Still, according to a CNBC report, personal finance experts say online banks may be a better bet than incumbent for savings returns at the moment. The USA's Federal Reserve has cut interest rates close to zero this year in an effort to prop up an economy ravaged by the Covid-19 crisis.

Revolut however argues its model works by incentivizing users to spend more with their accounts, attempting to succeed where other neo-banks like Monzo and Chime have struggled over the years, having to settle for being used by customers as a backup to the main accounts where they have their salary paid into.

The firm launched in the U.S. in March — just as governments around the world began enforcing lockdowns to stem the spread of Covid-19 — and has since gained over 150,000 customers in the country.

The USA In Focus

Population: 365.9 million (Compared to South Africa's 59.6 million)

GDP: $23.118 Trillion (Compared to South Africa's $369.85 billion)

GDP Per Capita: $63,777 (Compared to South Africa's $6,193)