This is my second story in "My Experience" series. To read the first, which talks about my experience with agent banking in Nigeria, please click here. This time around, I write about what financial services inclusion would entail for both young and old people in Nigeria - what I have experienced.

Have you wondered what financial inclusion is?

I mean, you might see the phrase thrown around a good number of times, maybe when the government says it is taking a certain action to get the financially excluded included into the financial services industry, or when a company says one of its goals is to increase financial inclusion in a certain location, typically a country.

In simple words, financial inclusion is including those not included, into the financial services sector. Financial services are services provided by the finance industry that involves the management, lending, and investment of money and assets. Put simply, money management, money lending, and money investing.

My experience as a young Nigerian.

My inclusion into financial services in Nigeria as a young Nigerian, like many other young Nigerians, began when I got admitted into a tertiary institution - a university. I was leaving home for the first time, to live separately from my family. I definitely needed a bank account to get money from my parents, to take care of myself in school.

I opened a savings bank account that suited me as a student. My use of the bank services in terms of having an account was strictly for receiving money from my parents, withdrawing the money at ATMs, and spending to take care of myself. This was the primary use of the bank services during my studies. Not much has changed now however.

Now I receive income into the bank account as deposits, leave the income there until I need it, and withdraw to spend or send to other people. I have never sought loans from the bank, or any other financial service. Just money management in a bank account in form of deposits and savings.

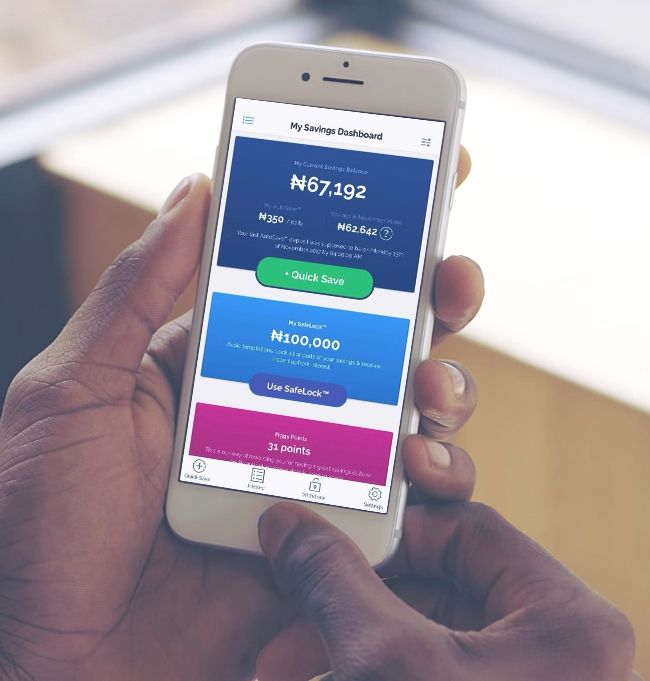

For loans and investments, including savings, Nigeria in recent years has seen a number of fintech startups offering these services launch. PiggyBank for savings and investments for instance. Other examples are Bamboo for buying international stocks and Branch for loans.

This is perfect for young Nigerians, many who are digital natives, as all they need is a smartphone to access these services. Banks also have their mobile banking apps. With a smartphone, a young Nigerian has access to any financial service of choice.

Personally, I am yet to use any fintech platform in Nigeria. The only exception is Branch, when I had to do something urgently, got a loan, and then repaid back as soon as I could with a 10% interest. I was for a large period of time, invested in the Nigerian Stock Exchange, holding stock positions. I used a stockbroking firm’s app to access the services I needed in investing in Nigerian stocks. From registration to exit, all on my smartphone.

While I have not really used any fintech platform yet, a couple of people around me have, for various reasons. Some platforms offering savings services give interests on the savings as opposed to mainstream Nigerian banks.

Naturally, people would move their money to these platforms. I also know a couple of people invested in American stocks using Bamboo, or other platforms offering similar services like Trove and Chaka. And I have a personal experience in getting a loan from a fintech platform.

My Mum's experience as a Nigerian in her fifties.

I asked my mum how she uses financial services, and I got a summary. Expectedly, my mum uses a bank account to manage money. To receive money, to save money, and to send money (paying for bills or sending my siblings pocket money, for instance).

For getting loans and savings away from her bank account, she uses a cooperative. A cooperative is an association of people that come together to meet what is often their economic needs. People working in organizations with cooperatives tend to use these cooperatives to save and get loans. It is a bit similar to the “ajo” thrift contributory system in Nigeria.

Ajo is a contributory thrift saving scheme among a group of people, where these people engage in a savings scheme. Information I got from my mum and confirmed by reading further is that the savings may be daily, weekly, or monthly, depending on what is agreed on. The aim is to let the savings accumulate to a huge sum of money, and return back to the contributors.

The 'Ajo' collector, who is in charge of collecting the contributions, gets a percentage of the total contribution as a reward for his hard work. This system is the norm among what people classify as the “informal” economy. For instance, among market women who trade and get money daily. People engaged in ajo also use it to get loans.

Finally, I asked my mum about investing for retirement. I was told that people working in organizations tend to have pensions to take care of that, while people doing business just rely on the business income sustaining them after retirement. I will add to this, the culture of children taking care of their parents at old age.

DISCLAIMER: This is a personal story of how my mum and I use financial services. It should not be taken as a fact of what many other people do. Many other people use financial services the way we do, and many others don’t.

Nigeria in focus:

Population: 200.9 million (2019)

GDP: $448.12 billion (2019)

GDP Per Capita: $2,229 (2019)